Are you a resident of Navi Mumbai looking to make your NMMC property tax payment online? Here’s a guide on how to make Navi Mumbai property tax online payment, check your property tax dues online, download the duplicate bill, do NMMC property tax bill search by name, calculate the tax amount, download the payment receipt, and more.

The Navi Mumbai Municipal Corporation has an official website through which you can make your NMMC property tax bill payment online in some simple and easy steps. You can pay the dues by entering your Property Code and choosing a preferred mode of payment, such as debit cards, credit cards, or internet banking.

Navi Mumbai Property Tax Online Payment – What Can You Do On The Official Website

Don’t know your NMMC Property Code to make Navi Mumbai property tax online payment? Worry not! The website also has an option for NMMC property tax bill search by name. That is, you can search for your property details by entering your name, ward name, and other available details.

The website also has other online services related to Navi Mumbai property tax. For instance, you can check your tax dues and payment status, download your latest NMMC property tax bill, and view and download tax payment receipts, among others.

Additionally, you can calculate the estimated tax value using the NMMC property tax calculator available on the website. Forms for transferring the property, obtaining NOC, etc., are also available for download on the NMMC website.

You Might Want To Read

FAQs on NMMC Property Tax Online Payment

Given below are some of the most commonly asked questions related to Navi Mumbai property tax. We have covered everything from NMMC property tax payment online to tax calculation to NMMC property tax bill search by name.

How to pay Navi Mumbai property tax online?

You can make your NMMC property tax bill payment online through the official website of the Navi Mumbai Municipal Corporation. Here’s how to do it:

