Pay Property Tax In Pune – Pay PMC Property Tax Online

Paying property tax in Pune online is a hassle-free process. The Pune Municipal Corporation offers PMC Property Tax online payment through their official website. In addition to making PMC property tax online payment, you can use the website to find your Pune property tax receipt, PMC property tax search by name and more.

Owners of all types of properties such as residential, non-residential or even open lands are liable to pay property tax in Pune Municipal Corporation. Depending on where the property is located in the district of Pune, the property tax payment will be collected either by:

- Pune Municipal Corporation (PMC); or

- Pimpri Chinchwad Municipal Corporation (PCMC)

You Might Want To Read

Property Tax In Pune Municipal Corporation Or PMC

The process for payment of property tax in Pune Municipal Corporation is simple and hassle free. We answer some of the most commonly asked questions on PMC property tax online payment.

Who needs to pay PMC property tax?

Everyone that owns properties within the PMC limits, including open lands, are liable to be assessed for payment of property tax in Pune.

What Is The Basis For Pune Municipal Corporation property tax assessment?

The basis of Pune Municipal Corporation property tax assessment are:

1) Carpet area of the property

2) Type of property

3) Type of construction

4) Ready reckoner rate, currently in force, as applicable to the property.

What is PMC property tax calculator formula?

The PMC property tax calculator formula is:

“Property Tax = Capital Value x Rate of Tax”

Capital Value is calculated as “Base value of the property x Built-up area x Category of Use x Type of property x Age factor of the property x Floor factor of the property.”

Is there an online PMC property tax calculator?

Yes. You can use the Property Tax Calculator in the PMC website to know the property tax payable on your property.

You will need the following details about the property to use the online Property Tax Calculator:

1) Peth Name (general locality). (If you do not know the specific peth, you can select the name of the peth nearest to your property).

2) Year of Construction

3) Type of Construction

4) Carpet Area in Sq.Ft.

5) Mobile Number

What is the due date for payment of property tax in Pune?

Property Tax becomes due twice a year. The due dates for PMC property tax online payment are as below:

1) For the period of April 1 to September 30 of each year, the due date is May 31. You can avail 5%/ 10% discount if you pay within May 31.

2) For the period of October 1 to March 31, the due date is December 31.

What PMC property tax penalty for late payment?

There is a penalty if you don’t pay your Pune property tax online. the PMC property tax penalty for late payment is calculated:

1) Penalty of 2% per month is applicable for delayed payment of Property Tax for each half of the year. For the period of April 1 to September, the penalty applies from July 1, and for the period of October 1 to March 31, the penalties will be levied from January 1.

2) Penalty of 2% per month will be levied on the on the outstanding amount of property tax arrears on a property.

3) Non-payment of taxes like Employment Guarantee Tax, Education Cess, etc. within due date will attract a notice fee of 1%.

What are the ways to pay Pune property tax online?

There are many ways to pay Pune property tax online. The following cashless payment options are available for payment of PMC property tax online.

1) Electronic Bill Payment through any of the authorized banks.

2) BHIM or Any other API

3) NEFT-RTGS

4) Google Pay

5) PhonePe

6) PayTM

7) Wallets/ Cash Cards

8) Credit card EMI

9) Credit Card Auto Deduct

What are the rebates and concessions applicable for property tax in Pune?

You can claim the following rebates for payment of property in Pune , if you pay the entire property tax due for the year by May 31:

1) 10% discount on General Tax, where Annual Rateable value is Rupees Twenty Five Thousand (INR 25000) or less, for any type of property (including open land registered as a residential building);

2) 5% discount on General Tax, where Annual Rateable value is above Twenty Five Thousand (INR 25000), for any type of property (including open land registered as a residential building);

3) For a residential property with Solar, Vermiculture and/or Rain Water Harvesting, you can claim discount on Municipal Tax (excluding water tax and other government taxes) to the extent of (i) 5% for any one of those projects, and (ii) 10% for two of the projects

Which properties are exempted from payment of property tax in Pune?

A. The properties used for the following purposes are exempted from property tax by PMC:

1) public place of worship

2) public or religious purpose

3) registered as charitable trust or charitable institute with the Charity Commissioner.

What are the details required for PMC property tax online payment?

