LIC Online Payment – How To Make Premium Payments Online, Check Status And More

Want to know how to make LIC online payment , which is the LIC customer care number or what is LIC direct pay? Read on to know everything about LIC premium payment online, checking policy status and downloading payment receipt.

Life Insurance Corporation of India (LIC) was established on September 1, 1956, with the goal of making life insurance much more accessible, particularly in rural areas, to reach all insurable persons in the country and provide sufficient financial cover at a fair price.

Through their website and mobile applications, LIC has made it convenient for customers to pay their LIC Premium online. The payment process is quick and secure. People are increasingly choosing this easy method of making payments online.

Some of the policies available to the customers online are:

- Dhan Rekha

- Bachat Plus

- Bhima Jyoti

- Jeevan Shanti

- Cancer Cover

Interesting Read

List Of The LIC Online Payment Policies

These are the available LIC online payment policies:

| Plan Type | Sum | Term |

| LIC’s Bhagya Lakshmi | Rs. 50,000 | 2 years + PPT (premium paying term) |

| LIC Single Premium Endowment Plan | Rs. 50,000 | 25 years |

| LIC New Endowment Plan | Rs. 1 lakh | 35 years |

| LIC New Jeevan Lakshya | Rs. 1 lakh | 25 years |

| LIC New Jeevan Anand | Rs. 1 lakh | 35 years |

| LIC’s Jeevan Tarun | Rs. 75,000 | 25 years minus the entry age |

| LIC New Money Back Plan | Rs. 1 lakh | 25 years |

| LIC’s e-Term | Rs. 25 lakhs (Rs. 50 lakhs for non-smokers) | 35 years |

| LIC’s Anmol Jeevan II | Rs. 24 lakhs | 25 years |

| Jeevan Akshay-VI | Rs. 1 lakh | N.A. |

Ways To Make LIC premium Payment Online

LIC provides a variety of options for making your LIC premium payment. The easiest alternative for making premium payments is to do it online since this is the most effective and safe way to do so. Here are the different ways to make your LIC premium payment.

Through The LIC’s website

Check the below FAQs to know how to pay using the website

LIC App

You can download the LIC app on your phone to make your LIC premium payment. They are available on the Play Store and App Store. The three apps available for making the payment are:

- LIC Customer

- LIC Pay Direct

- My LIC

1. LIC Customer App

You can make your premium payments using the LIC Customer app either by paying directly or by creating an account. You can make payments the same way as on the official website. Aside from making payments, other services like the LIC office location and premium calculation are available on this app.

2. LIC Pay Direct App

This app is solely for making the LIC premium payment using the Pay Direct option, as the name suggests.

3. My LIC App

You can find the links to the above mentioned apps on the My LIC app. Customers will have to install the LIC Pay Direct app or the LIC Customer app to pay their LIC premium through the app.

Payment Through ECS

LIC premium payments can also be made using ECS. The premium will be automatically taken from the policyholder’s registered bank account on the specified date through this ECS method.

To register for the ECS option, you must visit your bank branch with a canceled check and your insurance information.

LIC premium payment can also be made at the cash counters of any LIC branch, through cash, cheque, or DD.

LIC Premium Payment Online – Top FAQs

We will answer your queries and doubts on how to make an online LIC premium payment, what are the available apps, which are the LIC online payment policies, etc.

Can you make LIC online payment?

Yes, you can make an LIC online payment either through the app or through its official website. Read the next FAQ to know how to pay LIC premium online.

How to make LIC online payment of premium?

Registered policyholders and users can choose to make their LIC online payment of premium via the e-services offered on the LIC website. You can follow the steps given here for the same.