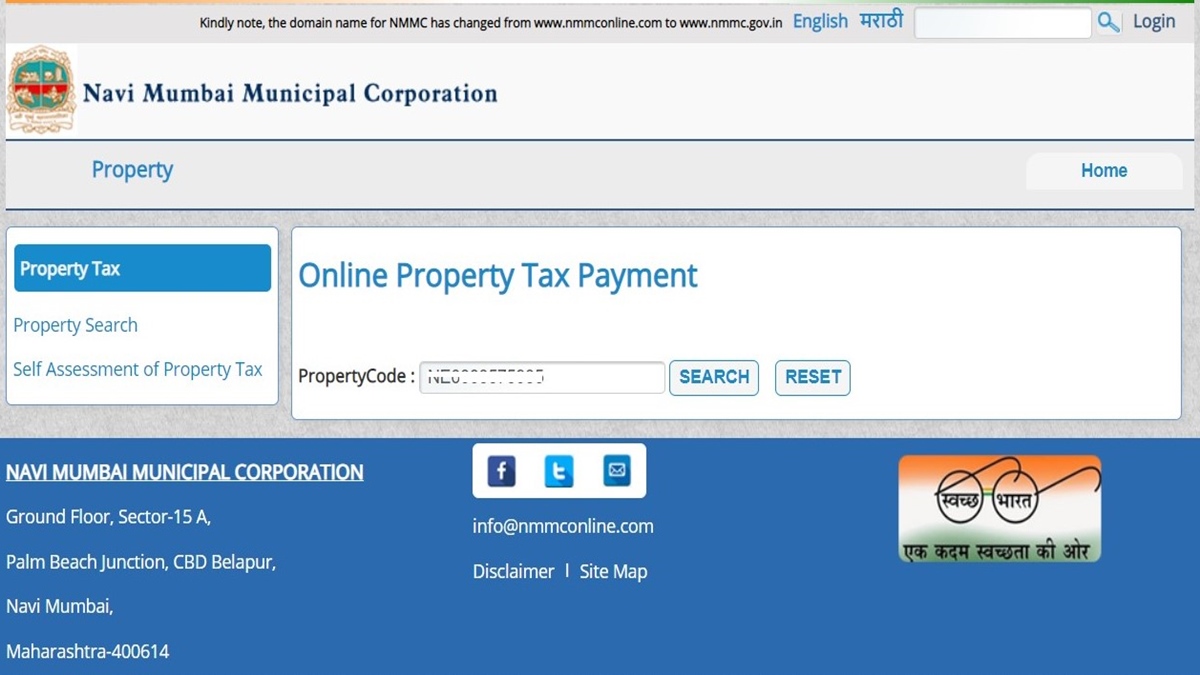

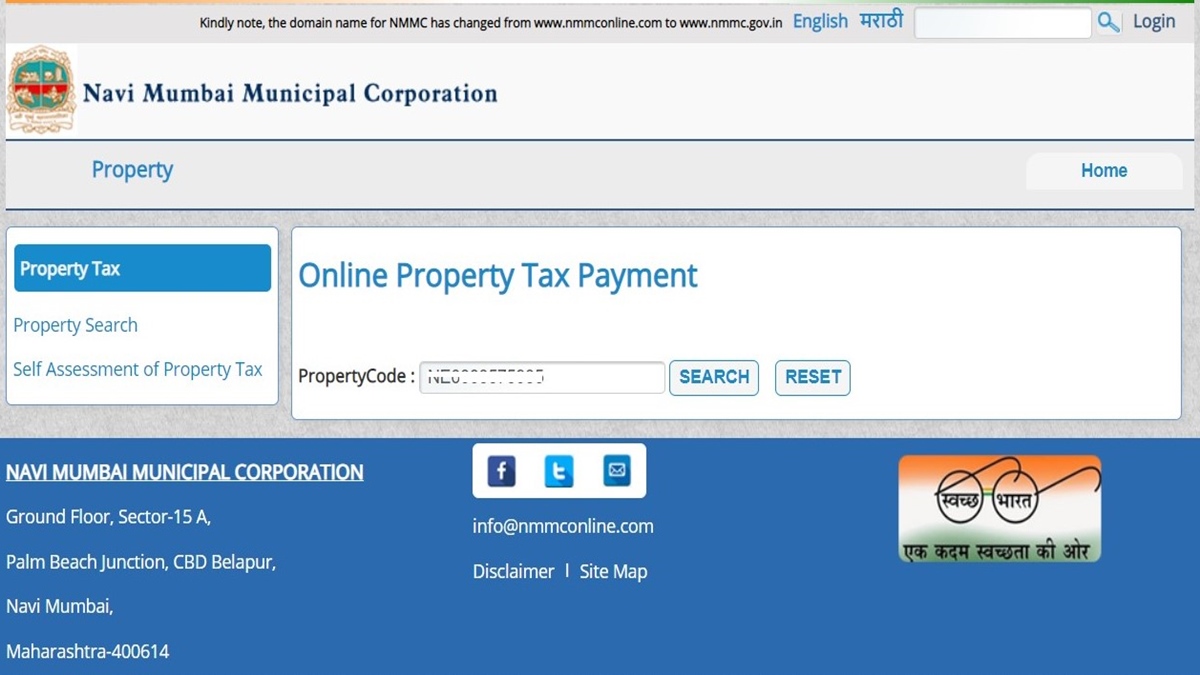

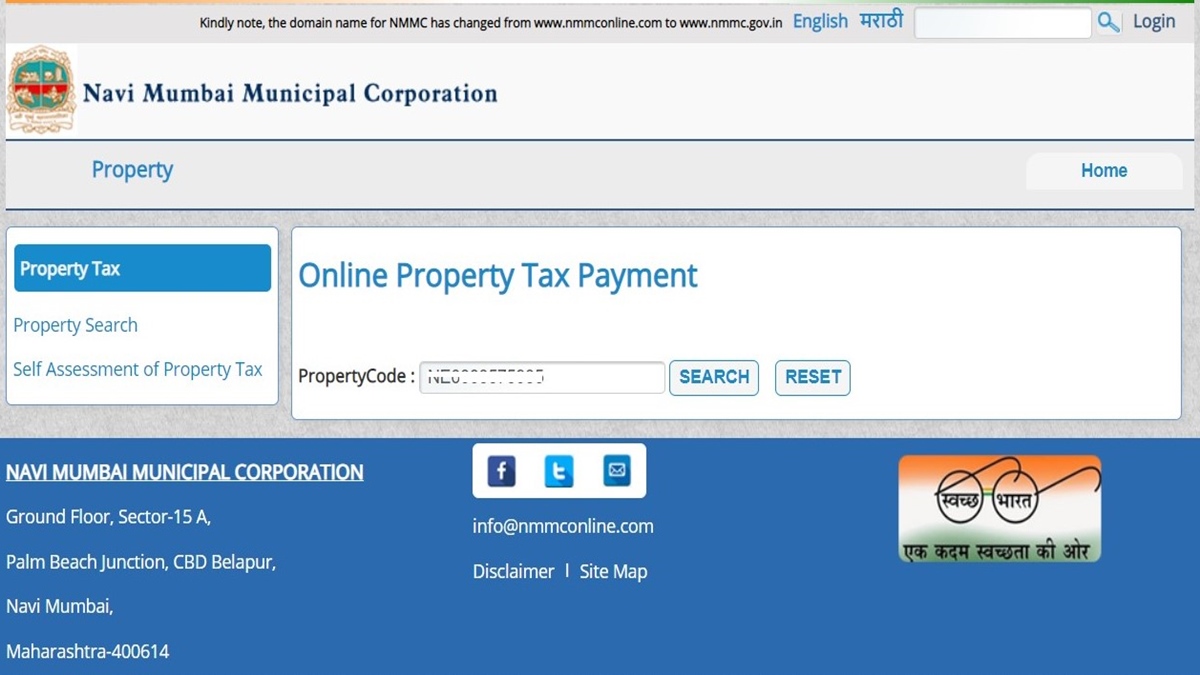

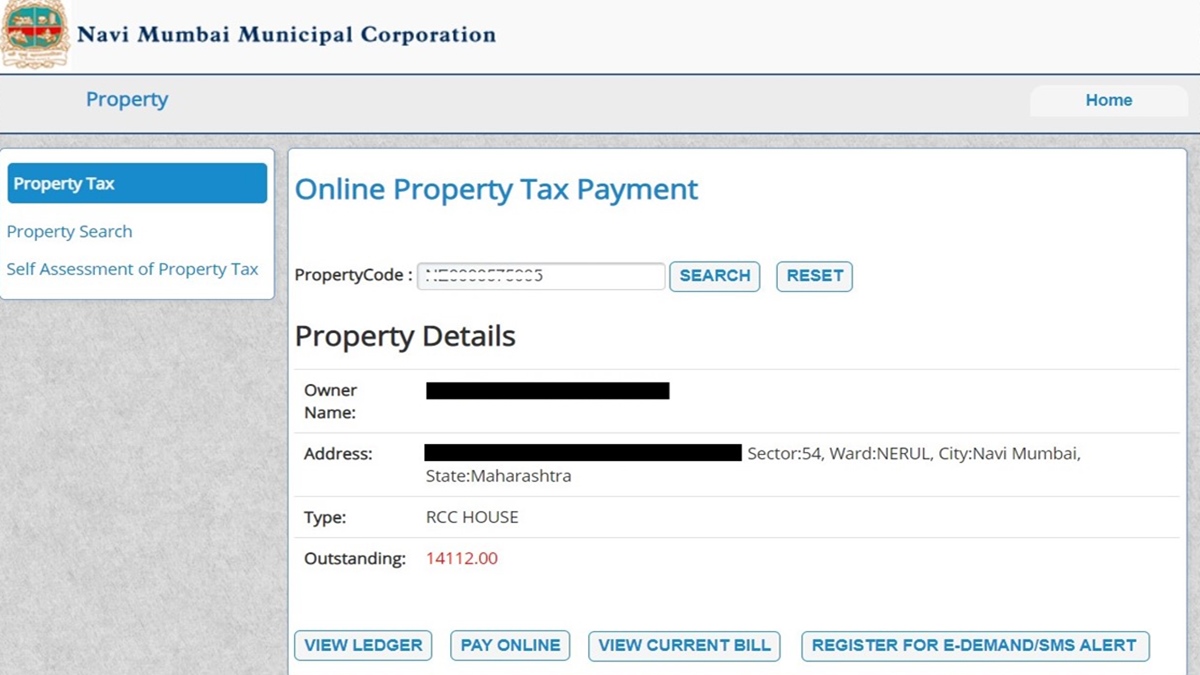

Step 1: Go to the NMMC property tax online payment page.