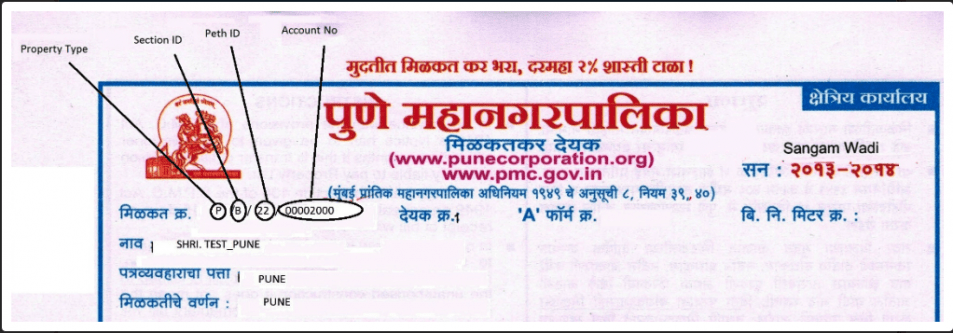

You will need to know the following basic details to make the PMC property tax payment online:

1) Type of Property

2) Section ID

3) Peth ID

4) Account No.

In case you are unable to find these details, you can click on the “?” symbol provided on the website next to the column for ‘Account No.’ for a help demo and refer to the indicated details from your previous bill.

For example, if the ID Number indicated in your bill is: F/3/20/00012340, the details can be identified as:

1) The alphabet “F” stands for Property Type ‘Flat’. Depending on the alphabet, you can identify the Property Type, where ‘O’ stands for ‘Occupier’, ‘P’ stands for ‘Peth’ and ‘F’ stands for ‘Flat’.

2) The number ‘3’ in this example is the Section ID

3) The next number ’20’ in this example is the Peth ID

4) ‘00012340’ is the Account Number.

How can I pay Pune property tax online?

You can follow the below steps to pay Pune property tax online or to make PMC property tax online payment:

Step 1 – Visit the PMC Property Tax Portal and Click on the option ‘Pay Online’

Step 2 – Enter the Property Type, Section ID, Peth ID and Account Number and click ‘Submit’.

Step 3 – Verify the details of the property owner and the property tax dues shown.

Step 4 – Determine the amount you wish to pay and enter the amount. Also provide the email id and mobile number in the designated columns.

Step 5 – Select your preferred gateway and click on ‘Pay Online’.

How to download Pune property tax receipt?

you can download the Pune property tax receipt here,. To download your PMC property tax receipt, visit the page and enter the following details that can be found on your previous bill:

1) Type of Property

2) Section ID

3) Peth ID

4) Account No.

What is PMC property tax customer care?

There is no PMC property tax customer care number. For any issues regarding your online payment, you can contact PMC through email at propertytax@punecorporation.org with the following details:

1) Full name of tax payer (if Owner of the property id different, you need to provide the name of the owner as well).

2) Contact number of the tax payer (and that of the Owner of the property, if the owner is a different person)

3) Property ID

4) Amount Paid

5) Date of Online Payment

6) Bank Account Number / Reference No.

7) Name of the Bank

Q. What is a PMC property tax Peth ID?

A Peth is the term used for a general locality in Pune, and each Peth is allocated a specific ID number for the purpose of property tax calculation. You can find your Peth ID from your property tax bill.

For example, if the ID Number indicated in your bill is: F/3/20/00012340, the number ’20’ in this example is the Peth ID.

What is Pune property tax website?

The official website to pay Pune property tax website is – Property Tax Department

Other Useful Information

- Property Tax In Mumbai – A Guide To Online BMC Property Tax Payment

- NMMC Property Tax Payment Online – A Complete Guide On Navi Mumbai Property Tax

- NMMC Water Bill Payment Online – Pay Water Bill Online in Navi Mumbai

- PCMC Water Bill Payment Online – Pay Pimpri Chinchwad Municipal Corporation Water Bill

I just recently shifted to newly purchased Flat located in Pune , Deed was done in 2019 where as i have received property Tax letter/cum bIll to pay from 2019 to 2021 of value 49K . Bill yet appears on Builder Name . While observing Type of property its mentioned as ‘O’ Occupier. I searched around the area that the property type should be Flat ‘F’ . I doubt because of this i have been receiving bill on upper side Value . Pl guide & advise.