KMC Property Tax Online Payment, Download Receipt, Calculation And More

Want to know how to pay your KMC property taxonline, download KMC property tax receipt or do KMC property tax calculation? In this article, we discuss everything you should know about payment of Kolkata Municipal Corporation property tax online.

If you own property in Kolkata, you are liable to pay property tax every year. The tax collected is used to develop and maintain civic infrastructure.

Read: Top FAQs On CESC Online Bill Payment In Kolkata

Top FAQs On KMC Property Tax Online Payment

Now you can pay KMC property taxonline. Here are a few FAQs about property tax Kolkata Municipal Corporation:

- KMC online payment of property tax

- Downloading duplicate KMC property tax receipt

- KMC property tax concession

- KMC property tax penalty and more

Which is the official KMC portal?

The KMC property tax online payment service is available at www.kmcgov.in

To check details for your property tax, hover over the Make Online Payment button on the right panel and select ‘Property tax’ from the drop-down menu.

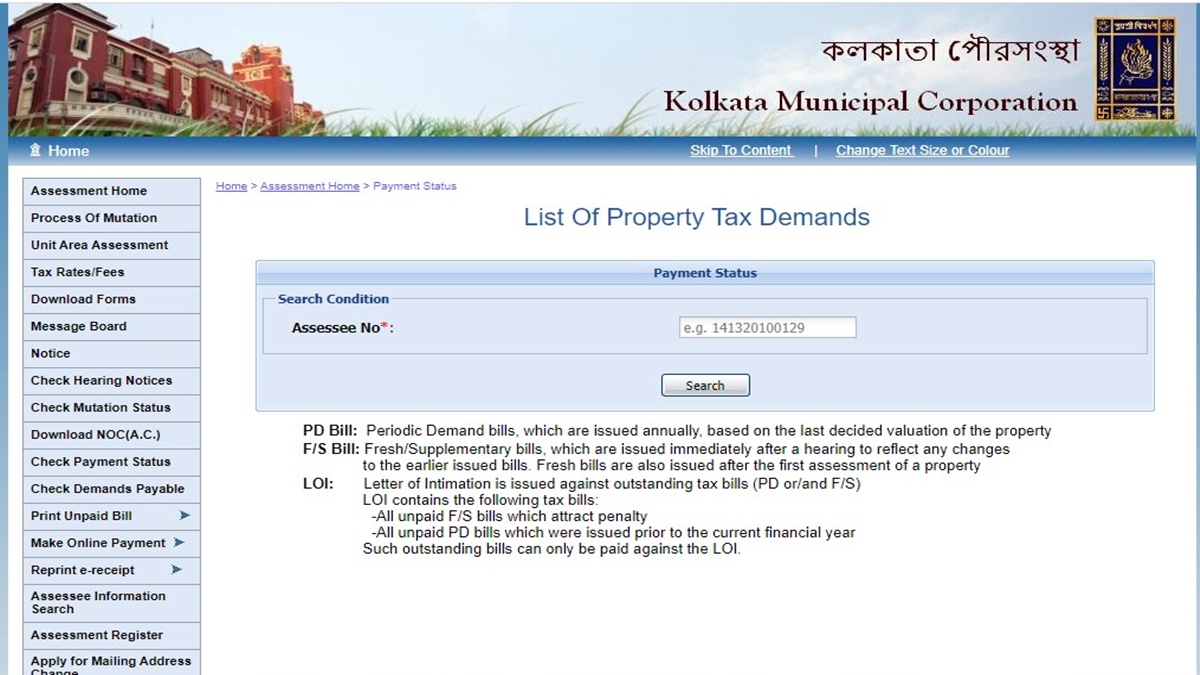

How can I check my property tax online in Kolkata?

KMC Property tax demands are issued once every 3 months. You can check all your outstanding as well as current demands on the KMC website. Here’s how to check your property tax online in Kolkata:

Step 1: Visit the Kolkata Municipal Corporation website

Step 2: Hover over the Online Services button on the left panel and click on the button for Assessment Collection’.