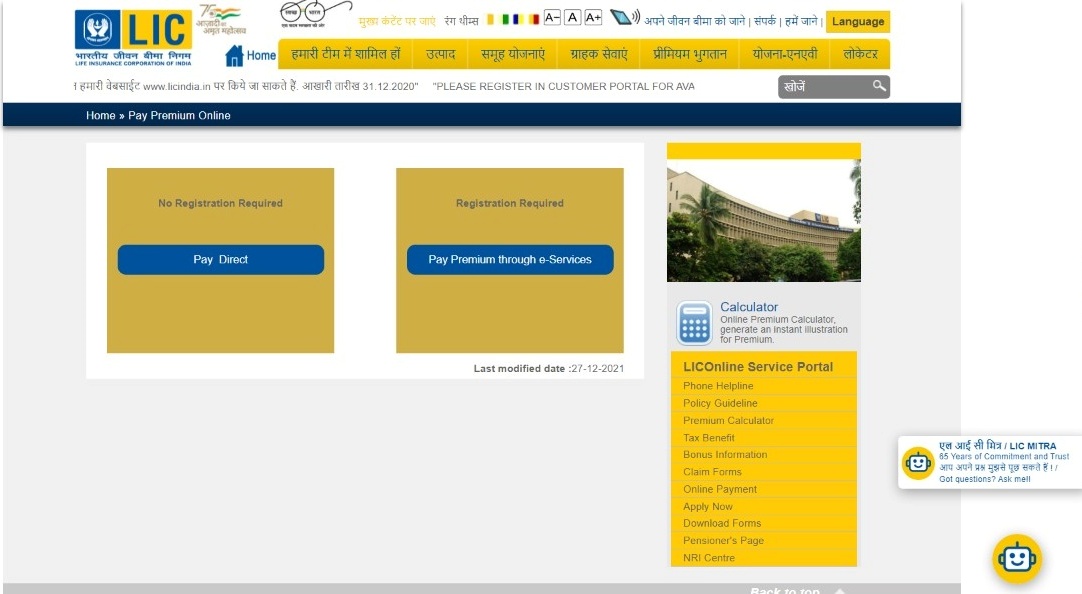

Step 1: Visit the LIC India website.

Step 2: Click on “Pay Premium Online”.

Step 3: You can select either the “Pay Direct” option or the “Pay Premium through e-Services”. For the “Pay Premium through e-Services”, an LIC login ID and password will be required to sign in.