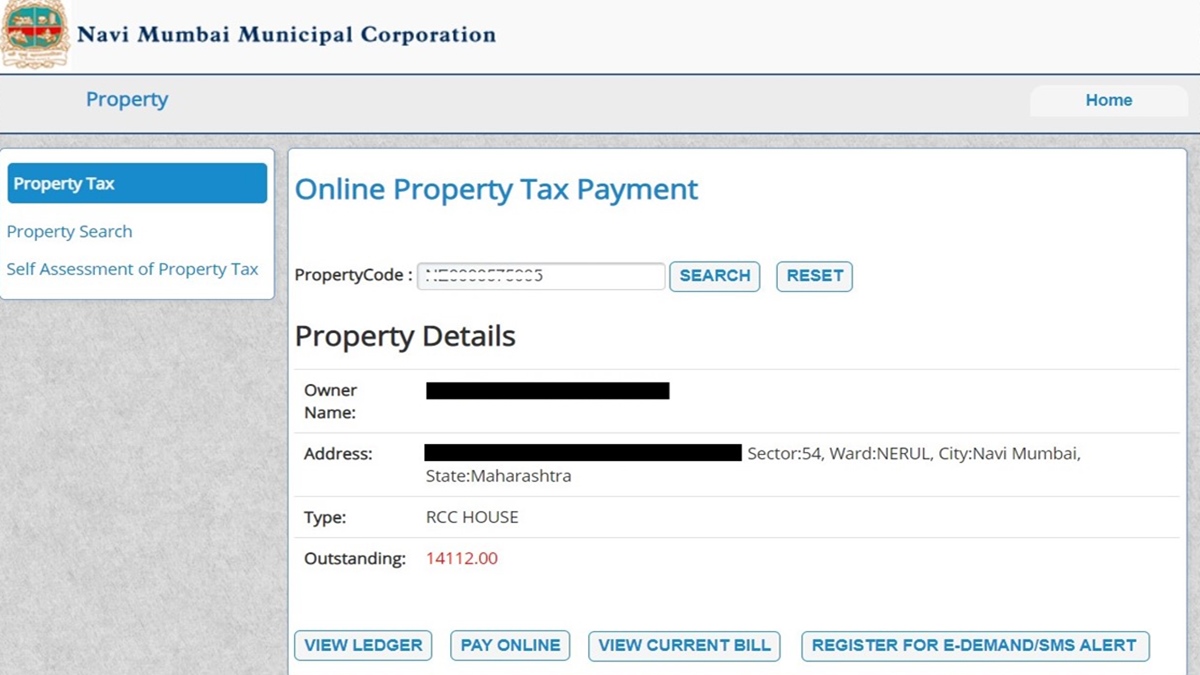

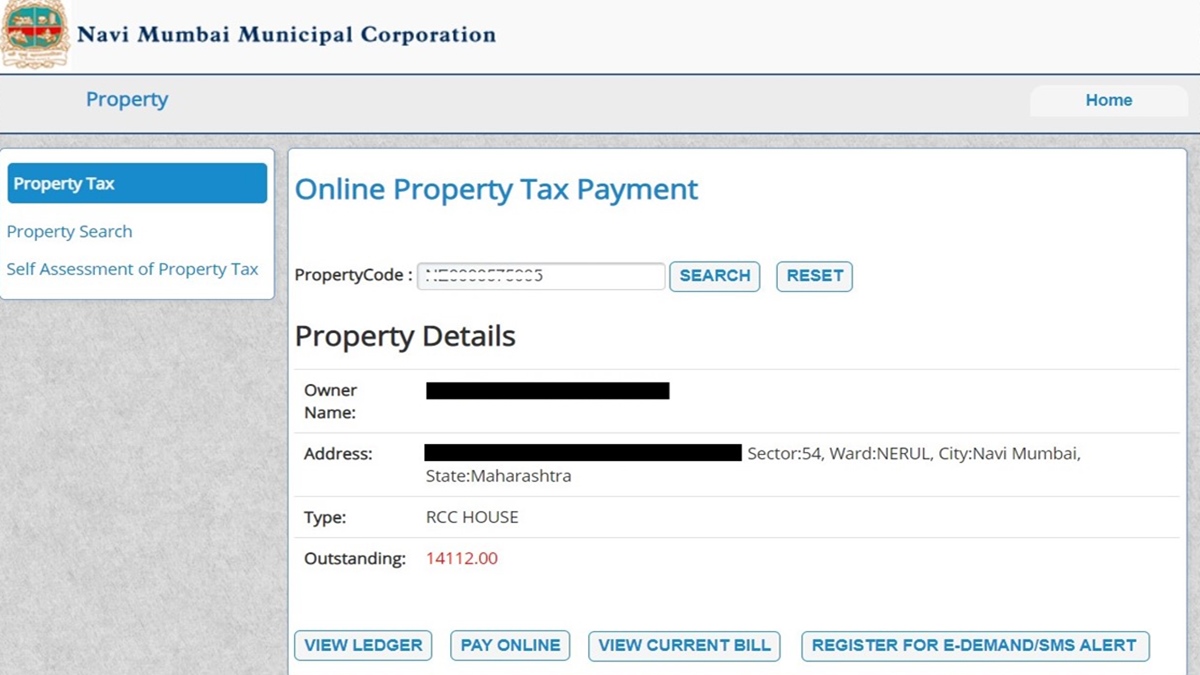

Step 2: Enter your Property Code > Click on the Search button.