Step 3: Click on ‘Check Payment Status’

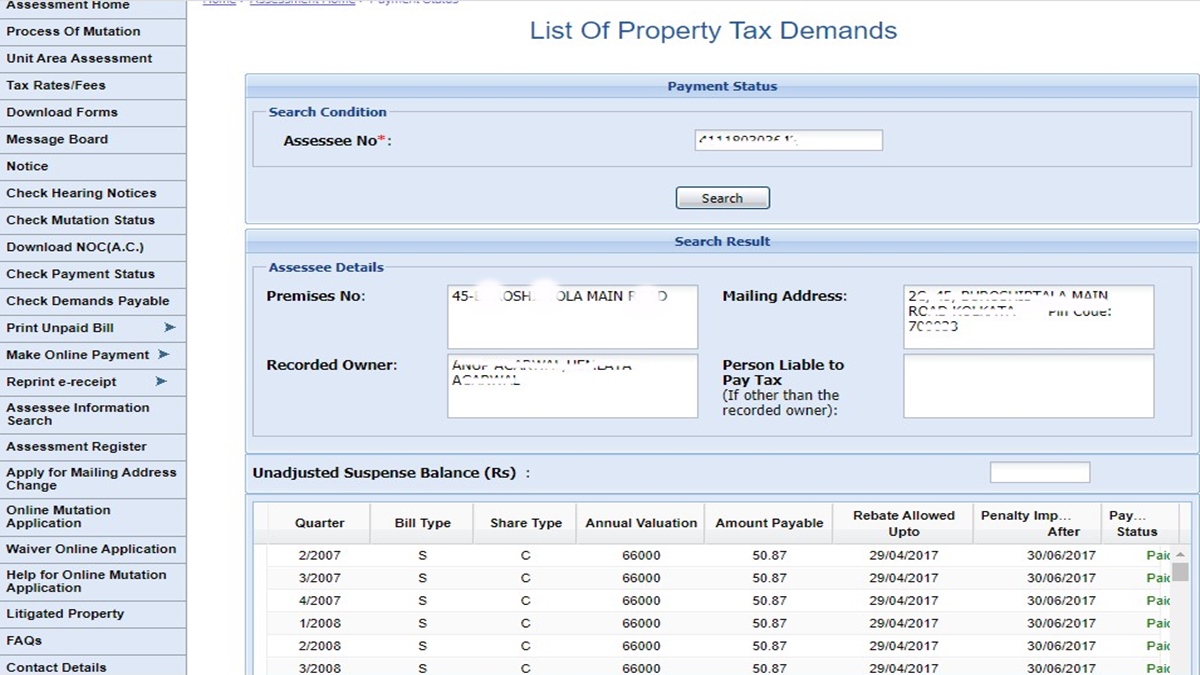

Step 4: Enter the assessee number and click search

You can scroll down to see all the tax demands raised in the past and their status as to whether they have been paid or not.

How to do KMC property tax bill payment online?

The process to pay KMC property tax online is quite simple. Here are the steps.

Step 1: Visit the Kolkota Municipal Corporation website

Step 2: Hover over the Make Online Payment button on the right panel. Hover over Property tax from the drop-down menu and click on the button for Current PD.

Step 3: Enter your assesse number and contact number. Entering the email id is optional. Click the Search button