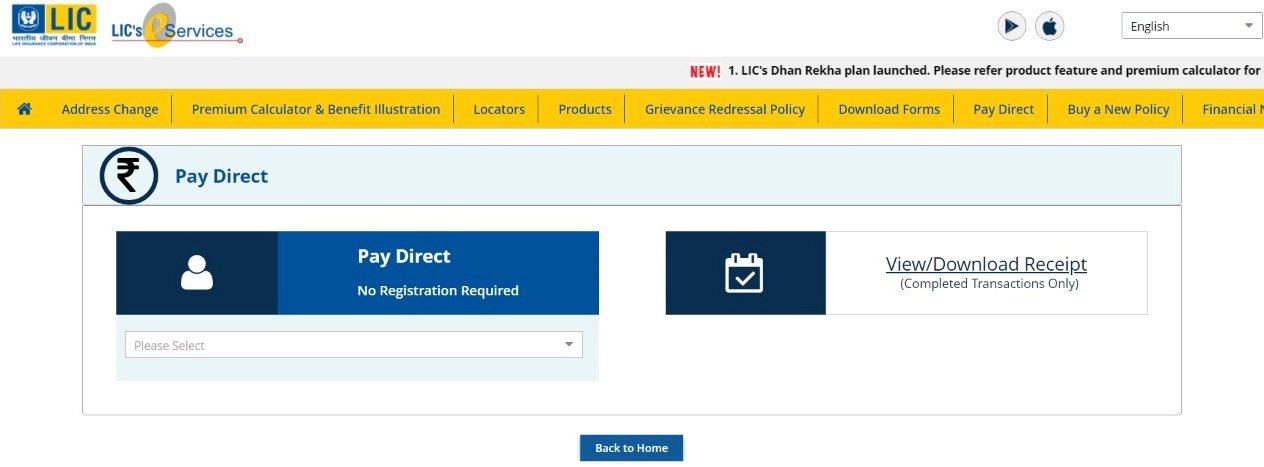

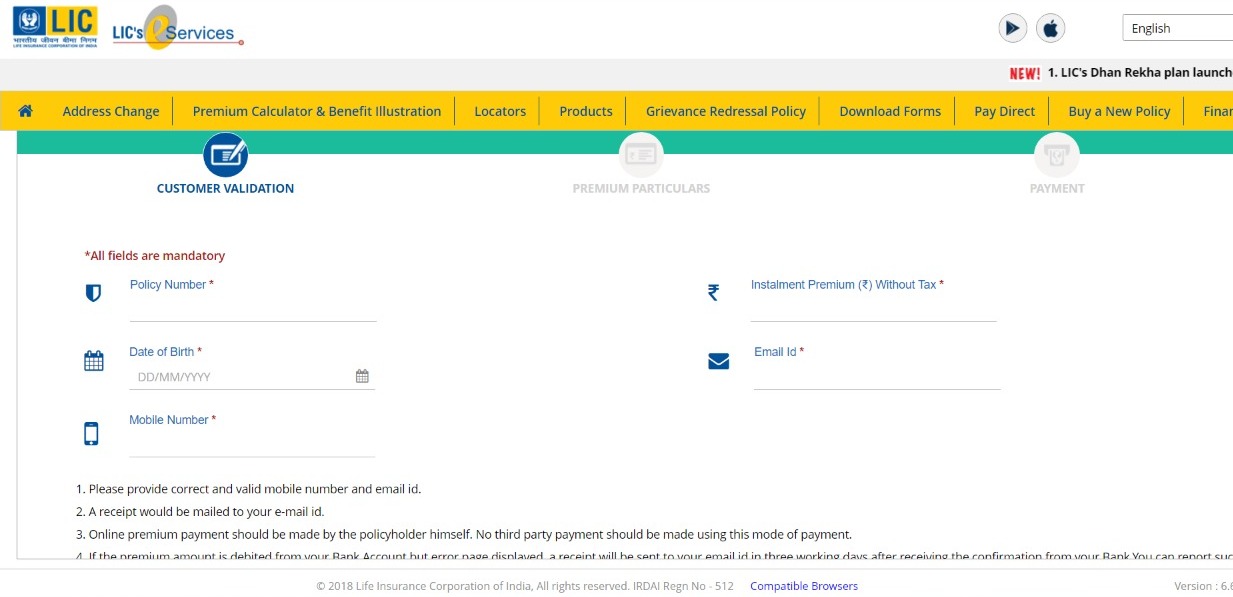

Step 4: If you select the “Pay Direct” option, you will have to choose the premium type, click “Submit”.

Step 5: Enter your policy number, installment premium (without tax), date of birth, email address, and mobile number. Once you have filled in the required information, click “Submit” again and proceed to payment.

Step 6: If you select “Pay Premium through e-Services”, you will have to log in on the new page that opens or register a new account if you don’t have one already. Click on “Individual Policy Details” to view your existing policies.

Step 7: Select a policy to view its details. Then click on “Check & Pay”.

Step 8: You will be shown the payment details for you to crosscheck. Once you have confirmed the details, click on “Check & Pay” again and proceed to the payment gateway.

Which is the LIC online payment login page?

You can find the LIC online payment login page here.

Which is the LIC online payment app?

How to download LIC online payment receipt?

To download LIC online payment receipt, you can refer to the steps given here.

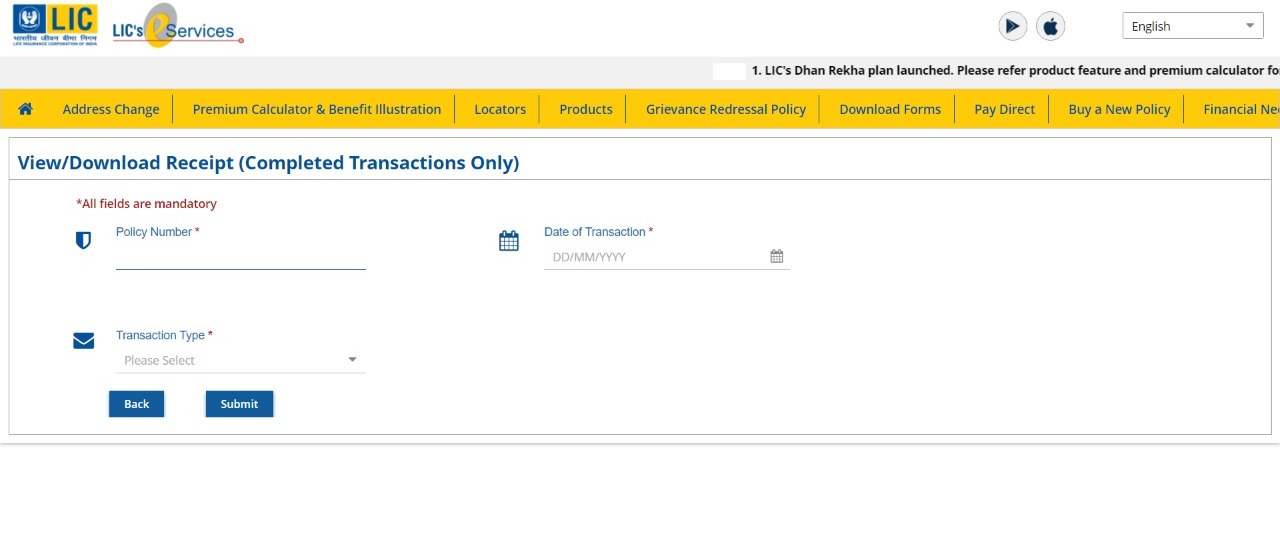

Step 1: On the LIC website, click on “Pay Premium Online”.

Step 2: Select “Pay Direct”.

Step 3: Click on “View/Download Receipt”.

Step 4: Enter the Policy Number, Transaction Date, and the Transaction Type, then click “Submit”.

Step 5: The receipt will be displayed to you. You can download it in a PDF format.

Which is the official LIC online payment portal?

You can find the official LIC online payment portal here.

Can you make LIC online payment without login?

Yes, you can make an LIC online payment without login by using the Pay Direct option.

How to check LIC policy status?

Follow these easy steps to check your LIC policy status online.

Step 1: Go to the official LIC website.

Step 2: Click on “Customer Portal” under “Online Services”.

Step 3: Log into your account or create one if you haven’t yet.

Step 4: Once you have logged in, click on “Policy Status”.

Step 5: Select the policy numbers to view the respective status and other details.

What is the LIC customer care number?

The LIC customer care number is +91 2268276827.

What is LIC Direct Pay?

The LIC Direct Pay option on the official LIC website lets customers make direct payment of Loan Interest, Loan Repayment, and Renewal Premium without having to log in or register a new account.

What is LIC full form?

The LIC full form is Life Insurance Corporation of India.

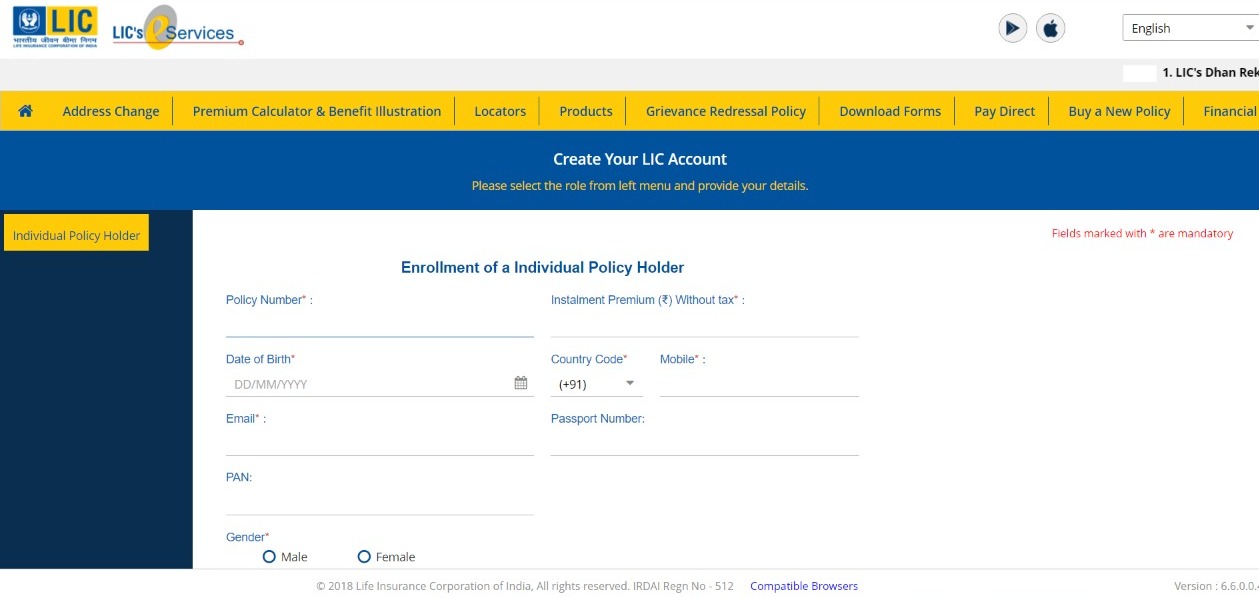

How to do LIC new user registration?

Here’s how you can do LIC new user registration.

Step 1: Go to the LIC website.

Step 2: Click on “Customer Portal”.

Step 3: Click on “New User”

Step 4: Fill in the required details and click “Proceed”.

Step 5: A pop-up box will appear, asking you to confirm your information by clicking “Yes”.

Step 6: You will need to verify your details through the verification link sent to you on your email address.

Step 7: Once you click on the verification link sent to you, a new tab will open and you will be directed to a page where you will be required to set a password using the OTP sent to you on your registered mobile number. After entering the OTP and setting the password, click “Submit” to complete your registration.

What is LIC e Service?

The LIC e Service project is an LIC initiative through which customers can avail themselves a wide variety of services from the convenience of their home. Many of the functions that were previously exclusively available at a branch office are now available online, saving you the time and the hassle of visiting the office.

How do I check my LIC policy status by SMS?

You can check your LIC policy status by SMS very easily. Just type “ASKLIC <Your Insurance Policy Number> STAT” and send it to either 9222492224 or 56767877. You will get an update on your LIC policy status immediately.

Where can I download the LIC surrender form from?

You can download the LIC surrender form from here

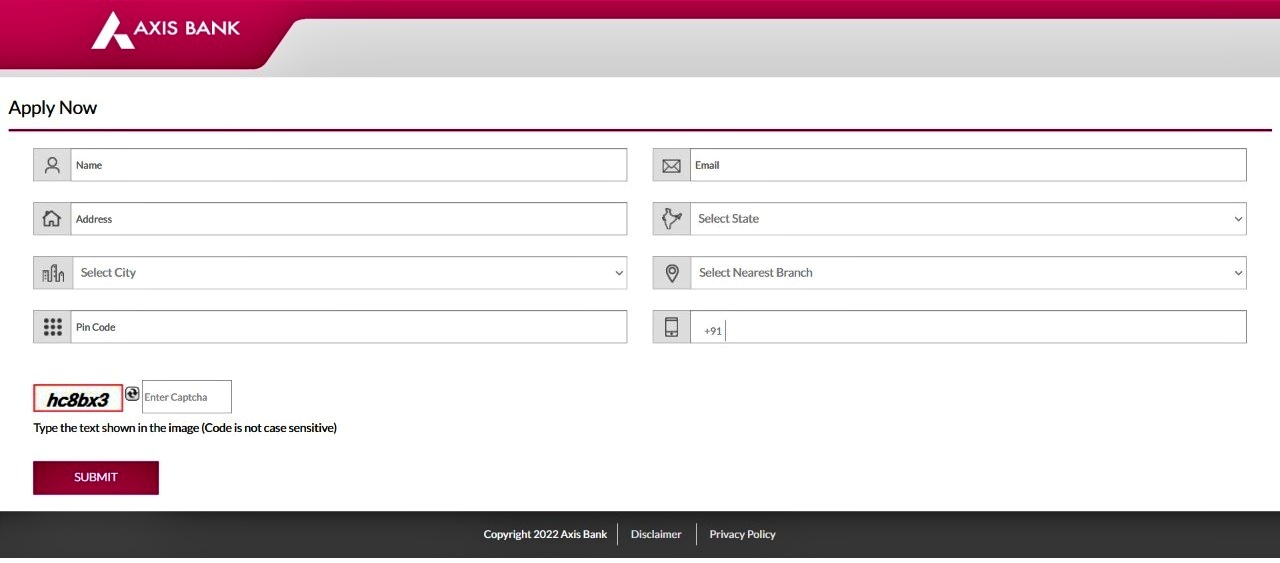

How to apply for an LIC credit card?

Here’s how you can apply for an LIC credit card.

Step 1: Go to the LIC Cards website.

Step 2: Click on “Apply Now” on the upper tab.

Step 3: Enter the required details and click “Submit”. Once you submit your details, a representative will contact you regarding the rest of the application process.

You can also apply for an LIC credit card offline by visiting your nearest LIC office. Obtain an application form from the counter and attach the necessary documents (Salary Slip, ID Proof, Address Proof, copy of PAN card, colored photograph) before submitting it. The rest of the process will be explained to you by the clerk.

How to check the status of my LIC credit card?

You can check the status of your LIC credit card by either calling customer care on the toll free number, 1800 419 0064, or through the official LIC Card website by clicking on “Track Your Credit Card Application” under the Important Links section. You will have to enter in your Application Reference Number, or your PAN or Mobile Number

What is the LIC credit card customer care number?

The LIC credit card customer care number is 1800 419 0064.

What is the LIC HFL customer care number?

Given below are the LIC HFL customer care numbers.

Delhi: 011 43524583, 011 43524584

Bengaluru: 080 65669564, 22960513

Mumbai: 022 22693165, 022 22693166

Hyderabad: 040 66631992, 23440506, 23440507

Faridabad:+91 129 2222629, 2222634

Pune: 020 25650508, 25676684

You can find the other customer care numbers here by selecting your state and area office.

Which is the agent portal for LIC?

You can find the agent portal for LIC here.

List Of Pension Plans From LIC

These are the Pension Plans from LIC.

1. LIC’s Pradhan Mantri Vaya Vandana Yojana

| Age Eligibility | 60 years |

| Policy Term | 10 years |

| Minimum Pension | ₹1,000 |

| Maximum Pension | ₹1,20,000 |

2. LIC’s Jeevan Akshay – VII

| Age Eligibility | 30 years to 85 years |

| Annuity Payment | 5, 10, 15, or 20 years and so on. |

| Interest Rate | 3% |

| Mode of Annuity | monthly, quarterly, half-yearly, or yearly |

3. LIC’s New Jeevan Shanti

| Age Eligibility | 30 years |

| Deferred Period | 1 to 20 years |

| Vesting Age | 31 to 80 years |

| Mode of Annuity | monthly, quarterly, half-yearly, or yearly |

4. LIC’s Saral Pension

| Age Eligibility | 40 years |

| Policy Term | Whole life policy |

| Payment Option | Single Premium |

| Mode of Annuity | monthly, quarterly, half-yearly, or yearly |