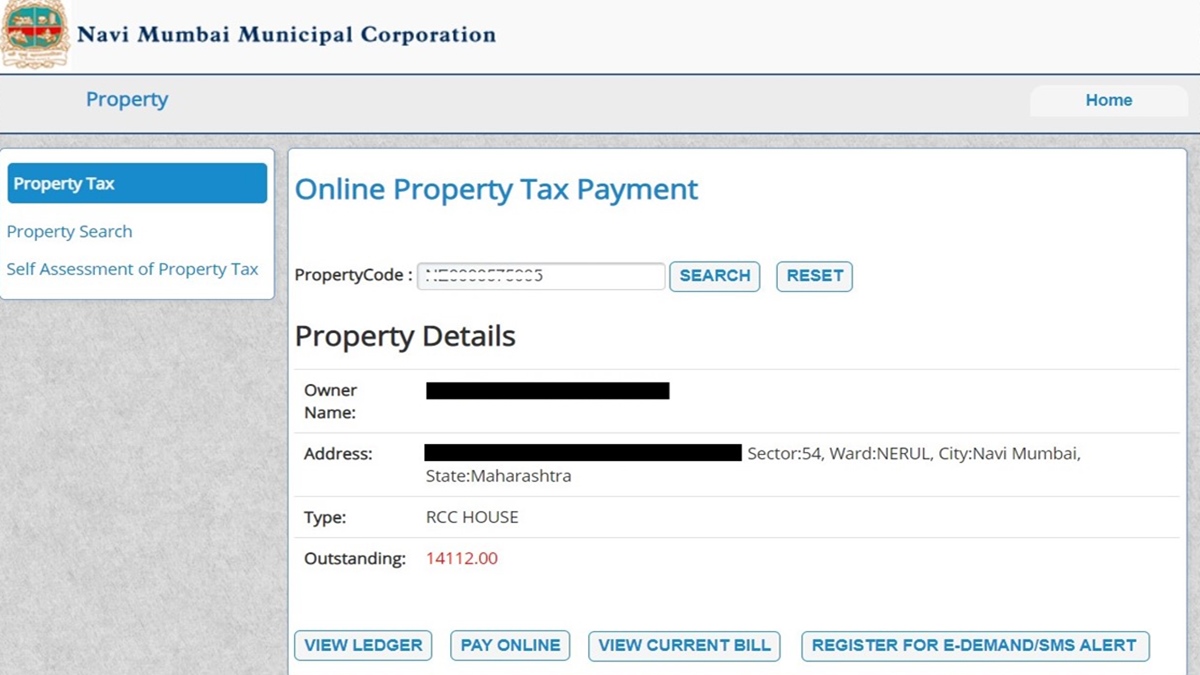

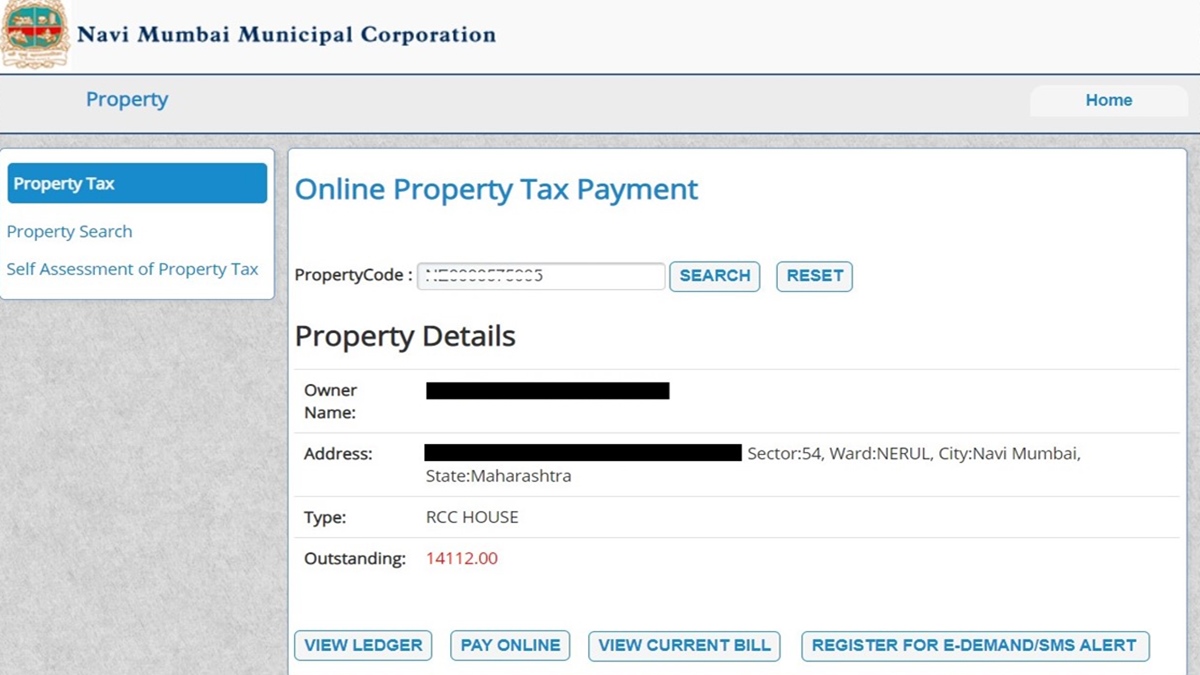

Step 3: The screen will show your property details, such as the name of the owner, address, and the outstanding tax amount. To pay the tax, click on the Pay Online button.