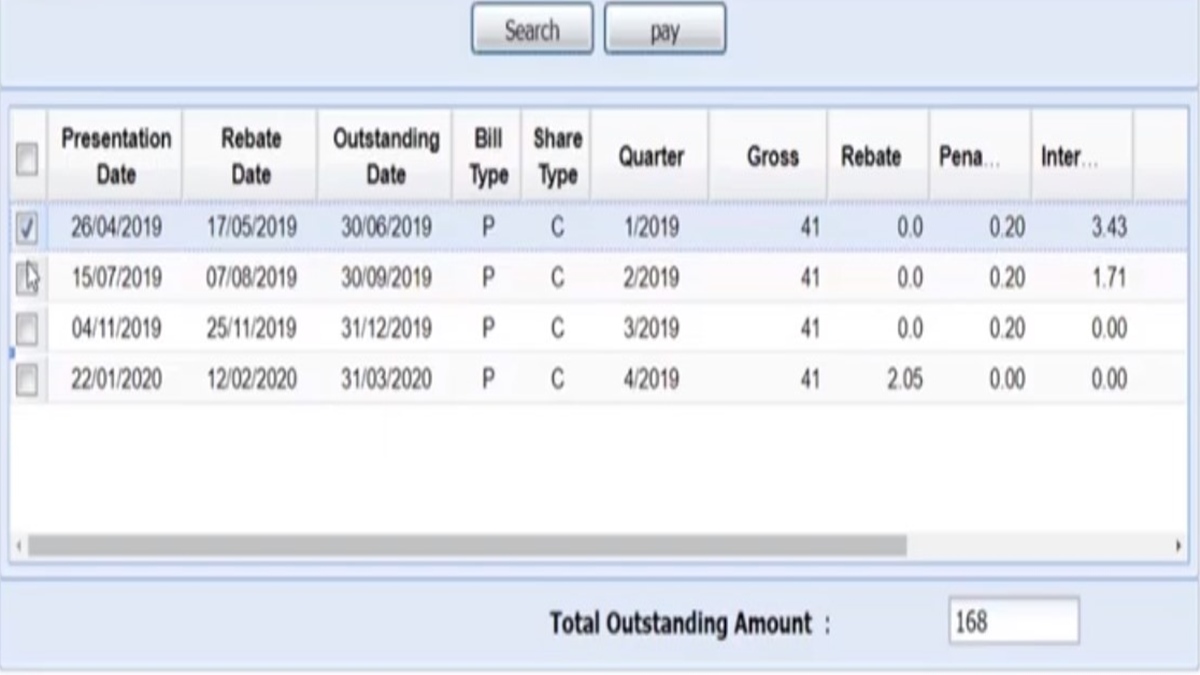

Step 4: Scroll down to see the outstanding bills. Check the box in the first column for the bill you want to pay. Click on the Pay button.

Step 5: You will be re-directed to a payment page. KMC property tax can be paid by credit card, debit card or internet banking.

Who is eligible for a KMC property tax concession?

Anyone who pays their KMC property tax on time is eligible for a 5% rebate.

Are there any exceptions to the KMC Property tax calculation rules?

Certain educational institutions in bustees/slums are exempt from KMC property tax if they meet the below criteria:

1. They possess their own buildings

2. Schools are audited by qualified accountants

3. Teachers are remunerated by the state government

Property tax for land, buildings or huts within a bustee improved by the West Bengal Slum Areas (Improvement and Clearance) Act, 1972 is calculated at 18%.

What is the KMC property tax penalty?

If you do not pay your KMC property tax in time, you may be subject to penalties. Check the below table:

| Demand | Penalty |

|---|---|

| 0.5% of the quarterly amount demanded |

|

| Between Rs 100 and Rs 200 | 1% of the quarterly amount demanded |

| Between Rs 200 and Rs 300 | 1.5% of the quarterly amount demanded |

| Between Rs 300 and Rs 400 | 2% of the quarterly amount demanded |

| Between Rs 400 and Rs 500 | 2.5% of the quarterly amount demanded |

| Between Rs 500 and Rs 700 | 3.5% of the quarterly amount demanded |

| Between Rs 700 and Rs 1000 | 5% of the quarterly amount demanded |

| Between Rs 1000 and Rs 5000 | 10% of the quarterly amount demanded |

| Rs 5000 | 15% of the quarterly amount demanded |

How can you get a KMC property tax receipt or download duplicate KMC property tax receipt?

Step 1: Visit the Kolkata Municipal Corporation website

Step 2: Hover over the Online Services button on the left panel and click on the button for Assessment Collection.

Step 3: Hover over the ‘Reprint e-receipt’ button and click on ‘Current PD’

Step 4: Enter the Assessee number and date bracket for the receipts. Click search

The page will be refreshed to show you a list of payment receipts issued. You can then download or print the required file for your records.

What is meant by PD Bills, F/S Bills and LOI?

These are abbreviations commonly seen on KMC Property Tax Demands and website. Here is what the abbreviations stand for:

PD Bill: This refers to Periodic Demand bills. These bills are based on the last property valuation and are issued annually

F/S Bill: This refers to Fresh/Supplementary bills. These bills are issued immediately after a hearing. They show modifications, if any, to the bills issued earlier.

LOI: This is a Letter of Intimation issued against outstanding tax bills.

What is the process for KMC property tax calculation?

