The Employee’s Provident Fund (EPF) is the main scheme under the Employees’ Provident Funds and Miscellaneous Act, 1952. Under the EPF India scheme, the employee and employer contribute an equal amount from the employee’s salary and dearness allowance. This contribution attracts an interest of 8.5%.

In a bid to simplify the documentation and processing associated with EPF, the government of India digitized the services and launched the EPF India website. If this is the first time you’re browsing through this website, you’ll have quite a few questions. How to do EPF online checking? How to view EPF passbook? How to do EPF online withdrawal India? And so on.

Read: LIC Online Payment Of Premium

EPF India – Highlights

| Name of the scheme | Employee’s Provident Fund |

| Issuer | Ministry of Labor and Employment |

| EPF India Website | epfindia.gov.in |

| App | NA |

| Interest rate | 8.5% |

| EPF toll-free number | 1800118005 |

| EPF complaint email id | rc.csd@epfindia.gov.in |

The Benefits Of EPF India

EPF India offers many benefits for salaried individuals. This includes:

- Assured capital appreciation at a better rate than bank savings accounts

- Builds a healthy retirement corpus for financial security

- With an easy premature withdrawal, it acts as an emergency corpus

- Interest accrued on the principal is tax-free up to a limit of Rs 1.5 lakh

EPF India – Find Answers To All Your Questions

Here are the answers to come of the most frequently asked questions about accessing your EPF account details online.

What is EPF India?

EPF refers to Employee Provident Fund. This is the world’s largest social security system. Employees pay a certain amount of their salaries every month towards the EPF India scheme. This amount is matched by a contribution from the employer. The lump-sum principal amount and interest are payable on retirement.

Which is the official EPF website?

All details about your RPF account can be found online at the official EPF website, epfindia.gov.in

What is the full form of EPF?

EPF stands for Employee Provident Fund. EPF India is a scheme under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

Who is eligible for EPF India?

Any salaried employee (in a company with more than 20 employees) who earns a salary less than Rs 15,000 per month must mandatorily have an EPF India account. This account must be opened by the employer.

Employees with a salary that is more than Rs 15,000 per month are termed as non-eligible employees. However, they may still have an EPF account with the consent of the employer and Assistant PF Commissioner’s approval.

What is pension contribution in EPF?

If you’re wondering, what is pension contribution in EPF, this is the amount employers contribute to an EPF account. It is usually 8.33% of the employee’s basic salary.

What is the EPF interest rate?

The EPF interest rate is currently set at 8.5% per annum.

How EPF pension is calculated?

Individuals with an EPF account are eligible for pension on retirement as long as they have contributed regularly to the account for 10 years or more. For your financial planning, it is important to know how EPF pension is calculated.

EPF monthly pension is calculated as:

Average last salary drawn X Numbers of years EPF contributions were made /70

What is EPF form 19?

If you want to withdraw your EPF savings as a final settlement, you will need the EPF form 19. This form can also be used to get a PF non-refundable advance. To apply for fund withdrawal with a Form 19 you must have:

1. An active UAN on the EPF Member portal

2. UAN linked with PAN, mobile number and bank account

The form can be accessed only if you are eligible for a final settlement.

What is the difference between VPF and EPF?

VPF stands for Voluntary Provident Fund. As the name suggests, this is a voluntary contribution. The employee can contribute 12% or more of their salary to this account. The employer is not obligated to match this contribution.

When it comes to VPF vs EPF, this is the main difference. Under the EPF scheme, employees must contribute 12% of their Basic salary + Dearness allowance towards the EPF account. This amount must be matched by the employer.

Which is official EPF mobile app?

There is no dedicated EPF mobile app. However, EPF related services have been made available on the UMANG app.

UMANG for Android Phones

UMANG for iPhones

Which is the EPF contact number?

If you have an EPF complaint, you can send an email about the same to rc.csd@epfindia.gov.in or call the EPF contact number, 1800118005

Which is the EPF toll-free number?

The EPF toll-free number is 1800118005.

What is form 15g in EPF used for?

Form 15g in EPF is a self-declaration form that is used to avoid paying TDS when making a withdrawal from an EPF account.

If the amount being withdrawn from an EPF account is more than Rs 50,000 and is has been saved for less than 5 years, TDS is payable unless the form 15g is submitted. It offers significant savings as TDS on withdrawals can range from 10% to 34.608%.

Eligibility criteria for submitting this form are:

1. Individual must be less than 60 years old

2. Total income must not exceed the basic exemption limit

3. An individual should have no tax liability for the current financial year

How to check EPF balance?

You can check your EPF balance online through the EPF India website.

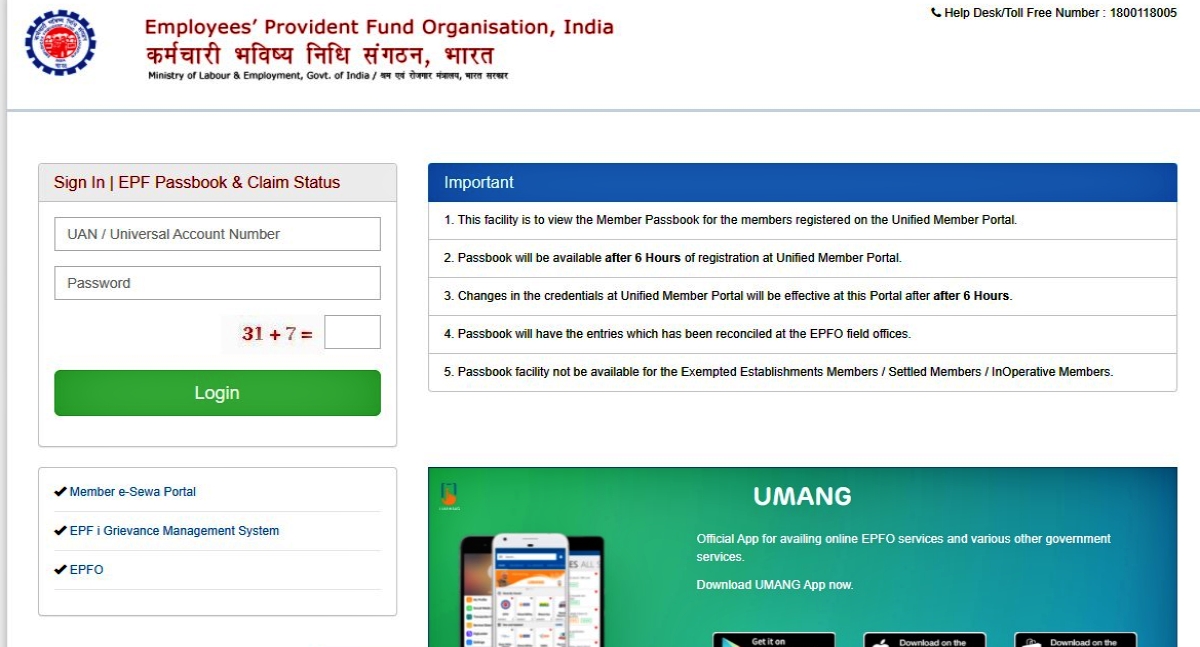

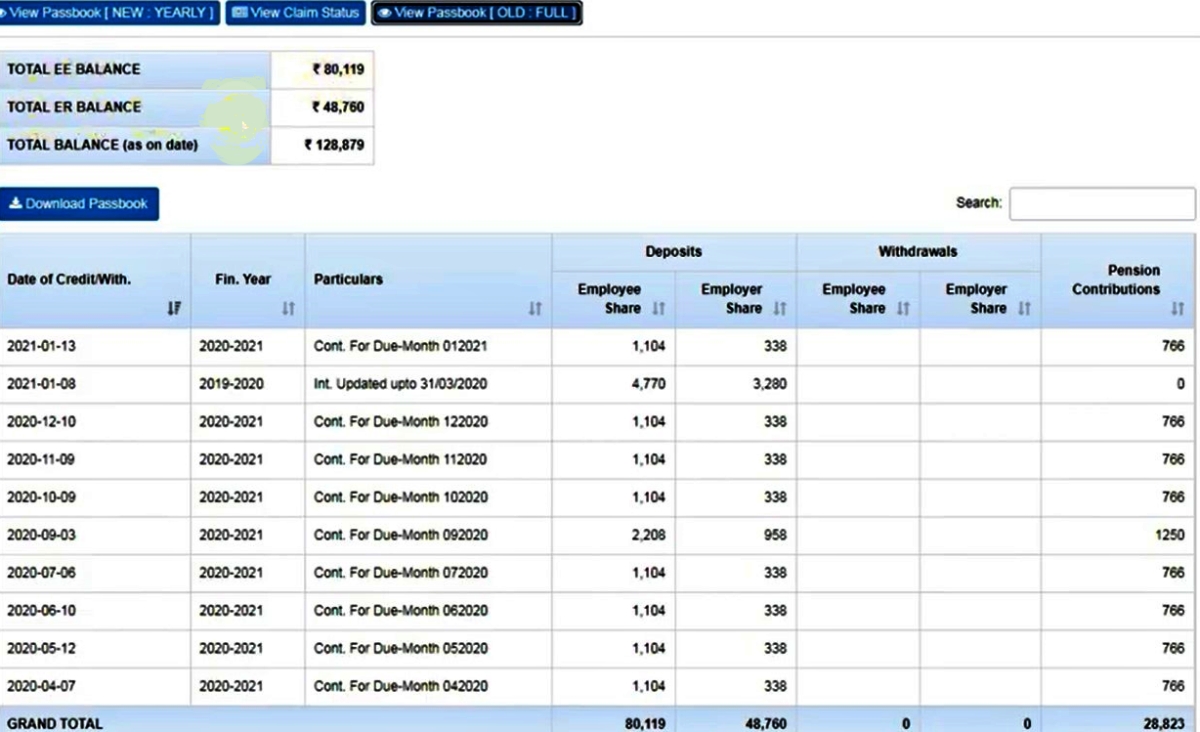

Step 1: Visit the direct link to the passbook section of the website

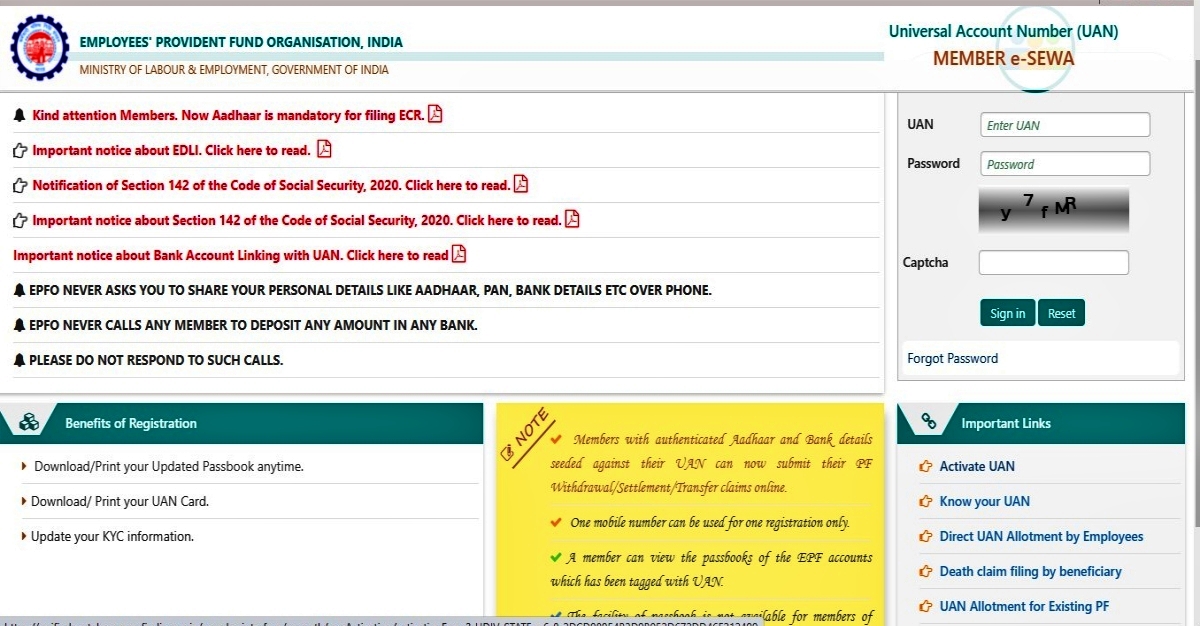

Step 2: Enter your Universal Account Number and Password. Complete the captcha verification and click on the Login button.

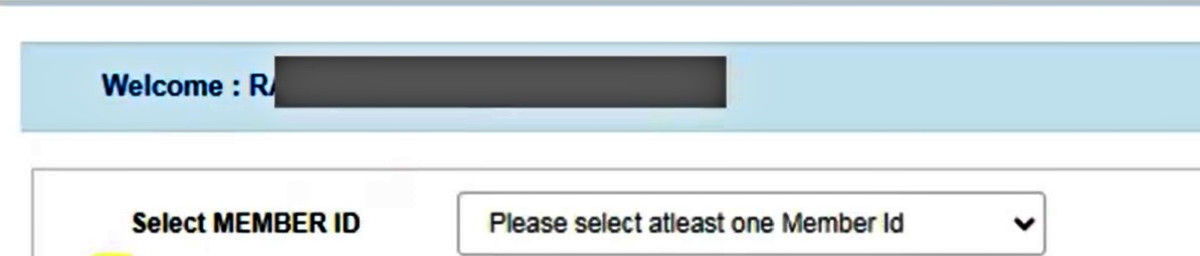

Step 3: Select your Member ID

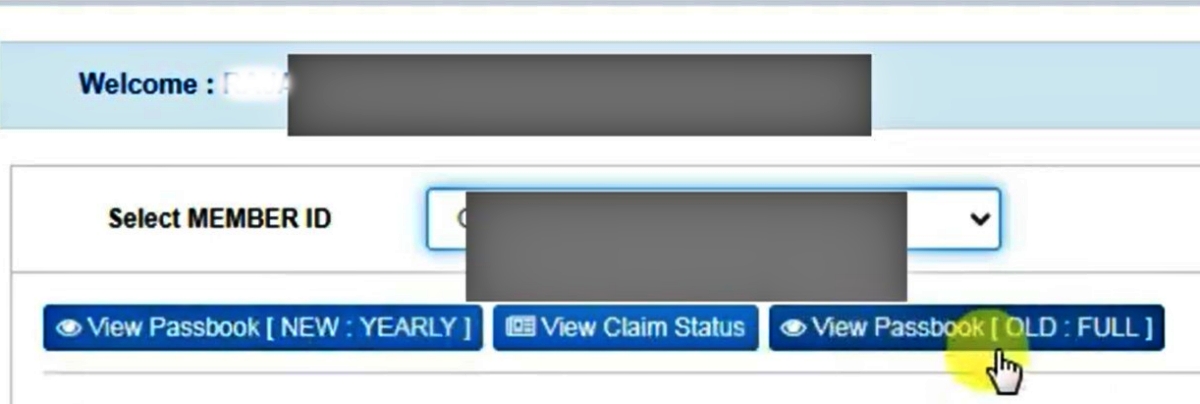

Step 4: Click on View Passbook

You will then be able to see your current balance along with particulars of past transactions.

Other ways to check your EPF balance are:

1. The UMANG app

2. Missed call from your registered mobile number to 011-22901406

3. SMS ‘EPFOHO UAN ENG’ to 7738299899

How to do EPF online checking?

Follow the below steps for EPF online checking of your current balance.

Step 1: Visit the passbook sections of the official EPF India website

Step 2: Log in to your account with your Universal Account Number and Password.

Step 3: Select your Member ID from the drop-down menu

Step 4: Click on View Passbook

You will then be able to view your EPF account statement.

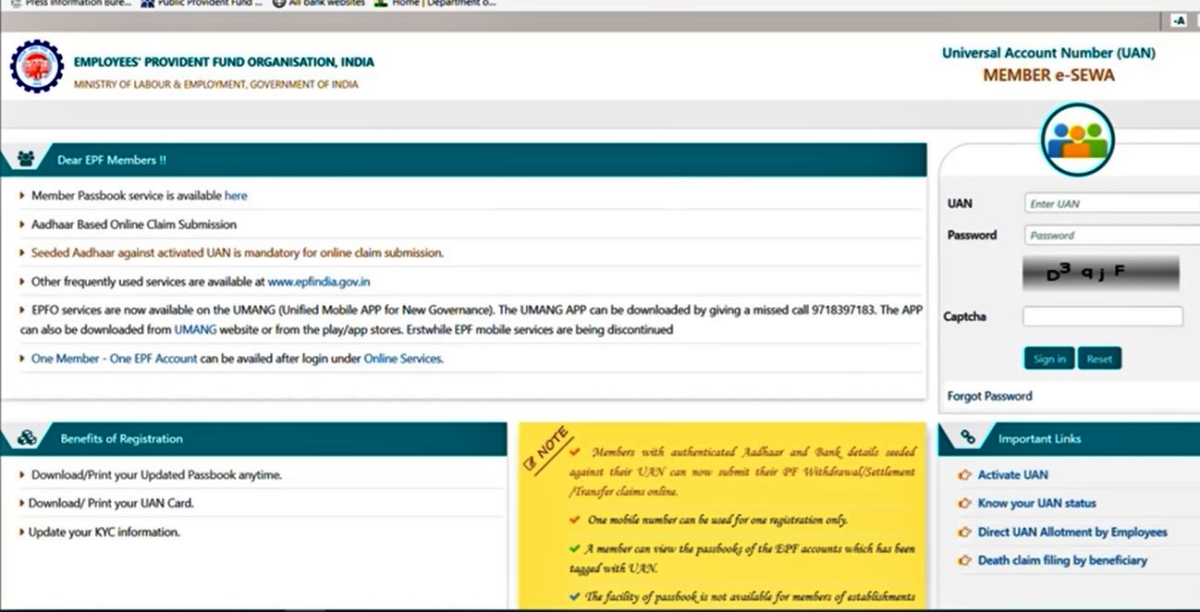

Which is the employee EPF log in page?

You can access the EPF log in page here.

Follow these steps to navigate to this page from the main EPF India website.

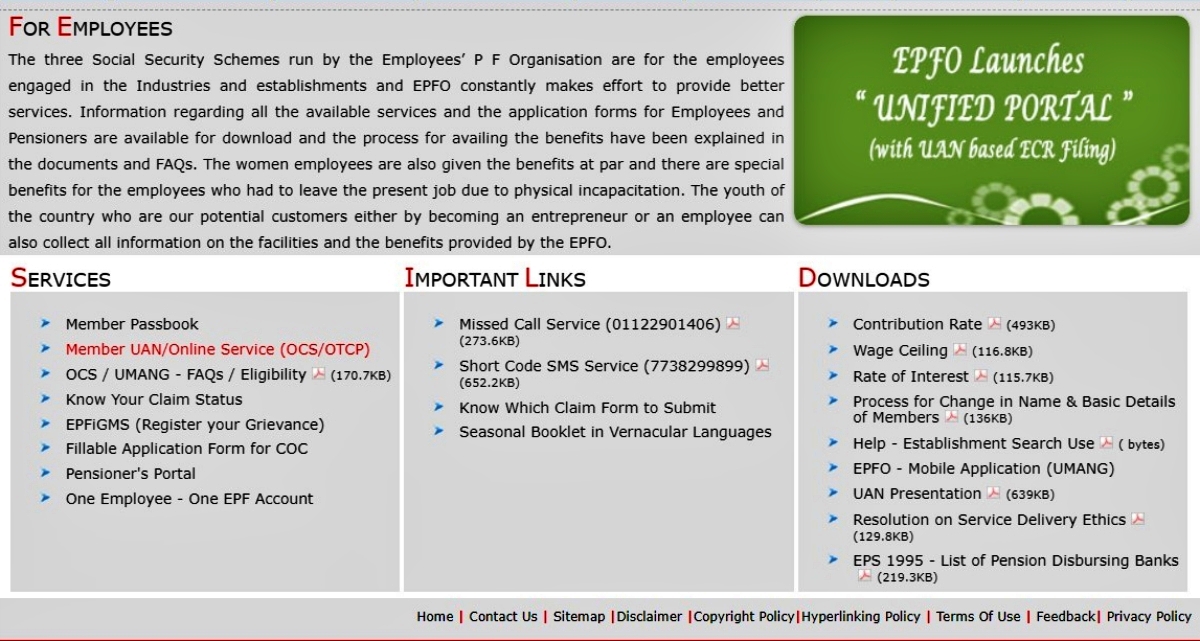

Step 1: Visit the EPFIndia website

Step 2: Hover over services and click on ‘For Employees’

Step 3: Scroll down and click on ‘Member UAN/Online Service (OCS/OTCP)’

To log in to this page, you will need to first activate your UAN. This number will be available with your employer and mentioned on your salary slip.

Step 1: Click on ‘Activate UAN’

Step 2: Enter your details as per your UAN and get authorization pin

Step 3: Agree to the terms and enter the OTP as received via SMS.

This will activate your UAN and a password will be sent to your registered mobile number.

You can now use this UAN and password to log in to the EPF website and access all the services provided.

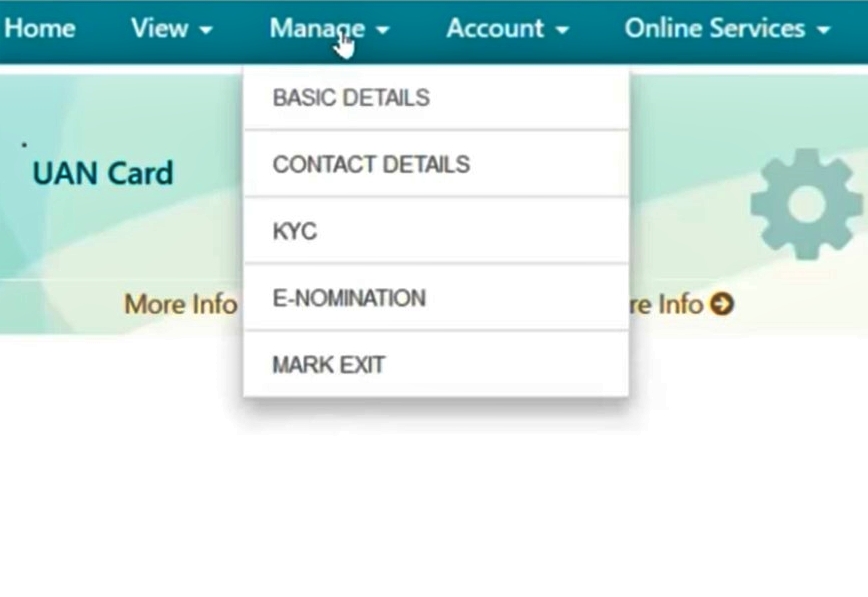

How to link aadhar to EPF?

It’s easy to link aadhar to EPF. Here’s what you need to do.

Step 1: Visit the official EPF website

Step 2: Log in to your account

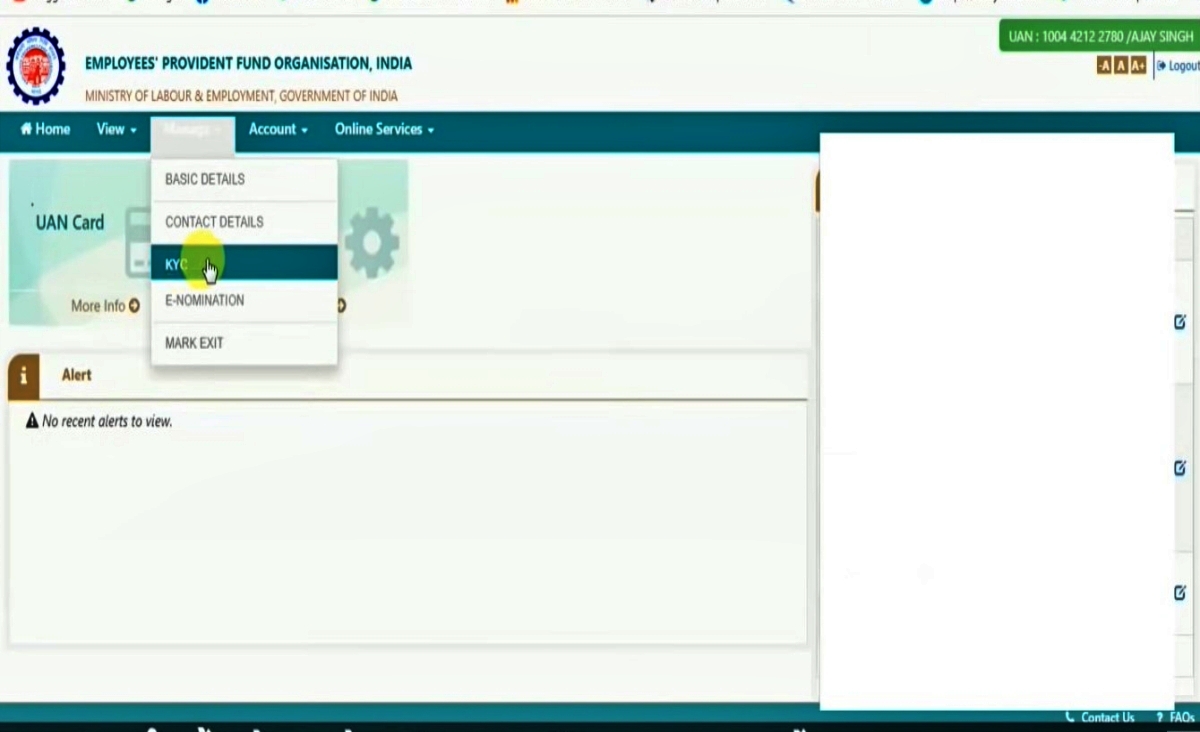

Step 3: Hover on the Manage tab and click on KYC

Step 4: Click on Aadhaar. Enter your Aadhaar number and name as registered on the Aadhaar card and save.

Your details will then appear under the Pending KYC tab. Once approved, it will be listed under the Approved KYC tab.

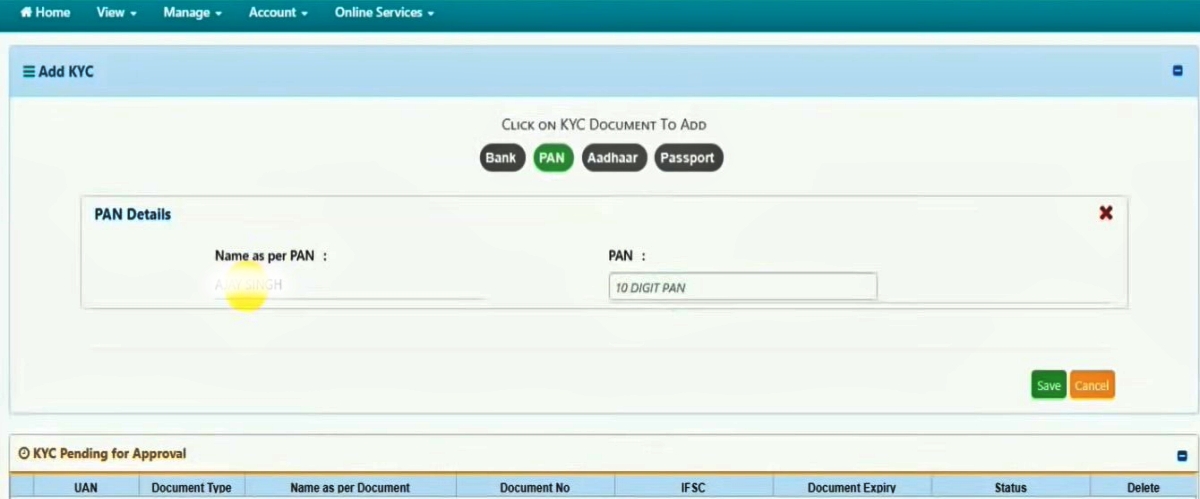

How to update EPF KYC?

It’s easy to update EPF KYC online. The steps for EPF KYC update are:

Step 1: Visit the official EPF website and log in to your account.

Step 2: Click on the Manage tab and select the KYC button from the drop-down menu.

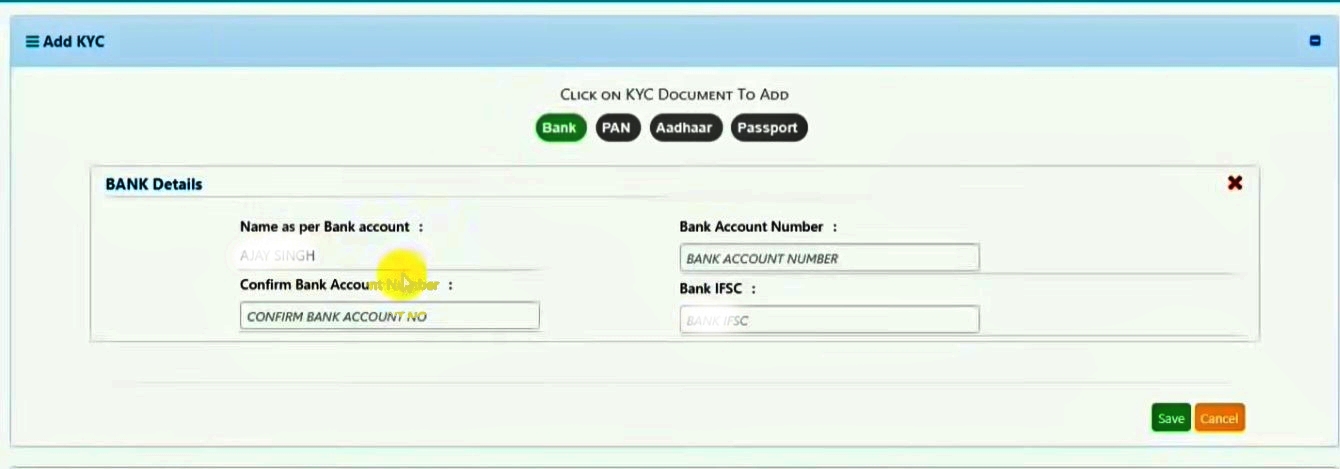

Step 3: You can choose to update your KYC by linking your bank account, PAN card or Aadhaar card.

Step 4: Click on the appropriate button and enter the details required.

Screenshot for KYC update with Bank details

Screenshot for KYC update with PAN card

Screenshot for KYC update with Aadhaar card

Step 5: After entering the details, click on save and wait for the details to be approved.

How to register for EPF passbook?

Do not worry about how to register for EPF passbook. An EPF passbook is generated when your EPF account is opened. You can use the epfindia.gov.in website to check your current balance at any time.

How to view EPF passbook?

Follow these steps to check out your EPF passbook.

Step 1: Visit https://epfindia.gov.in

Step 2: Click on e-Passbook

Step 3: Log in with your UAN number and password

Step 4: Select your Member ID

Step 5: Click to select New Passbook or Old Passbook

How to download EPF passbook?

You can download your EPF passbook from the official EPF website.

Step 1: Visit the official EPF website

Step 2: Click on the tab to View Passbook

Step 3: Use your UAN and password to log in

Step 4: Select your Member ID

Step 5: Click on View Passbook (old or new)

Step 6: Click on Download Passbook

How to apply for an EPF loan?

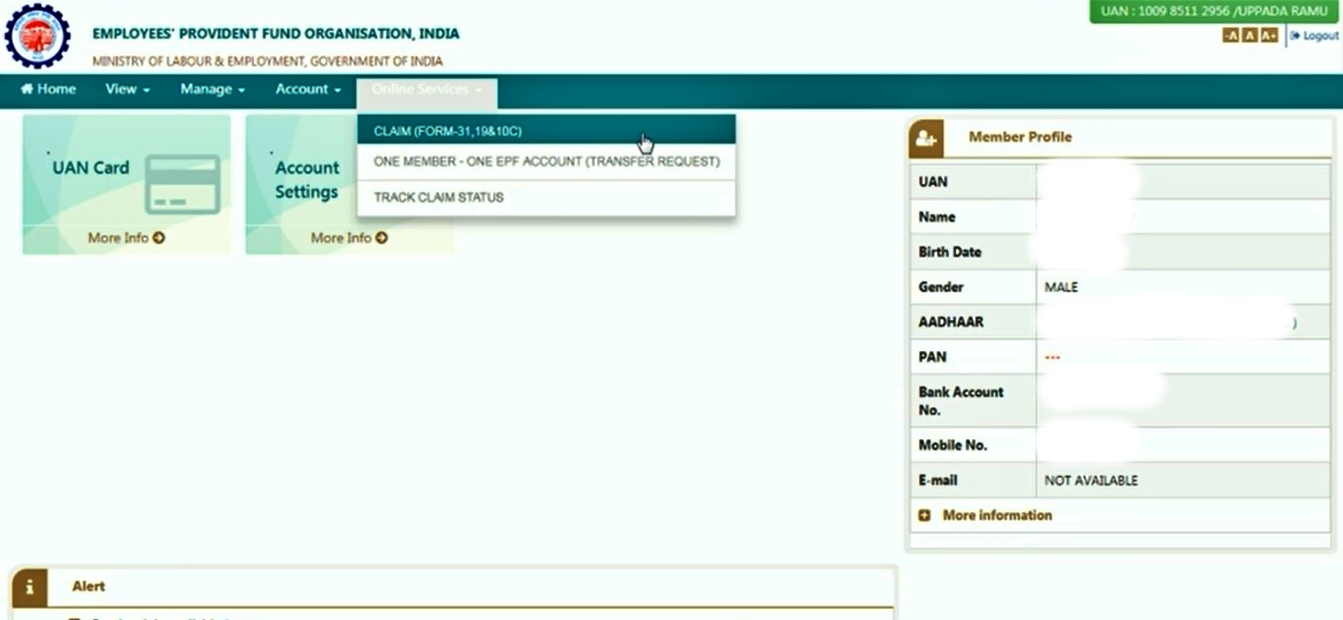

You can apply for an EPF loan online at the official EPF website. The steps to follow for an EPF loan application are:

Step 1: Log in to the official EPF website

Step 2: Hover over Online Services and click on Claim (Form 31, 19 & 10C)

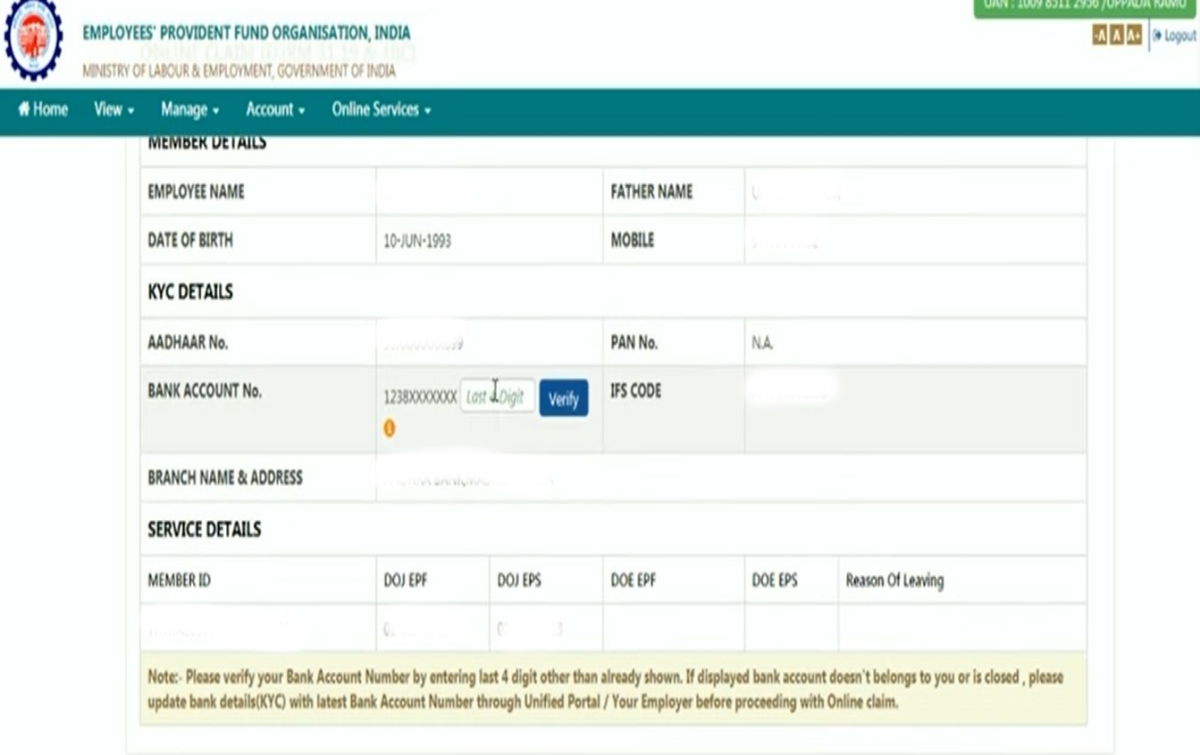

Step 3: Enter the last 4 digits of your bank account, accept the terms and click on the button to Proceed for Online Claim

Step 4: Select the EPF loan form

Step 5: Select a reason for the loan and enter the amount required and your address

Step 6: Click on the button to get Aadhaar OTP, once you enter the OTP, your claim will be selected.

How to download EPF claim form?

Depending on your reason for withdrawal and the number of years of service, you can download an EPF claim form from the EPF India website.

Step 1: Visit the EPF India website

Step 2: Click on ‘For Employees’ from the service tab

Step 3: Click on ‘Know which claim form to submit’ from the points listed under Important Links

Step 4: Choose the appropriate form and download it. For example, the form 10C for EPF is required by people who have left a job before completing 10 years of service or those who have completed 10 years of service but are below the age of 50 years

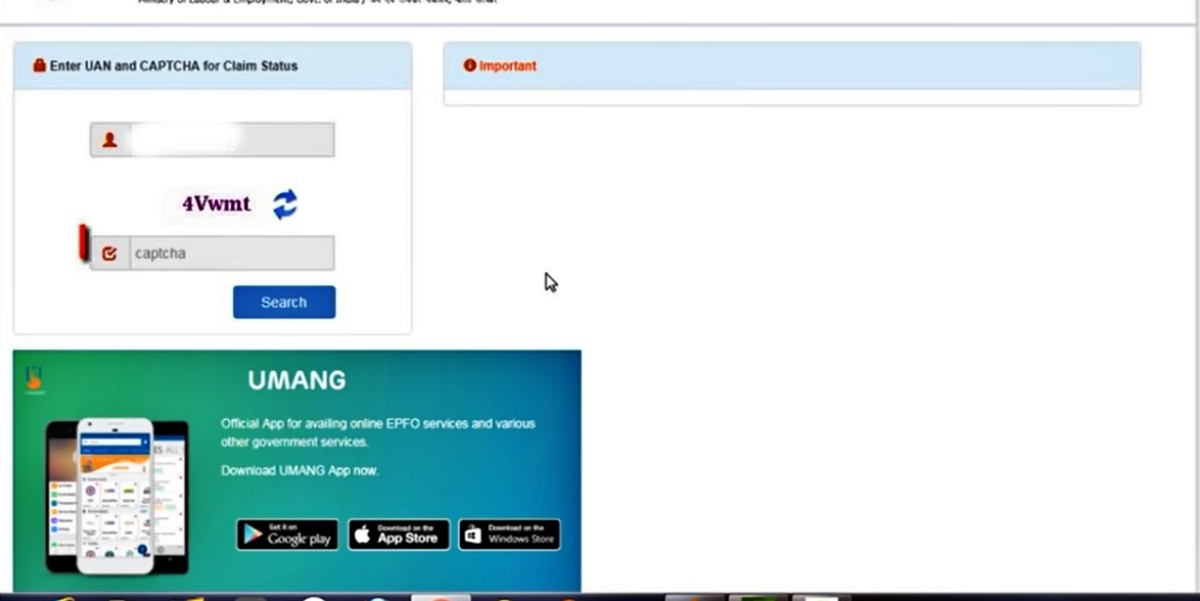

How to check claim EPF status?

Tracking EPF claim is easy on the RPF website.

Step 1: Visit the official EPF website and log in with your UAN details

Step 2: Scroll down and click on Know Your Claim Status

Step 3: Enter your UAN number and the captcha code

Step 4: Select your Member ID and click on View Claim Status

You will then be able to see your claim EPF status and save it if required.

What are the EPF withdrawal rules?

Many rules for EPF withdrawal were revised in 2021. Some of the most important rules for withdrawal from EPF are:

· Money can be withdrawn completely only after the account holder has retired

· Partial withdrawals are limited to the reason a withdrawal is being made

· 90% of the corpus can be withdrawn 1 year before retirement as long as the person is at

least 54 years old

· 75% of the corpus can be withdrawn after a month of unemployment.

· Corpus withdrawal is exempted from tax under certain circumstances

· 100% withdrawal can be done after two months of unemployment

· Employer approval is not required for an EPF withdrawal

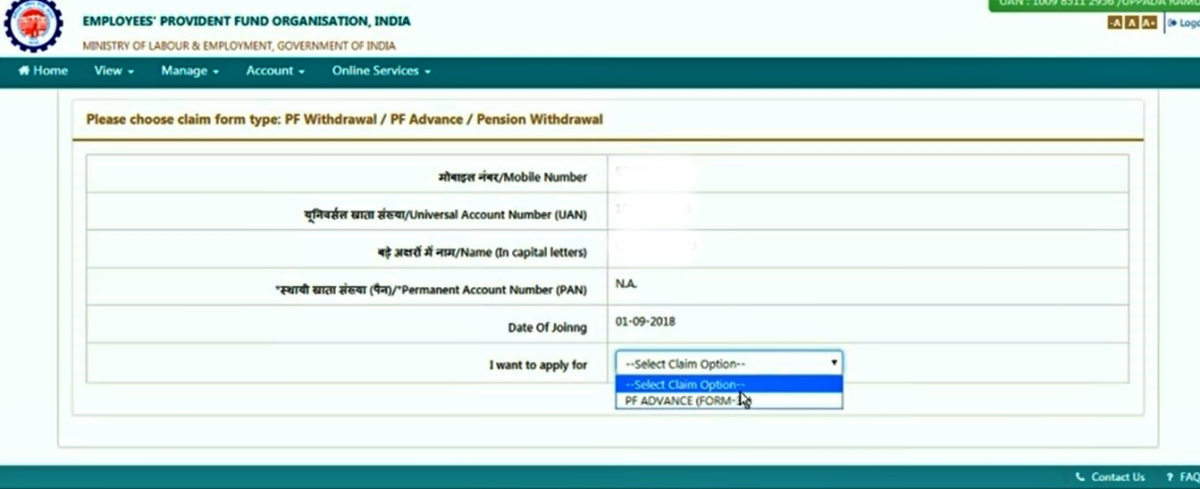

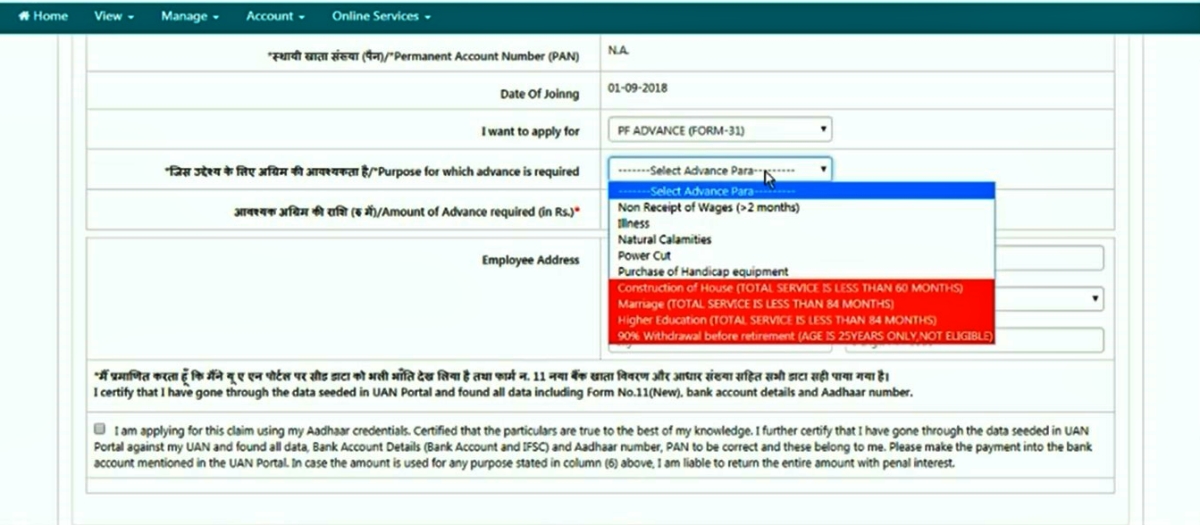

How to do EPF withdrawal without employee signature?

If you apply for EPF withdrawal online, you don’t need an employee signature. Here’s what you need to do:

Step 1: Log in to the official EPF website

Step 2: Click on Claim (Form 31, 19 & 10C) from the drop-down menu under Online Services

Step 3: Enter the last 4 digits of the bank account linked to your EPF account and agree to the Certificate of Undertaking. Click on the Proceed for Online Claim button

Step 4: Select PF ADVANCE (FORM – 31)

Step 5: Select a reason for the advance. Depending on the reason for withdrawal, you may need to upload supporting documents.

Step 6: An OTP will be sent to your registered mobile number. Enter the OTP to complete the process for withdrawal from EPF.

How to do EPF online withdrawal?

EPF online withdrawal India is simple and easy as long as your UAN is activated and linked to your Aadhaar, PAN and bank account.

Step 1: Visit the UAN website and login with your UAN and password

Step 2: Click on online services and select the Claim Form option.

Step 3: Enter your bank account and click on the Verify button

Step 4: Agree to the terms and conditions and Proceed for online claim

Step 5: Select the claim you want to apply for

Step 6: Upload Form 15G and enter your employee address. Accept terms and click on Get Aadhaar OTP.

Step 7: Enter the OTP and click to Validate OTP and Submit claim

How to withdraw pension contribution in EPF

The process for how to withdraw pension contribution in EPF is the same as making a withdrawal from your EPF account. The only difference is in the type of claim used.

Step 1: Log in to the UAN website

Step 2: Select online services and click on the Claim Form option.

Step 3: Enter the last 4 digits of your bank account and click on the Verify button

Step 4: Agree to the terms and conditions and Proceed for online claim

Step 5: Select form 10C or 10D as applicable

Step 6: Upload Form 15G and enter the address for your employee.

Step 7: Accept terms and click on Get Aadhaar OTP.

Step 8: Enter the OTP as received via SMS. Click to Validate OTP and Submit claim

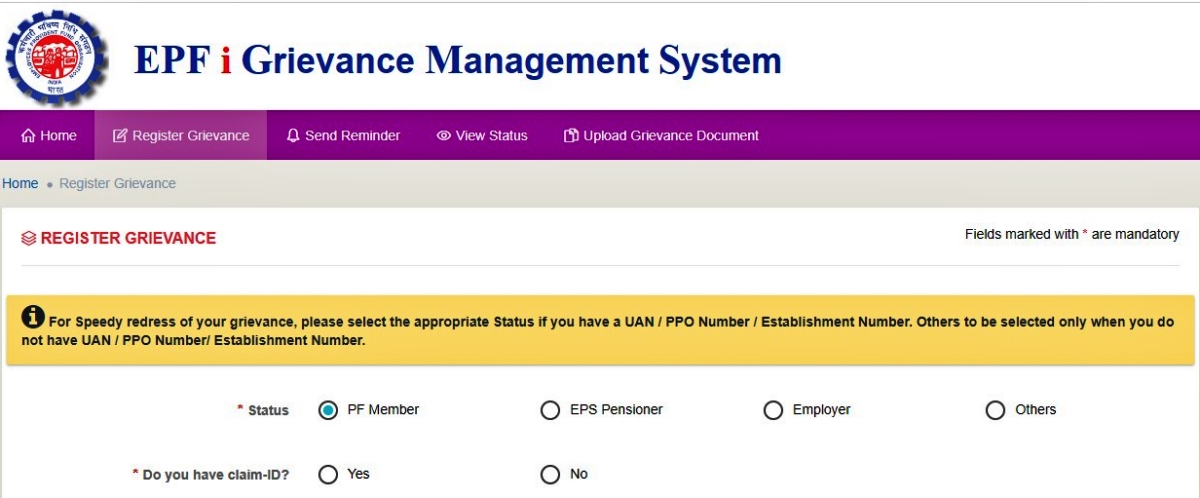

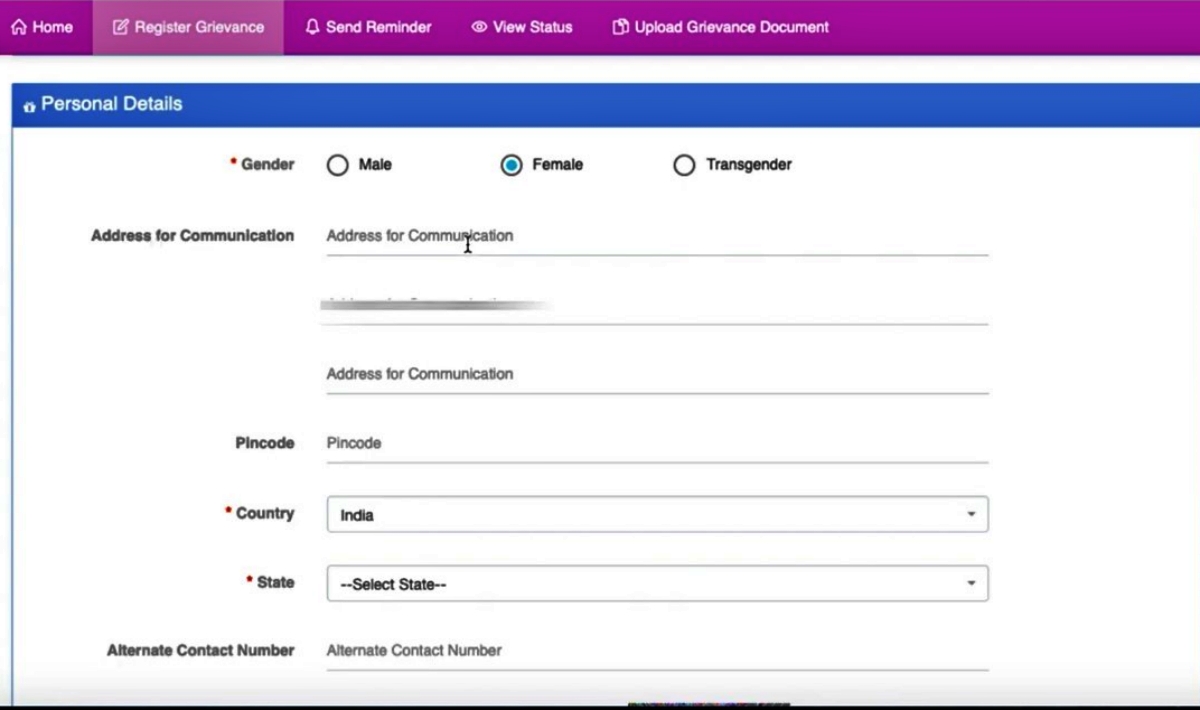

How to register EPF grievance online?

You can register an EPF grievance online at the EPFiGMS portal. Here’s what you need to do:

Step 1: Visit the EPF India website

Step 2: Hover over the Service tab and click on ‘For Employees’

Step 3: Click on EPFiGMS (Register your Grievance) from the menu under Services

Step 4: A new page will open. Select your status

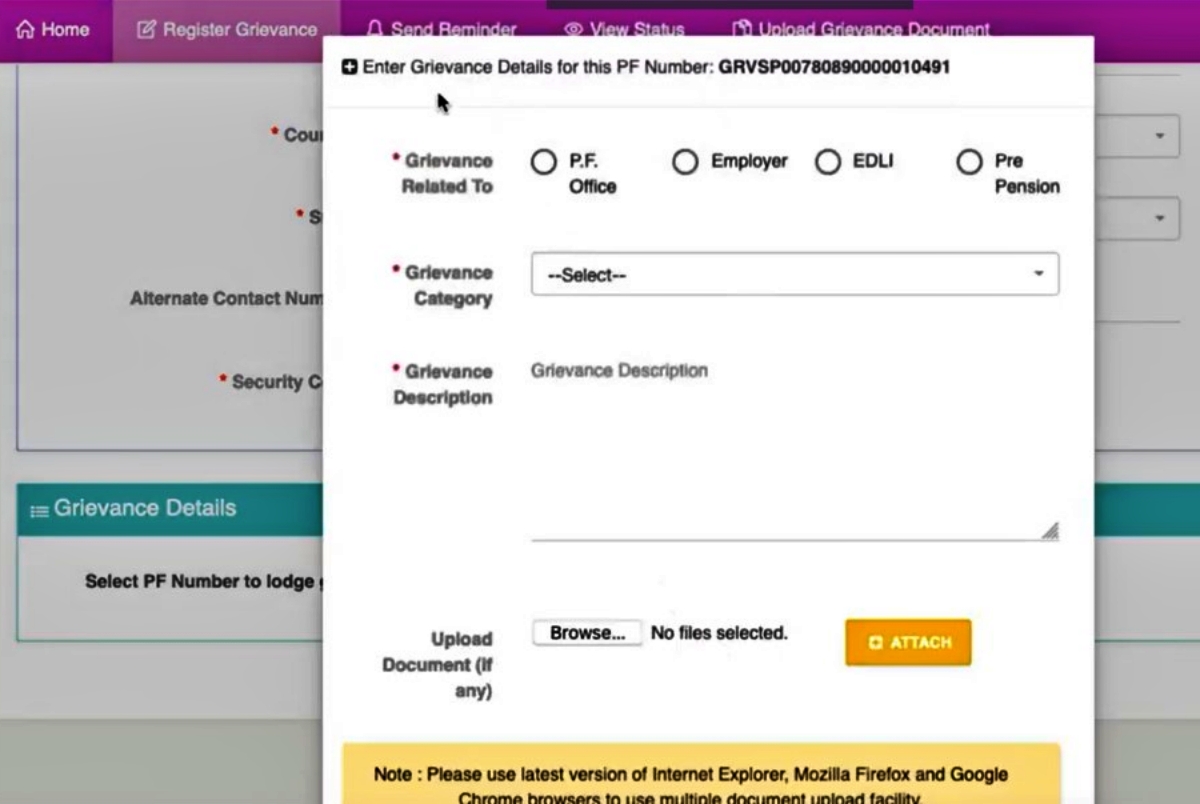

Step 5: Enter your UAN number and security code. You may be sent an OTP to complete the login

Step 6: Enter your personal details and select the PF number for which you want to register a grievance

Step 7: Enter the details on the pop-up form and type a description of your grievance. If needed, you can upload supporting documents/ screenshots in pdf format. Click on Add.

Step 8: You will be able to see your grievance details on the main page. Click on Submit to complete the process

How to update exit date online after a job change on your EPF account

When you move from one job to another, you must transfer the EPF account to your new employer. For this, you must first update the exit date. This can be done 2 months after leaving a job.

Step 1: Visit the EPFIndia website

Step 2: Click on Online Claims Member Account Transfer

Step 3: A new page will open. Login with your UAN and password.

Step 4: Hover over the Manage tab and click on Mark Exit

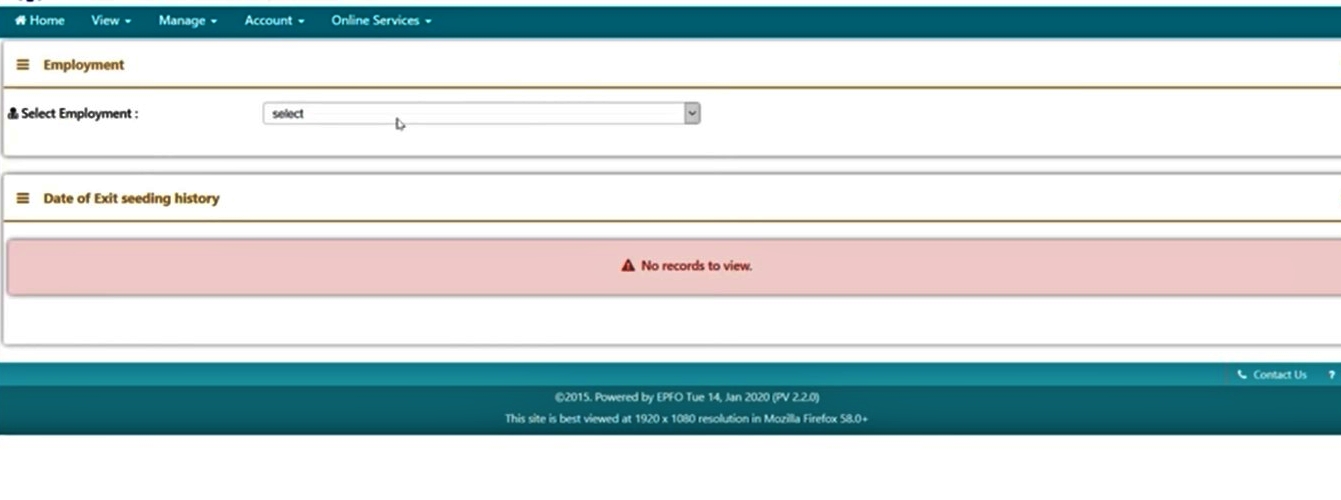

Step 5: Select employment from the drop-down menu

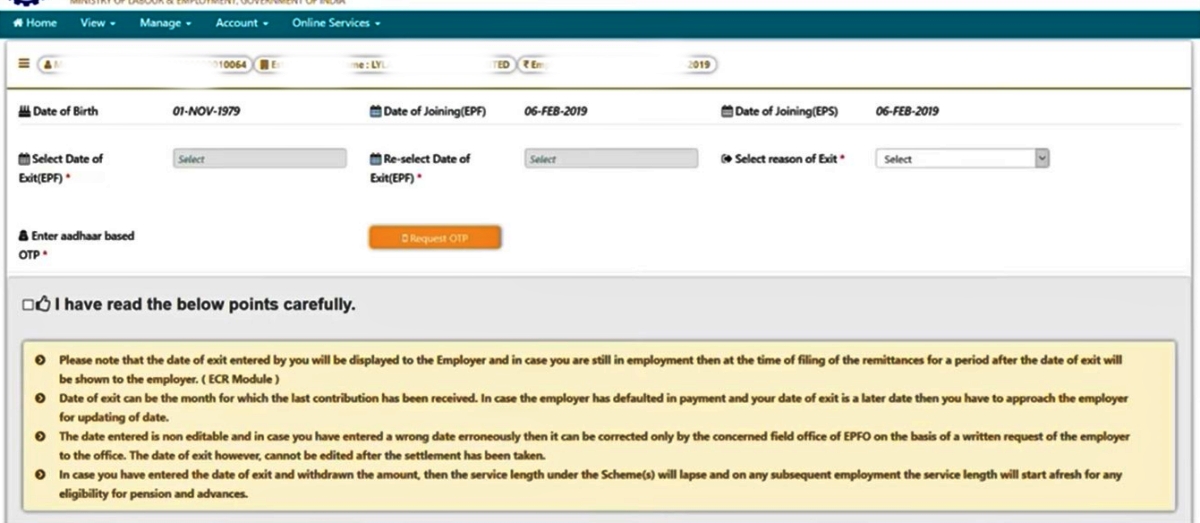

Step 6: Select the date of exit. This must be in the month where the employer has made his last contribution. This cannot be modified online later. Also, select a reason for exit from the drop-down menu. Request an OTP. This will be sent to your registered phone number. Enter this OTP and click on the box for ‘I have read the below points carefully’. Click on Submit

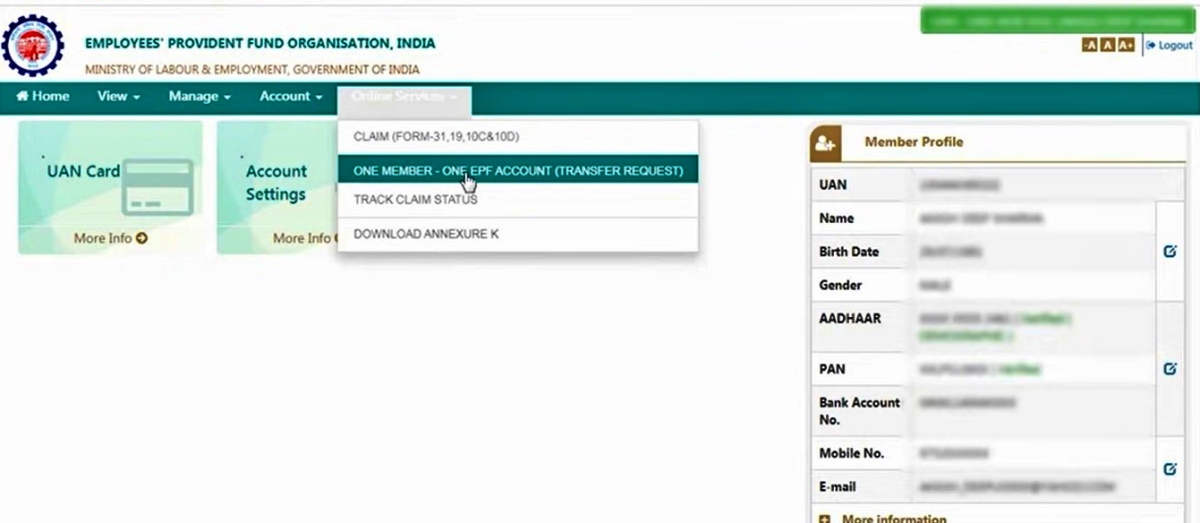

How to transfer EPF account online?

When you shift from one job to another, you will need to transfer EPF account as well.

Step 1: Visit the EPFIndia website and login into your account

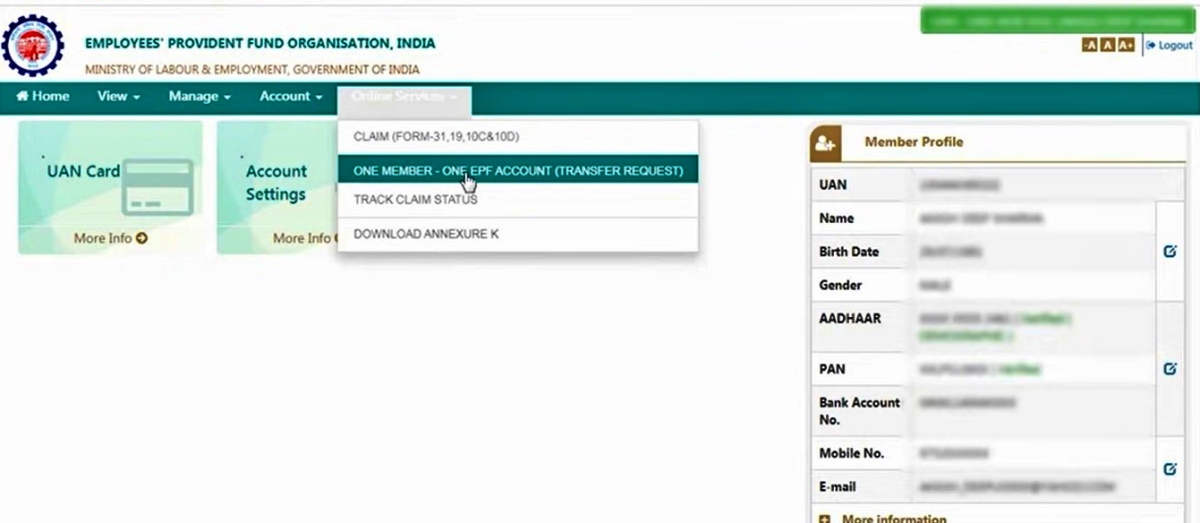

Step 2: Select the ‘One Member-One EPF Account (Transfer Request)’ from the drop-down menu under Online Services.

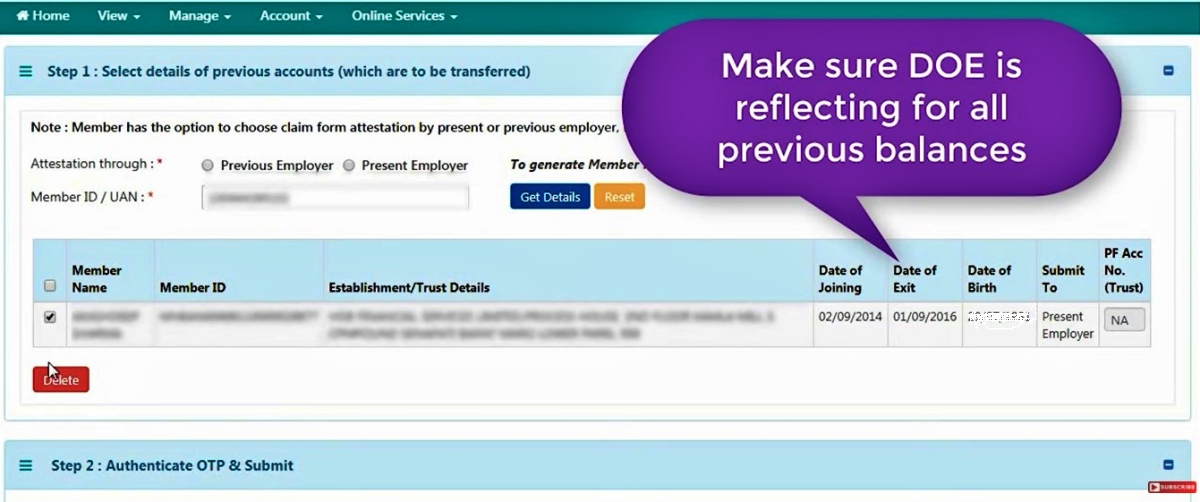

Step 3: Scroll down past your personal details and details of the current account.

Step 4: Click on the box for attestation through the present employer and enter the Member ID/UAN. Click on Get Details and select the details of the employer from where the account has to be transferred.

Step 5: Scroll down to see a link for a Printable Form 13. This will need to be downloaded, signed and submitted to the HR department in your new office.

Step 5: Click on Get OTP and enter the OTP as received.

Your request will be initiated and the online EPF transfer can take up to a month to be completed.

Useful Government Services

- mParivahan App

- Sarathi Parivahan

- DigiLocker App

- Parivahan Services

- Jeevan Pramaan Patra

- eCourts Services

- PMEGP Scheme

- Online e challan

- PM Ujjwala Yojana

Ministers Of Delhi – Full List Of Rekha Gupta Cabinet Ministers

Ministers Of Delhi – Full List Of Rekha Gupta Cabinet Ministers Full List Of Chief Ministers of Delhi – Tenure And Party

Full List Of Chief Ministers of Delhi – Tenure And Party Assam Bank Holiday List 2025

Assam Bank Holiday List 2025 Maharashtra Ministers – Full List Of Devendra Fadnavis Cabinet

Maharashtra Ministers – Full List Of Devendra Fadnavis Cabinet