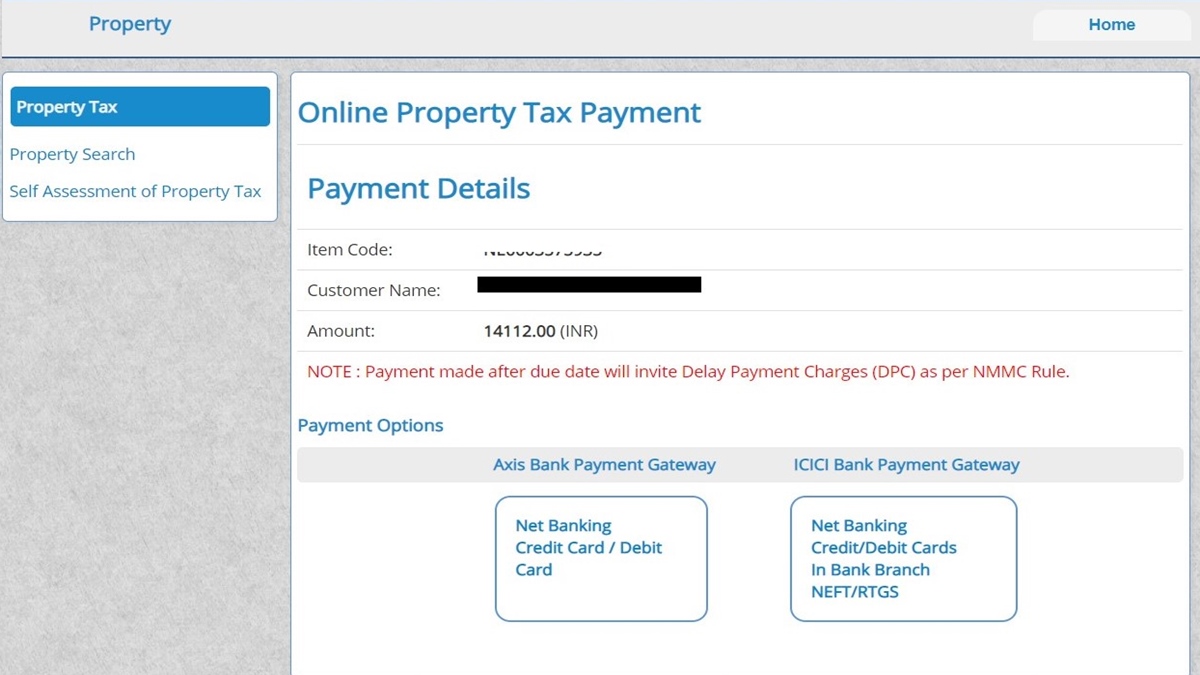

Step 4: Choose a payment gateway > Choose a payment method (internet banking, credit card, debit card, etc.) > Proceed to pay the amount.

Step 5: Once you have successfully made your Navi Mumbai property tax online payment, you will get an acknowledgment with receipt ID and transaction details.

How to check NMMC property tax dues online?

To check your property tax dues online in Navi Mumbai, follow the instructions given below:

Step 1: Go to the NMMC property tax online payment page.

Step 2: Enter your Property Code > Search.

Step 3: You can now see your Navi Mumbai property tax dues and other details on the page.

How to view the latest NMMC property tax bill online?

You can view your latest Navi Mumbai property tax bill online by following the steps given below:

Step 1: Firstly, go to the NMMC property tax bill view page > Enter the Property Code > Click on the Search button.

Step 2: Your property details along with the outstanding bill amount can be seen on the screen. Click on the View Current Bill button.

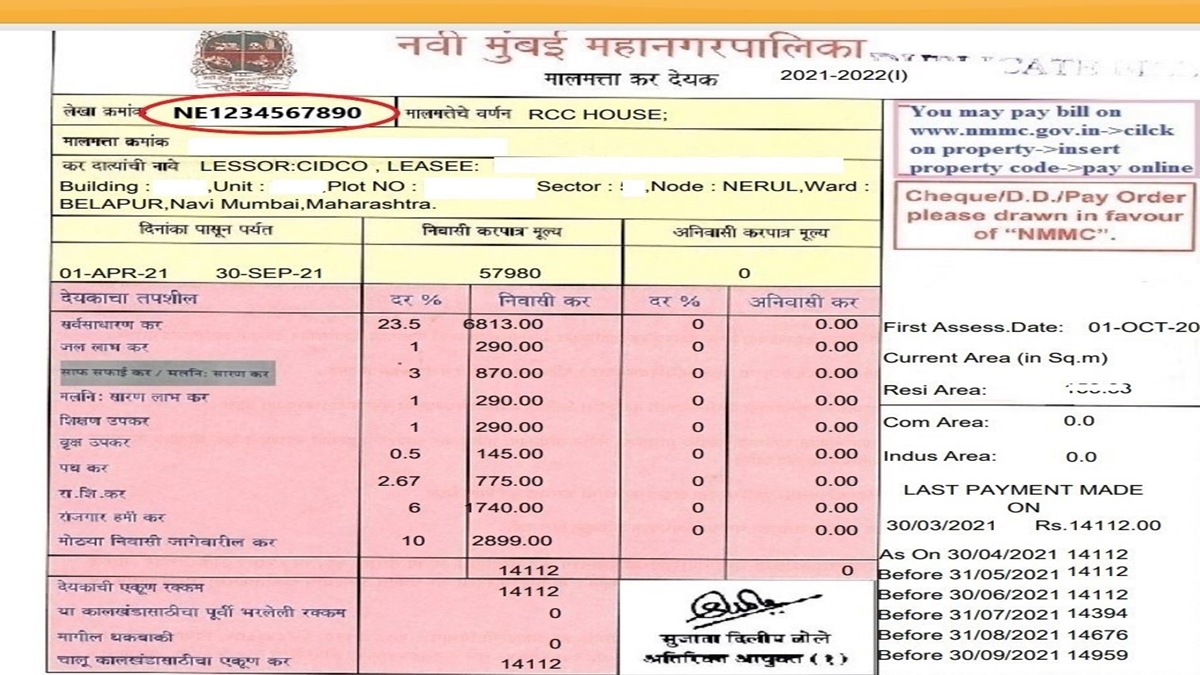

Step 3: Your latest Navi Mumbai property tax bill open on the screen. You can also download the bill in PDF format.

How to download NMMC property tax duplicate bill?

Here’s how to download your Navi Mumbai property tax duplicate bill:

You can view your latest NMMC property tax bill online by following the steps given below:

Step 1: Go to the Navi Mumbai property tax bill download page >

Step 2: Enter your Property Code > Click Search.