Property tax rates in Kolkata range from 6% to 20% of the annual value. Check the table below:

| Property type | Un-developed bustee | Developed bustee | Govt property within the specification of section 171, subsection (8) of the KMC Act,1980 | Property with an annual value>Rs 30,000 | Others |

| Tax rate | 6% | 8% | 10% | 15% | 20% |

In a bid make the assessment of property tax simplier, Kolkata Municipal Corporation introduced the “Unit Area Assessment” system. All property within the city has been divided into blocks, 293 to be precise, with 7 categories (A–G) each. Category A has the highest value while category G has the lowest value. Each category is assigned a corresponding Base Unit Area Value (BUAV).

| Block category | A | B | C | D | E | F | G |

| BUAV per sq ft | 74 | 56 | 42 | 32 | 24 | 18 | 13 |

In addition, there are 5 Multiplicative Factors to be considered.

Location

| Location Code | Property situated beside roads with a width of : | Multiplicative Factor value |

| L1 | <=2.5m | 0.6 |

| L2 | >=2.5m and <=3.5m | 0.8 |

| L3 | >=3.5m and <=12m | 1 |

| L4 | >12m | 1.2 |

Structure

| Structure Code | Type of structure | Multiplicative Factor value |

| S1 | Residential buildings other than apartments on a plot>10 cottahs | 1.5 |

| S2 | Apartments with covered space excluding car parking space >2000 sq ft OR Apartments earmarked by IG Registration as ”Special Projects” (excluding certain types of apartments) | 1.5 |

| S3 | All other pucca construction | 1 |

| S4 | Garages and open/covered car parking | 0.8 |

| S5 | Semi-pucca construction | 0.6 |

| S6 | Proportionate common area | 0.5 |

| S7 | Kuchcha building | 0.5 |

Usage

| Usage Code | Type | Multiplicative Factor value |

| U1 | Water bodies | 0.5 |

| U2 | Residential property Car parking State Government aided institutions Assembly buildings | 1 |

| U3 | Industrial units registered as SSI units Commercial establishments with an area <250 s ft (excluding those in malls) Restaurants without bars | 2 |

| U4 | Health institutions Hotels categorized as 3 stars or below Single screen cinemas Non-government educational institutions Industrial units not registered as SSI units Clubs | 3 |

| U5 | 3 and 4-star hotels Vacant land used for storage/commercial purposes Assembly buildings Fuel stations | 4 |

| U6 | 5-star hotels Office spaces | 5 |

| U7 | Commercial establishments excluded from U3 | 6 |

| U8 | Communication towers Building with a hoarding Offsite ATMs Night clubs and discotheques | 7 |

| U9 | Vacant land or land under construction with an area <5 cottah (excluding vacant land that falls into any of the above categories) | 2 |

| U10 | Vacant land or land under construction with an area >5 cottah | 8 |

Occupancy Status

| Occupancy code | Status | Multiplicative Factor Value |

| O1 | Property used for non-commercial purposes and occupied by tenants other than the owner or his/her family with tenancy <=20 years | 4 |

| O2 | Property used for residential purposes and occupied by tenants other than the owner or his/her family with tenancy <=20 years | 1.5 |

| O3 | Car parking spaces | 4 |

| O4 | Property occupied by tenants other than the owner or his/her family with tenancy >=20 years and <=50 years AND Tenant is not protected by the West Bengal Premises Tenancy Act 1997 | 1.2 |

| O5 | Property occupied by tenants other than the owner or his/her family with tenancy >=20 years and <=50 years AND Tenant is protected by the West Bengal Premises Tenancy Act 1997 | 1 |

| O6 | Property occupied by tenants other than the owner or his/her family with tenancy <50 years | 1 |

| O7 | Property occupied by the owner or his/her family | 1 |

Age

| Age Code | Age of Premises | Multiplicative Factor Value |

| A1 | <=20 year | 1 |

| A2 | >=20 years and <=50 years | 0.9 |

| A3 | >50 years | 0.8 |

Once you have these details, you can calculate the property tax payable with the below formula:

Tax rate x BUAV x Area of land/ covered space x Location Multiplicative Factor Value x Structure Multiplicative Factor Value x Usage Multiplicative Factor Value x Occupancy Multiplicative Factor Value x Age Multiplicative Factor Value

You can do KMC online payment of property tax using the portal once you have the calculation. Installments are usually payable each quarter. You can read more details about tax calculation here or check the below PDF: