With PM Surya Ghar Muft Bijli Yojana online registration, it is expected to benefit over 1 crore households in India.

The PM Surya Ghar Muft Bijli Yojana has a simple aim – to encourage solar power and make electricity more affordable for all. This is one of the latest solar panel government schemes launched in 2024.

This solar panel scheme by the government of India offers a certain number of free electricity units and a subsidy for setting up solar panels. So, what is the government solar scheme? What’s the process for PM Surya Ghar Muft Bijli Yojana online registration? Let’s find out.

The PM Surya Ghar Muft Bijli Yojana – An Overview

The PM Surya Ghar Muft Bijli Yojana is a solar panel government scheme launched by the central government on 15th February 2024. Like the Prime Minister Mudra Loan Yojana and other government schemes, this scheme is aimed at improving the quality of life for Indians.

The solar panel central government scheme has allotted Rs 75 billion for residential rooftop solar plant subsidies. The program is expected to reduce demand on existing fossil-fuel-powered plants by generating 30 gigawatts of solar power.

There are two key facets to the PM Surya Ghar Muft Bijli Yojana.

Firstly, it provides a subsidy to help people set up solar power plants on the roof of their homes. Depending on the size of the power plant, the subsidy covers up to 40% of the solar panel cost. The size of the power plant to be set up further depends on the monthly consumption of electricity.

| Average monthly electricity consumption | Solar plant capacity | Subsidy available |

|---|---|---|

| 0-150 units | 1-2 kW | Rs 30,000 – 60,000 |

| 150-300 units | 2-3 kW | Rs 60,000 – 78,000 |

| >300 units | >3 kW | Rs 78,000 |

Secondly, households eligible for this rooftop solar panel government scheme will receive up to 300 units of free electricity per month.

Who is eligible for this solar panel government scheme?

Before starting the PM Surya Ghar Muft Bijli Yojana registration process, you must check your eligibility. The key criteria are:

- The applicant must be an Indian citizen

- The applicant must own the house with a roof suitable for installing solar panels

- The house must have a working electricity connection

- The household must not participate in any other solar panel government scheme

Choosing the solar plant capacity

The subsidy offered by this solar panel government scheme is dependent on the size of the solar power plant being set up.

If your household consumes up to 150 units of electricity each month, you may set up a rooftop solar plant with a capacity of 1-2 kW. Households consuming 150-300 units of electricity per month can install solar panels with a capacity of 2-3 kW.

Houses requiring more than 300 units of electricity can set up a rooftop solar plant with a capacity of more than 3 kW. However, note that the subsidy payable for a 3 kW and a 5 kW system are the same.

Read: Mahila Samman Savings Scheme and How to Open an Account

What are the documents required for the PM Surya Ghar Muft Bijli Yojana?

The key documents required to apply for the PM Surya Ghar Muft Bijli Yojana are:

- Proof of identity

-

- Any other government-issued ID card

- Proof of address

- Property tax receipt

- Latest electricity bill

- Any other government-issued proof of address

- Electricity bill

- Certificate proving ownership of the roof

- Property deed

- House tax receipts

Applying for the PM Surya Ghar Muft Bijli Yojana

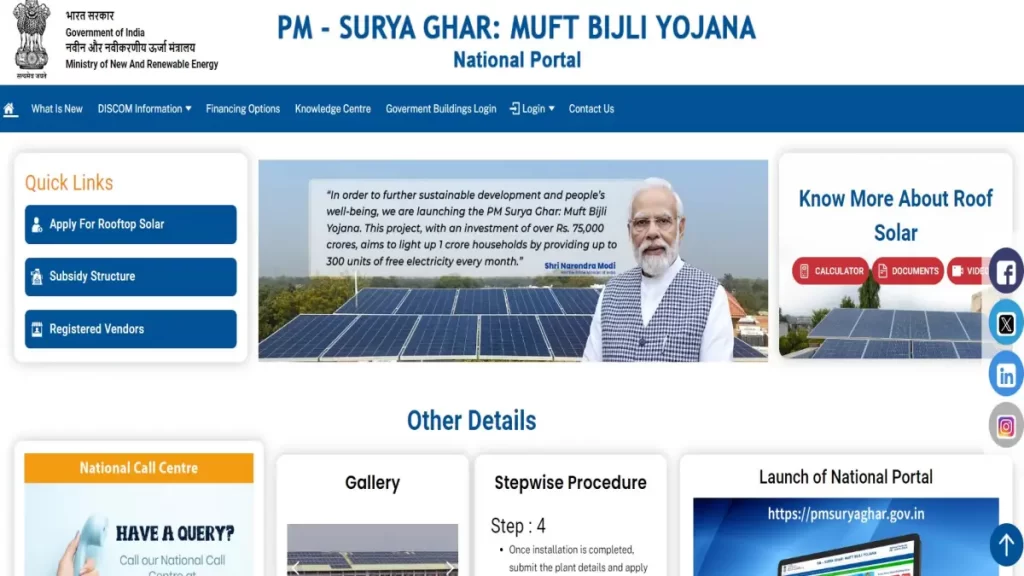

Applications for the PM Surya Ghar Muft Bijli Yojana may be submitted online at the PM Surya Ghar Muft Bijli Yojana official website. Here’s what you need to do:

Step 1: Register yourself on the PM Surya Ghar Muft Bijli Yojana official website. You can choose your state, district and electricity distribution company from the drop-down PM Surya Ghar Muft Bijli Yojana apply online menus. Enter your electricity consumer number. Enter the captcha code and click on the Next button.

Step 2: Enter your mobile phone number. You will receive an OTP. Enter the OTP and optionally share your email address. Enter the captcha code and click on the Submit button.

This completes the process for PM Surya Ghar Muft Bijli Yojana registration.

Step 3: Use your registered mobile number to log in to your PM Surya Ghar Muft Bijli Yojana account.

Step 4: Follow the website’s directions to fill out the application form to apply for rooftop solar installation. You can use the solar rooftop calculator to calculate the investment required and the subsidy you will be eligible for.

Step 5: Attach a JPEG or PDF version of an electricity bill from the last 6 months to complete the application.

Step 6: Enter details of the bank account where the subsidy is to be transferred.

Step 7: Wait for the application to be assessed and to see an update on your Feasibility Approval Status.

Step 8: Once your application is approved, you may get solar panels installed by any of the registered vendors in your DISCOM. The cost of installing the panels must be borne by you.

Step 9: Once the panels are installed, click on ‘Submit installation details” and apply for a net meter.

Step 10: A team will check the solar panel installation and set up a net meter. They will then generate a Project Commission Report.

Step 11: Check your bank details and submit a canceled cheque through the PM Surya Ghar Muft Bijli Yojana official website. The subsidy amount will be transferred to your bank account within 30 days.

Read: Read: PM Ujjwala Yojana Scheme: Apply Online For Free Gas Cylinder

Financing solar plants for the PM Surya Ghar Muft Bijli Yojana

The PM Surya Ghar Muft Bijli Yojana benefits will come into play only after the solar power plant has been installed. The initial costs for this solar panel central government scheme must be paid by the homeowner.

That said, there are several ways to get financial help. Many banks provide loans for solar panel government schemes.

| Bank | Product | Max Loan Amount | Max Loan Tenure | Net Interest Rate (% p.a.) |

|---|---|---|---|---|

| SBI | Installation of Solar rooftop to 3 KW | Rs 2 lakhs | 120 months | EBLR – 2.15% Effective Rate as of date: 7% |

| Installation of Solar Rooftops more than 3 KW and up to 10 KW | Rs 6 lakhs | 120 months | For Home Loan customers – 9.15% For Non-Home Loan Customers – 10.15% | |

| Central Bank of India | Model Roof Top Solar Loan Scheme – Installation of Solar Roof Top Upto 3 KW Margin | Rs 6 lakhs | 120 months | ROI at Repo + 0.50% i.e. 7% |

| Model Roof Top Solar Loan Scheme: Installation of Solar Roof Top Above 4KW to 10KW | Rs 6 lakhs | 120 months | ROI as per RBLR+0.15% i.e. 9.50% | |

| Punjab & Sind Bank | PSB Scheme for Financing Roof Top Solar (RTS) Projects up to 3 KW backed by PM Surya Ghar: Bijli Mukth Yojana | Rs 2 lakh | 10 years | Reducing 7% |

| PSB Scheme for Financing Roof Top Solar (RTS) Projects 3-10 KW backed by PM Surya Ghar: Bijli Mukth Yojana | Rs 6 lakhs | 10 years | 8.50% to 10.00%, | |

| Financing Solar PV as a component under Home Loan/Home Improvement Loans | Need-based | 30 years | 8.50% to 10.00%, | |

| Canara Bank | CRTS – PMSGY – up to 3kW | Rs 2 lakh | 10 years | Floating ROI Regime # 7.00% (RLLR – 2.25%) *Fixed ROI Regime # 7.75% RLLR + FRP (0.75) – 2.25% |

| CRTS – PMSGY– above 3kW to 10kW | Rs 6 lakh | 10 years | Floating ROI Regime 10.00% (RLLR+0.75%) Fixed ROI Regime 10.75% (RLLR + FRP (0.75) + CRP (0.75)) | |

| Union Bank of India | URTS-PM Suryaghar – Roof Top Solar plant up to 3kw | Rs 2 lakh or 90% of project cost | 120 EMIs | EBLR-2.25 % presently 7% pa. Reducing. |

| URTS-PM Suryaghar – Roof Top Solar plant 3-25kw | Rs 15 lakh or 80% of project cost (whichever is less) | 120 EMIs | Floating ROI CIC Score 750 & Above: EBLR+1.00% pa i.e 10.25% pa presently & CIC Score Below 750: EBLR + 1.50% i.e 10.75% pa presently. Reducing. | |

| URTS composite- Roof Top Solar plant 3-25kw | Rs 15 lakh or 80% of project cost (whichever is less) | 120 EMIs | Home loan ROI 8.35 % to 9.5% pa. Reducing | |

| Punjab National Bank | PNB Rooftop Solar Finance Scheme (up to 3 KW) | Rs.50000/- to Rs.70000/- per kw | 120 months | RLLR+BSP-2.25% i.e. presently 7.00% p.a |

| PNB Rooftop Solar Finance Scheme (more than 3 KW up to 10 KW) | Maximum Loan Amount Rs. 6.00 Lakh | 120 months | Varying rates of interest ranging from 8.4 – 8.9% | |

| Bank of Maharashtra | Maha Bank Rooftop Solar Panel Loan scheme- PM Suryaghar Muft Bijli Yojna-Upto 3KW | Rs 2 lakh | 120 months | RLLR – 2.30%, Effective Rate as of date: 7% |

| Maha Bank Rooftop Solar Panel Loan scheme- PM Suryaghar Muft Bijli Yojna -Above 3KW to 10KW | Rs 10 lakhs | 120 months | 9.50% to 10.30% (Floating-based CIC score) | |

| Maha Bank Rooftop Solar Panel Composite Loan | Rs 10 lakhs | 30 years | For Rooftop Solar Plant Capacity up 3 KW – RLLR – 2.30%, Effective Rate as of date: 7% Rooftop Solar Plant Capacity above 3 KW- 8.35% to 10.10% | |

| UCO Bank | UCO Suryodaya Loan Scheme | Up to 3KW : Maximum 2 Lakh Above 3KW: Maximum 6 Lakh | 10 Years + Including Maximum Moratorium Period of 6 Month | Capacity up to 3KW: UCO Float Rate – 2.30% (Strategic Discount) i.e. 7.00% at present Capacity above 3 KW: dependent on existing home loan |

| Indian Overseas Bank | IOB Surya | Rs 20 lakhs | 10 years | For RTS up to 3kW-7% For RTS above 3kW-9.35% to 10.50% |

| IOB HL Surya | Rs 20 lakhs | As per housing loan repayment | For RTS up to 3kW-7% Floating: For RTS up to 3kW-7% For RTS above 3kW-As per Housing Loan Interest Rate based on Rating Starting from 8.40% Fixed: 13% | |

| Karnataka Bank | KBL Ravi Kiran – Finance For Solar Projects | Rs 10 lakhs | 5 years | 11.16% |

| Bank of Baroda | PM-Surya Ghar Yojana – Composite | Rs 2 – 10 lakh | 10 years | For Solar units up to 3 KW: 7% For Solar units above 3 KW to 10 KW: Starting from 9.15% |

| PM-Surya Ghar Yojana-Standalone | Rs 10 lakh | 10 years | ||

| Indian Bank | Roof Top Solar Loan Scheme PM-Surya Ghar: Muft Bijli Yojana (Upto 3 KW | Rs 2 lakh | 10 years | ROI –Repo ( at present 6.50%)+Prime Spread (2.70%) – BSD (2.20%) presently 7% |

| Roof Top Solar Loan Scheme PM-Surya Ghar: Muft Bijli Yojana Above 3 KW to 10 KW | Rs 6 lakh | 10 years | For Home Loan customers (Same rate as Home Loan) For Non-Home Loan Customers (Home Loan ROI + 100 bps) | |

| Bank of India | BOI Star Roof Top Solar Panel Finance – Up to 3 KW | Rs 2 lakh | 10 years | RBLR- 2.25% Minimum 7.00% p.a. |

| BOI Star Roof Top Solar Panel Finance – 3 to 10 KW | Rs 10 lakh | 10 years | For Home Loan Customers: Same as applicable to new Home Loans For Non-Home Loan Customers: Home Loan ROI + 100 bps subject to minimum RBLR | |

| IDBI Bank | IDBI Surya Sakthi | Rs 0.25 lakh | 7 years | For SFMF 10% For Non SFMF 11 % |

| Saraswat Bank | Solar Urja Loan | Rs 50 lakhs | 7 years | Floating @11.75% |

| Dhanlaxmi Bank | Dhanam Green Loan | Rs 10 lakhs | For existing Home Loan/LAP customers – 15 years or residual tenor, whichever is lower 5 years for others and standalone customers | Dhanam Green Loan with collateral security-9.50% to 9.80% Dhanam Green Loan without collateral security-11.50% to 11.80% |

Setting up a solar power plant for the PM Surya Ghar Muft Bijli Yojana

To avail of the subsidies promised by PM Surya Ghar Muft Bijli Yojana, you must get the solar power system installed by registered vendors. You can find a list of approved vendors on the PM Surya Ghar Muft Bijli Yojana official website.

Step 1: Visit the PM Surya Ghar Muft Bijli Yojana official website

Step 2: Click on Registered Vendors

Step 3: The vendor list is segregated by state and DISCOM name. You can enter the city or DISCOM name in the search field to filter the list. Click on the button to view relevant details.

Step 4: Browse through the list of vendors for your area and contact them through the email address provided.

Maximizing subsidies from solar panel government schemes

Subsidies provided by the PM Surya Ghar Muft Bijli Yojana are capped at Rs 78,000 for a 3 kW solar power plant. In addition, you can also apply for subsidies from other solar power schemes in India.

Take the solar panel scheme in Uttar Pradesh for example. Once the solar panel central government scheme subsidy has been disbursed, households in UP that have put up a solar power plant on their rooftop may apply for an additional solar panel government subsidy in Uttar Pradesh.

The solar panel UP govt scheme provides an additional subsidy of Rs 15,000 per kW. This is subject to a maximum of Rs 30,000. The amount will be credited directly to their bank.

PM Surya Ghar Muft Bijli Yojana vs PM Kusum Yojana

The PM Surya Ghar Muft Bijli Yojana and the PM Kusum Yojana sound similar but there are several key differences. The former is for residential households while the latter is an Indian government solar panel scheme for farmers.

Firstly, the PM Surya Ghar Muft Bijli Yojana is directed towards families wanting to set up solar power plants on the roofs of their homes.

On the other hand, the PM Kusum Yojana details focus on helping farmers use barren farmland to generate electricity. This solar panel scheme by the government of India allows farmers to set up solar power plants with a capacity of 500 kW to 2 mW. The solar panels may be set up on stilts thereby allowing the land below it to be used to grow crops.

Subsidy structure for the 2 solar panel government schemes

The PM Surya Ghar Muft Bijli Yojana gives households a subsidy to set up the solar power plant. This subsidy is calculated based on the power plant capacity. It is capped at Rs 78,000.

A close look at the PM Kusum Yojana details will show that this scheme does not include a subsidy to set up the solar panels but provides a subsidy to install standalone solar pumps or solarize existing grid-connected agricultural pumps. The central government will pay between 30% and 50% of the total cost.

Other financial benefits of solar panel government schemes

The PM Surya Ghar Muft Bijli Yojana gives households up to 300 units of free electricity each month in exchange for the excess power generated by their solar power plants.

On the other hand, PM Kusum Yojana lets local DISCOMs buy power generated by the farmer’s power plants at the rate of 40 paise/kWh or Rs. 6.60 lakhs/MW per year. Thus, it acts as an additional source of income for them.

PM Surya Ghar Muft Bijli Yojana – Top FAQs

Do any of the solar panel government schemes offer free solar panels?

Free solar panels and installation are not included in any solar panel government schemes. The schemes do offer subsidies to balance costs.

Can PM Surya Ghar Muft Bijli Yojana participants apply for the Prime Minister Mudra Loan Yojana?

PM Surya Ghar Muft Bijli Yojana participants are not eligible for the Prime Minister Mudra Loan Yojana. They can apply for other kinds of financial aid from private and government banks.

Which is the PM Surya Ghar Muft Bijli Yojana official website?

The PM Surya Ghar Muft Bijli Yojana official website for consumers is https://www.pmsuryaghar.gov.in/

Which is the best Indian government solar panel scheme for farmers?

The PM Kusum Yojana is the best Indian government solar panel scheme for farmers.

What is the PM Kusum Yojana customer care number?

The PM Kusum Yojana customer care number is 1800-180-3333.

Ministers Of Delhi – Full List Of Rekha Gupta Cabinet Ministers

Ministers Of Delhi – Full List Of Rekha Gupta Cabinet Ministers Full List Of Chief Ministers of Delhi – Tenure And Party

Full List Of Chief Ministers of Delhi – Tenure And Party Assam Bank Holiday List 2025

Assam Bank Holiday List 2025 Maharashtra Ministers – Full List Of Devendra Fadnavis Cabinet

Maharashtra Ministers – Full List Of Devendra Fadnavis Cabinet