Step 3: The page will now show your property details and outstanding dues > Click on the View Current Bill button to download your NMMC property tax duplicate bill.

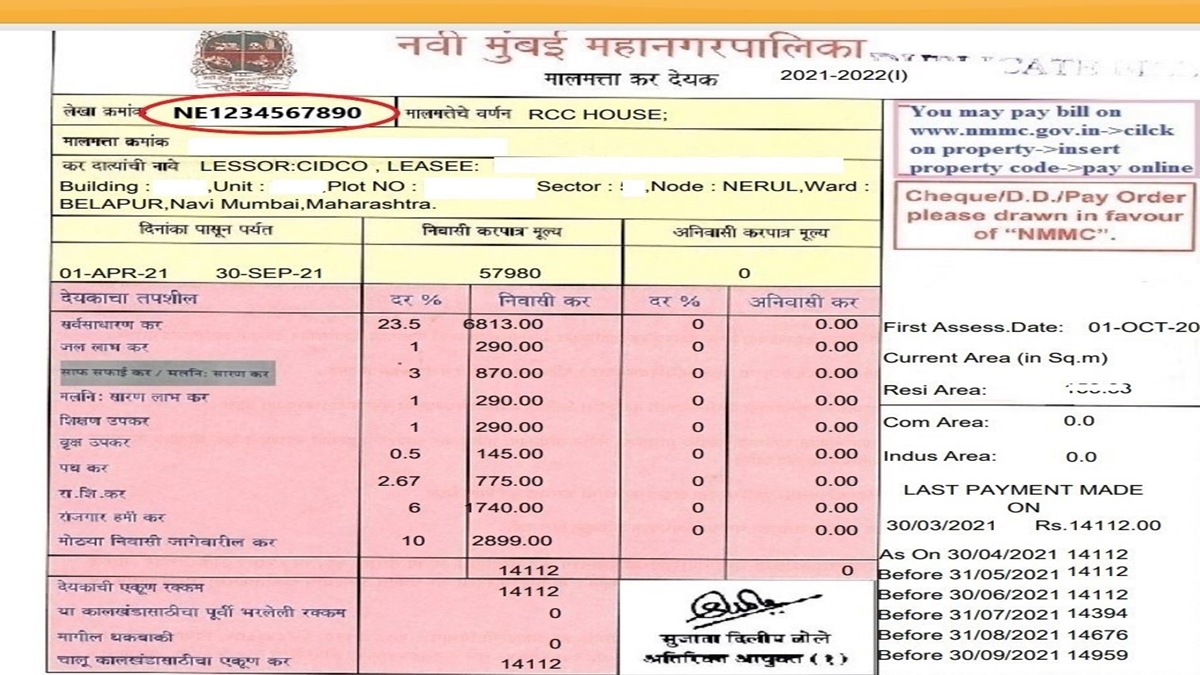

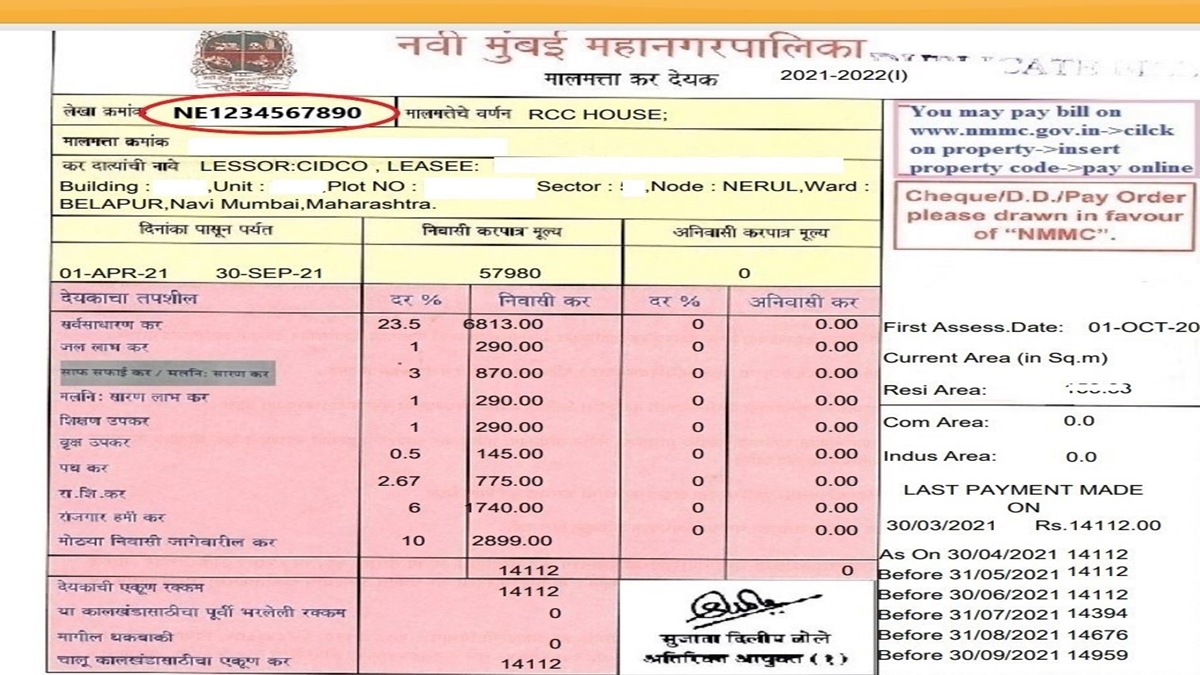

Step 3: You can now see your latest bill > Download it in PDF format by clicking on the download icon. Check the sample bill below:

How to get details of Navi Mumbai property tax payment history?

To get details of your NMMC property tax payment history, follow the steps given below:

Step 1: Click here.

Step 2: Enter your Property Code > Click on the Search Button > You can see your property details and the outstanding tax payment details.

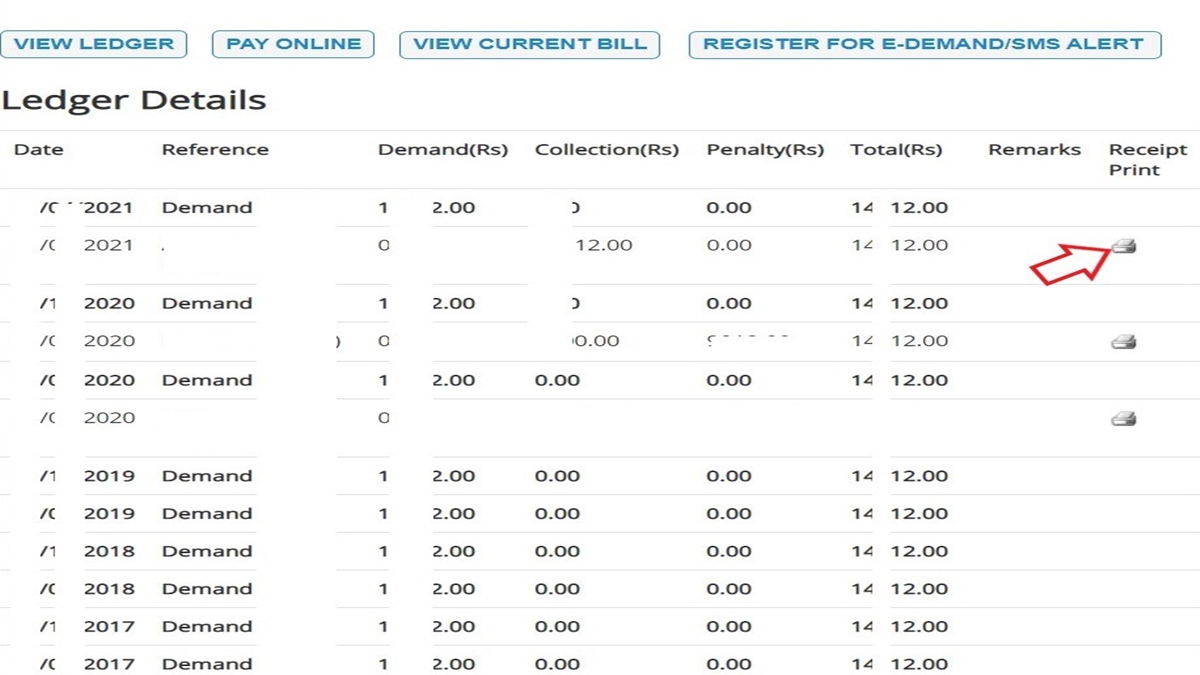

Step 3: Click on the View Ledger button > You can see your previous tax details and payment history.

How to download NMMC property tax payment receipt online?

Here’s a step-by-step guide on how to download Navi Mumbai property tax payment receipt online:

Step 1: Click here > Enter your Property Code > Search.

Step 2: Your property details will be shown on the page > Click on the View Ledger button at the bottom of the page.

Step 3: A ledger with details of your previous tax payments will appear on the screen > Click on the Receipt Print icon to print or download your NMMC property tax payment receipt.

How to calculate property tax using the NMMC property tax calculator?

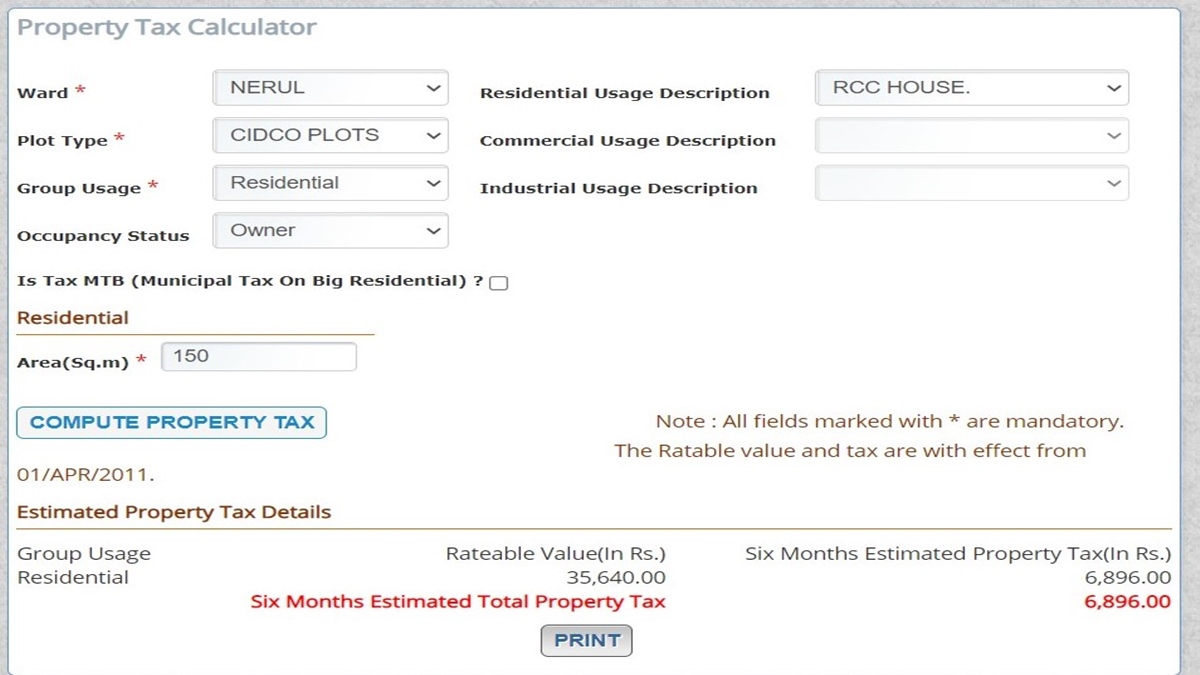

The NMMC website has a property tax calculator using which you can assess your property tax. Here’s a step-by-step guide on how to use the NMMC property tax calculator:

Step 1: Click here for the Navi Mumbai property tax calculator.

Step 2: Enter the following details: ward, plot type, group usage, occupancy status, usage description, area (in square meters), etc.

Step 3: Click on the Compute Property Tax button.

Step 4: You can now see the estimated amount of your property tax in Navi Mumbai based on the inputs given.

The Navi Mumbai property tax calculator gives you the estimated tax value for 6 months. You can also see the estimated total rateable value.

How to do NMMC property tax bill search by name?

If you don’t your property code and details, you can search for these details using your name. Here’s how to do it:

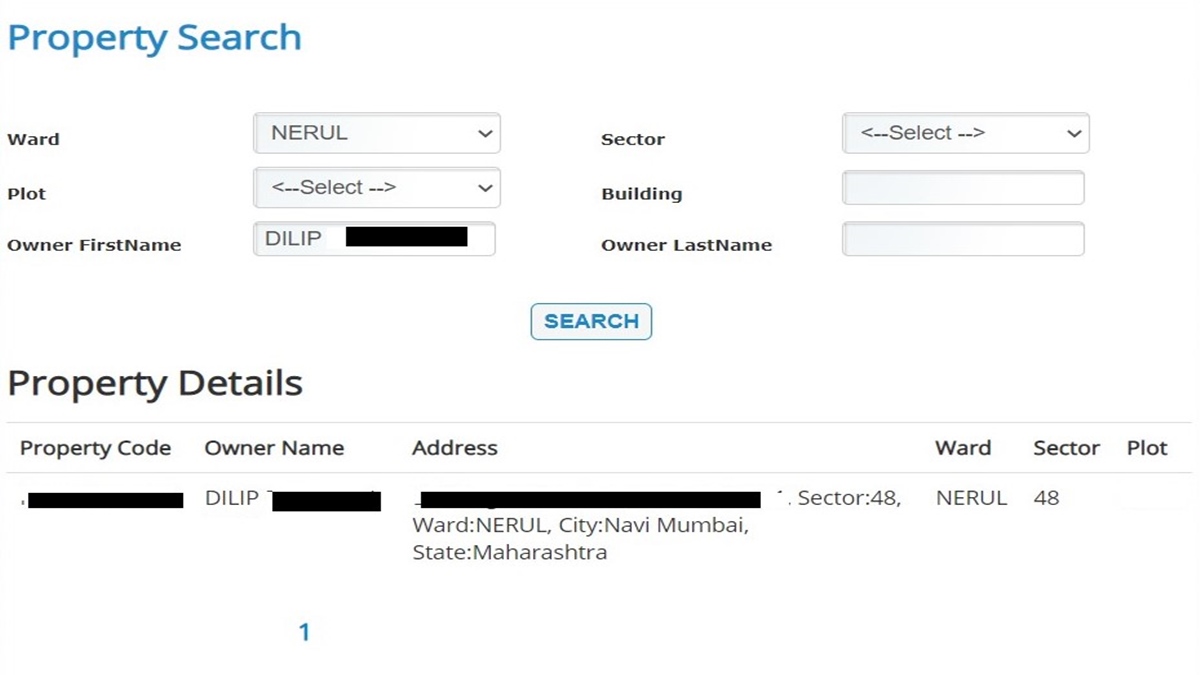

Step 1: Go to the page for NMMC property tax search by name.

Step 2: Choose your ward from the dropdown menu > Enter your first and last names (or the name of the apartment or housing society) > Click on Search.

Note: Plot name, ward name, and building name are not mandatory, but these details will help you get more accurate results.

Step 3: Your property details will be shown on the screen. It includes the property code, name, address, ward, plot, sector details, etc.

If you search for property details using just your first name (for ex: Dilip) or the name of your housing society, all matching properties will be shown on the screen. You can find out your property details from this list.

What is the full form of NMMC?

The full form of NMMC is Navi Mumbai Municipal Corporation.

What is the official website of the Navi Mumbai Municipal Corporation?

The official website of NMMC is https://www.nmmc.gov.in/.

What is the NMMC property tax contact number?

The contact number for Navi Mumbai water tax is 022- 27567333. You can also write to the officials at dmc_ptax@nmmconline.com or info@nmmconline.com.

What is the NMMC Property Code?

The NMMC Property Code is a unique alphanumeric digit allotted to each property in the Navi Mumbai Municipal Corporation. You can find your Navi Mumbai Property Code on the top of your tax bill.

Alternatively, you can search for your NMMC Property Code here by entering your name, ward name, and other details available.

Is there an app for making the Navi Mumbai property tax online payment?

NMMC e-Connect is the official app of the Navi Mumbai Municipal Corporation using which you can make your NMMC property tax payment online. To make Navi Mumbai property tax payment online using the app, you must follow the steps given below:

Step 1: Download the app (Play Store or App Store)

Step 2: Open the app > Tap on the Property Tax option on the home screen.

Step 3: Enter your Property Code > Search > Your outstanding dues will appear on the screen > Make your Navi Mumbai property tax payment online by clicking on the Pay Now button.

How is property tax calculated in Navi Mumbai?

The property tax in Navi Mumbai is calculated on the rateable value of the property. Currently, the NMMC property tax rate for residential properties is 38.67 of the annual rateable value and for non-residential and industrial properties, it is 68.33. Click here to know more.

You can also calculate your estimated rateable value and property tax using the NMMC tax calculator.

How To Pay Kerala Land Tax Online And Download Receipts

How To Pay Kerala Land Tax Online And Download Receipts  KMC Property Tax Online Payment, Download Receipt, Calculation And More

KMC Property Tax Online Payment, Download Receipt, Calculation And More How To Pay Chennai Water Tax Online

How To Pay Chennai Water Tax Online How To Pay Chennai Property Tax Online, Download Receipt And Check Payment Status?

How To Pay Chennai Property Tax Online, Download Receipt And Check Payment Status?