Bihar Student Credit Card – A Complete Guide

Are you a student looking for details of the Bihar Student Credit Card Yojna (BSCC)? Do you wish to know how to apply for a student credit card in Bihar or check your Bihar Student Credit Card status online? Read on.

The Bihar government has launched this plan to help students fulfil their dream of higher education. Applying for the card is a simple online process you can complete yourself.

However, if you are unsure how to apply for a student credit card in Bihar, worry not. We will walk you through the step-by-step Bihar Student Credit Card process for application.

You can also find the complete Bihar Student Credit Card course list, college list, helpline numbers, eligibility, moratorium details, repayment rules, and other information here.

Read: Bihar Caste Certificate: Jaati Praman Patra Online

The Bihar Student Credit Card Course List

| B.A./ B.Sc./ B. Com. (All subjects) | Bachelor of Hotel Management & Catering Technology (B.H.M.C.T.) | Bachelor of Physical Education (B. P. Ed.) |

| B.Sc. (Information Technology/Computer Application/Computer Science) | B. Tech/B.E. for laterally admitted candidates having a degree of three-year diploma courses approved by the State Technical Education Council | Bachelor of Business Administration (B.B.A.) |

| B.Sc. (Agriculture) | M.B.B.S. | Master of Business Administration (M.B.A.) |

| B.Sc. (Library Science) | B.Sc. (Nursing) | Bachelor of Fine Arts (B.F.A.) |

| M.A./M.Sc./M. Com (All subjects) | Bachelor of Homoeopathic Medicine & Surgery (B.H.M.S.) | BL/LLB (5-Year Integrated Course) |

| Aalim | Bachelor of Dental Surgery (B.D.S.) | Degree/Diploma in Aeronautical, Pilot Training, Shipping |

| Shashtri | General Nursing Midwifery (G.N.M) | Polytechnic |

| BCA | Bachelor of Physiotherapy | M.Sc./M.Tech Integrated course (in which the eligibility of enrolment is +2 equivalent) |

| MCA | Bachelor of Occupational Therapy | Bachelor of Veterinary Medicine and Surgery (B.V.M.S.) |

| Hotel Management and Catering Technology | Bachelor of Pharmacy | Bachelor of Ayurveda, Medicine, and Surgery (B.A.M.S) |

| Hospital and Hotel Management | Diploma in Food, Nutrition/ Dietetics | Bachelor of Unani Medicine & Surgery (B.U.M.S) |

| Diploma in Hotel Management (Three Year) (I.H.M. Course) | Bachelor of Mass Communication/Mass Media/Journalism | Diploma in Food Processing/ Food Production |

| Bachelor’s in yoga (Entry Level+2Pass) | B.Sc. in Fashion Technology/Designing/Apparel Designing/Footwear Designing | Diploma in Food & Beverage Services |

| B. Tech/B.E./B.Sc. (Engineering-all branches) | Bachelor of Architecture | B.A./B.Sc.-B.Ed. (Integrated Courses) |

Read: The PM Yashasvi Yojana: Everything You Need to Know

FAQs On Bihar Student Credit Card

Here are some frequently asked questions regarding the Bihar Student Credit Card application process, eligibility criteria, repayment, and rules. We have answered all relevant questions below.

What is the Bihar Student Credit Card scheme?

The Bihar Student Credit Card loan scheme is an initiative of the Bihar government to provide financial assistance to students pursuing higher education. Introduced in 2016, the state government offers an education loan of up to 4 lakhs under this scheme.

The scheme allows you to apply for 42 courses in several government-approved institutions in Bihar. There is a counselling team – Bihar Student Credit Card Awareness Program (BSCCAP) – to counsel students and offer important information and guidance

Which is the Bihar Student Credit Card official website?

The Bihar Student Credit Card official website is https://www.7nishchay-yuvaupmission.bihar.gov.in/. It is also called the MNSSBY website.

Who is eligible for a Bihar Student Credit Card?

Here are the eligibility criteria to apply for a student credit card in Bihar:

· You must be a resident of Bihar.

· For undergraduate courses, you should have passed the 12th or equivalent

examination from any institution recognized by the Bihar government. For

Polytechnic courses, the educational qualification is 10th standard.

· Applicants who have completed their 12th or 10th board education from states

bordering Bihar, such as Jharkhand, Uttar Pradesh, and West Bengal, can also apply.

· You must be enrolled in or secured admission to a higher education institution

recognized by the concerned regulatory agency of Bihar, other states, or the

Central government.

· You should not be more than 25 years on the day of applying.

· The loan is available for general higher education courses (B. A, B.Sc., M. A, M.Sc.,

etc.) and professional and technical courses (law, engineering, management, MBBS,

etc.)

· The age limit for postgraduate courses is 30 years, and the educational qualification

is graduation.

What are the documents required for a student credit card in Bihar?

The list of documents required for a student credit card in Bihar includes:

· A duly filled application form

· Aadhar Card of the applicant and co-applicant

· Pan Card of the applicant and co-applicant

· Certificates and mark sheets of 10th and 12th board examination/ last successful

examination

· Copy of the bank passbook of the applicant (with details such as bank name,

account number, IFSC, branch name, etc.)

· Approved course structure

· Your proof of admission to the college/institution

· Fee schedule

· Certificates regarding the received scholarship, free education, etc., of the applicant

(if available)

· Residential proof (Passport/ Voter ID/ Driving License/First page of the bank

passbook/ Telephone bill/ Electricity bill)

· Passport-size photographs of the applicant and co-applicant (2 numbers)

Based on the employment status of the co-applicant, you might also require to

submit the following documents:

· Form 16 or the previous year’s income certificate of the co-applicant

· Income tax return of the last two years of the co-applicant

· Bank statement of the last 6 months of the co-applicant

· Tax receipt of the co-applicant

Which is the Bihar Student Credit Card helpline number?

The Bihar Student Credit Card toll-free number is 1800 3456 444.

This Bihar Student Credit Card helpline number is a dedicated line where you can clarify doubts about the application process, application status, or any other inquiries for free.

What is the Bihar Student Credit Card loan?

The BSCC loan is an educational loan available for students pursuing higher education in Bihar. You can get a loan of up to 4 lakhs, which you must repay after completing the course.

What is the Bihar Student Credit Card course list?

There are 42 courses under the BSCC course list which you can apply for and enrol yourself. Check the Bihar Student Credit Card course list.

Can you apply for a Bihar Student Credit Card online?

Yes. You can apply for a Bihar Student Credit Card online in a few easy steps:

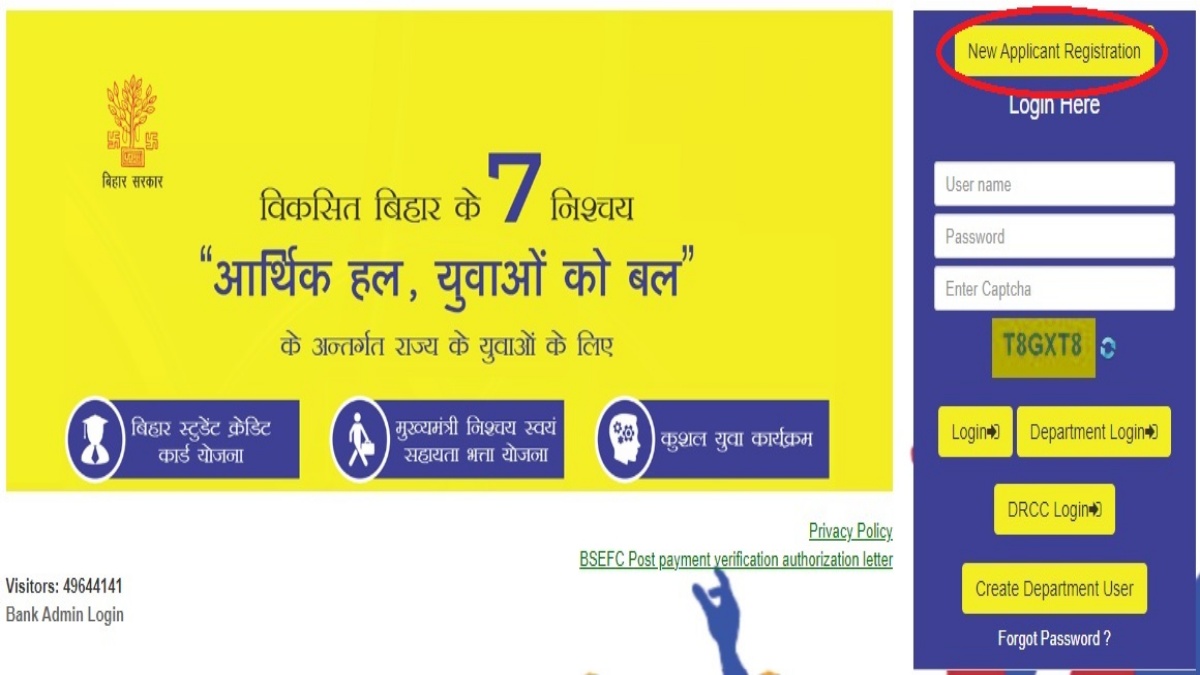

Step 1: Visit the BSCC official website (also called the MNSSBY website).

Step 2: Click on the New Applicant Registration button.

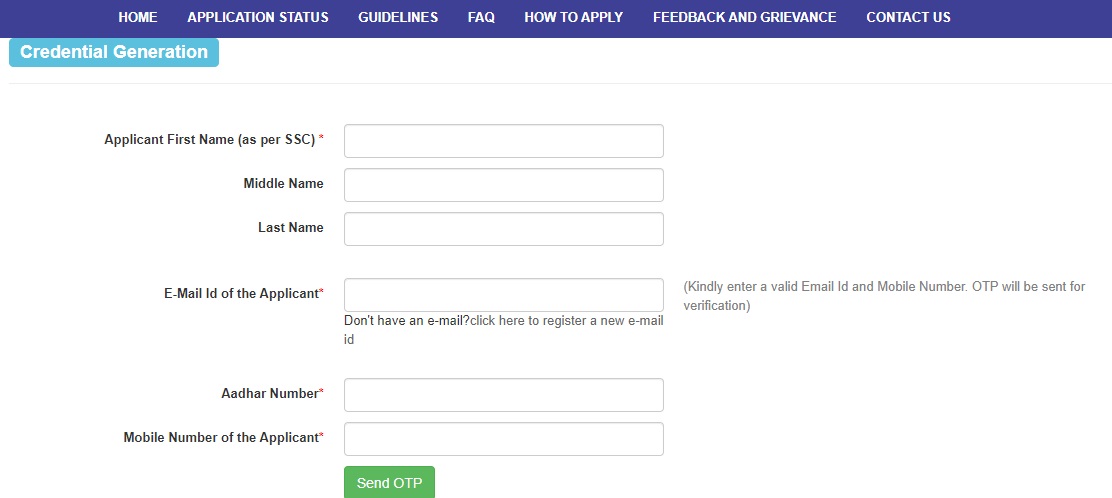

Step 3: Fill in your name, email ID, Aadhar number, and mobile number. Click on the Send OTP button.

Step 4: You will receive an OTP on your email and mobile number. Enter the OTP > Click Submit.

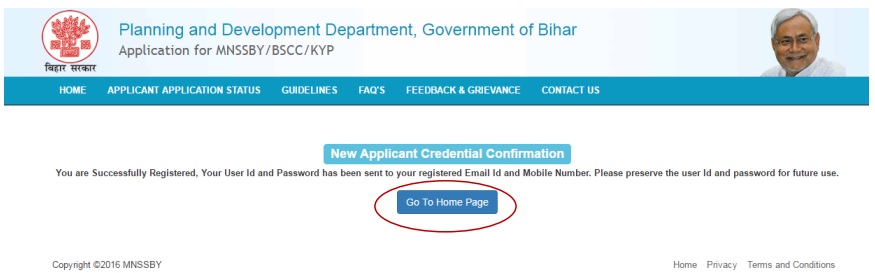

Step 5: You will see a confirmation message on the screen. You will also receive a confirmation SMS and email with your login credentials. Now, click on the Go to Home Page button to continue.

Step 6: Log in using the username and password you received on email/SMS.

Step 7: After logging in successfully, you need to change your password.

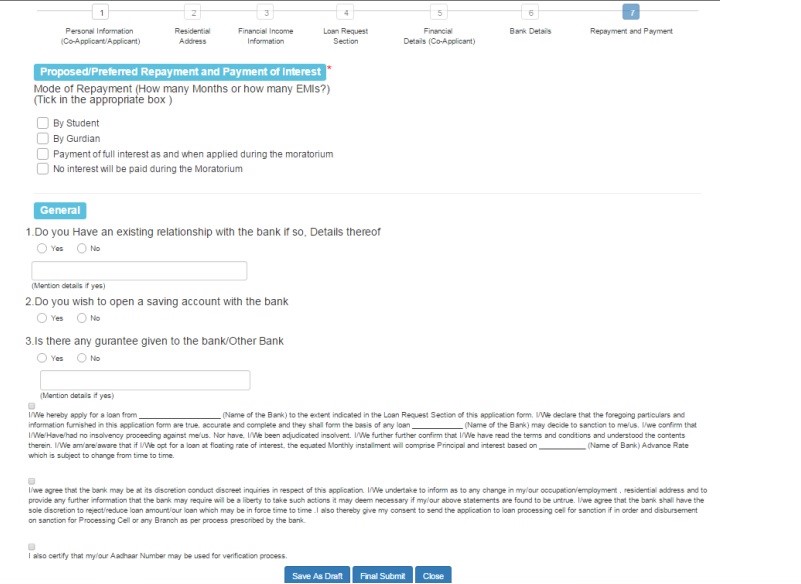

(BSCC 4)

Step 8: After you have reset the password, use your new password and log in again.

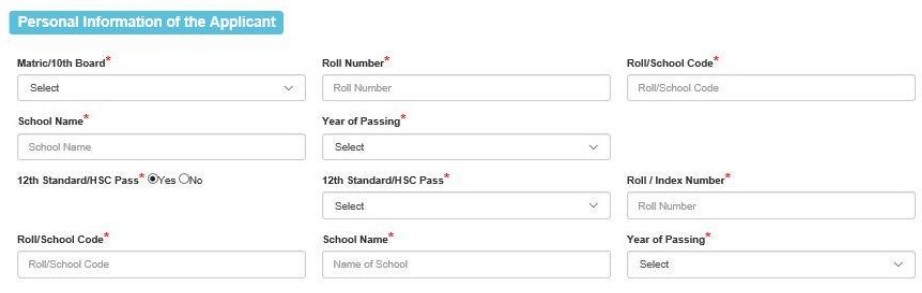

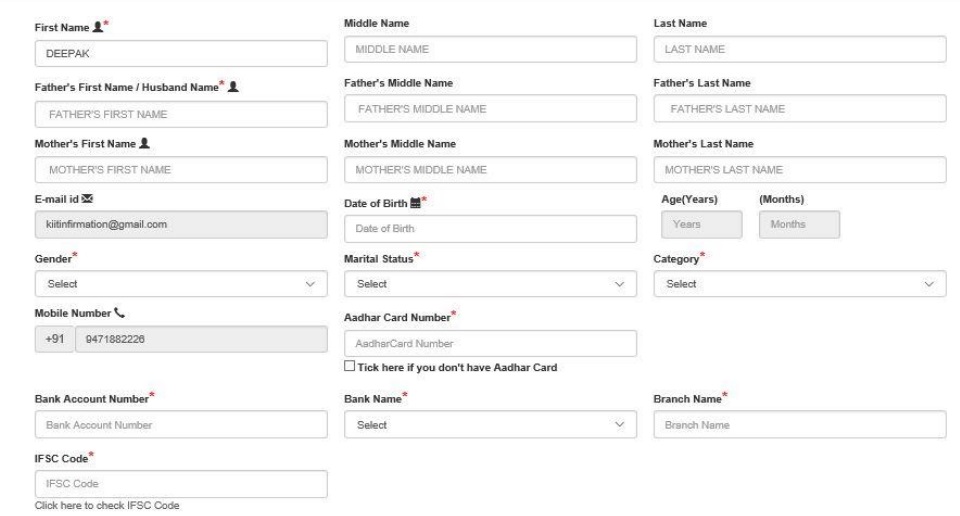

Step 9: Enter your personal information. Once done, click on the Submit button.

Step 10: Next, select the scheme you are applying for. To apply for the Bihar Student Credit Card, choose BSCC from the dropdown menu.

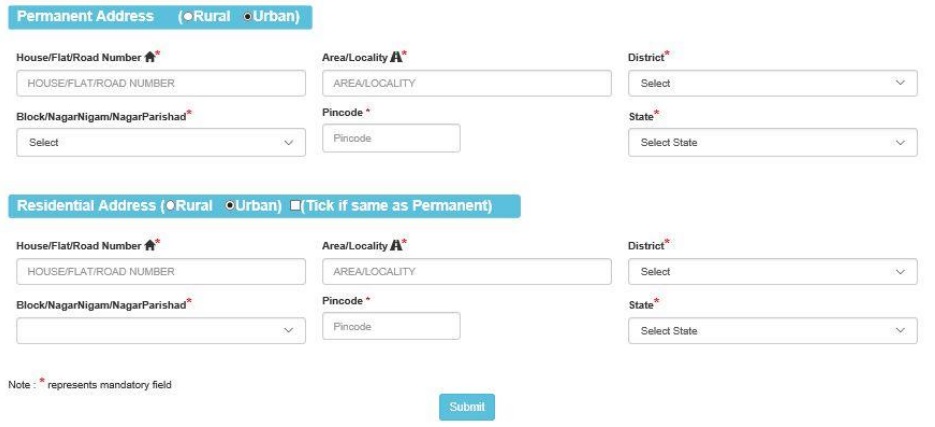

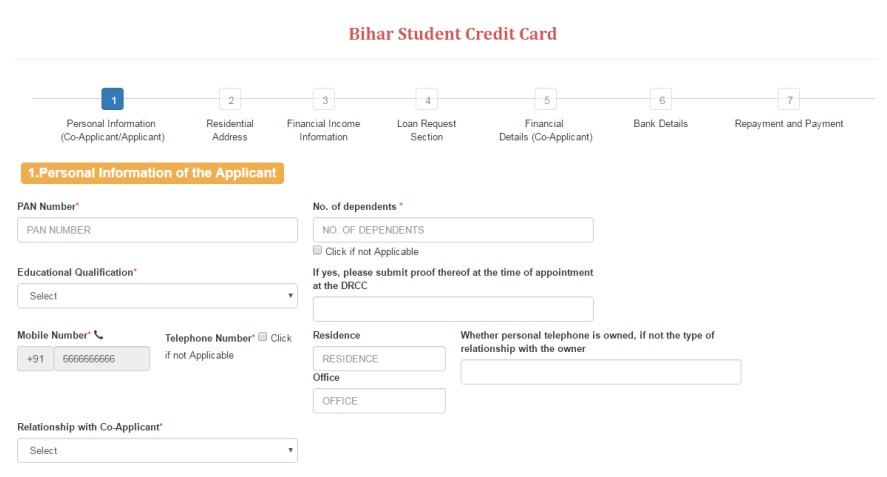

Step 11: You will now see the Bihar Student Credit Card application form on the screen. Provide the required personal details.

Step 12: Fill out the personal details of the co-applicant as well.

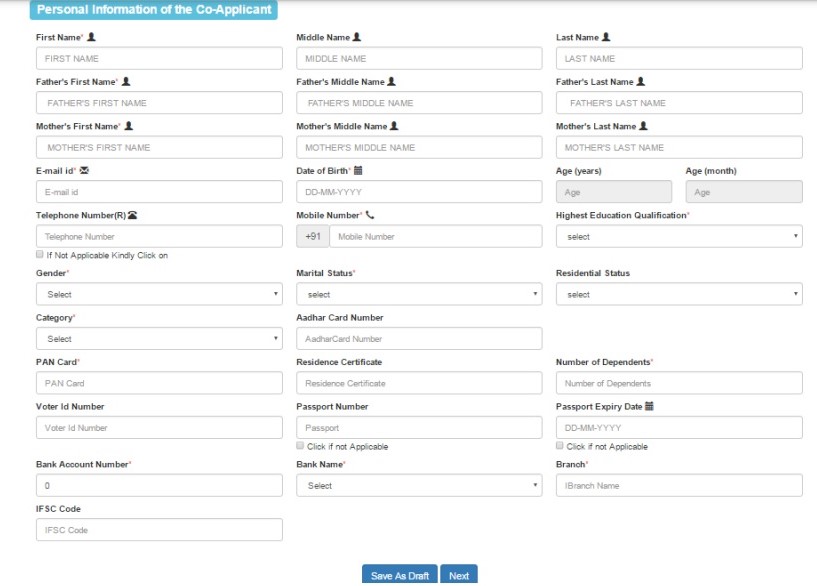

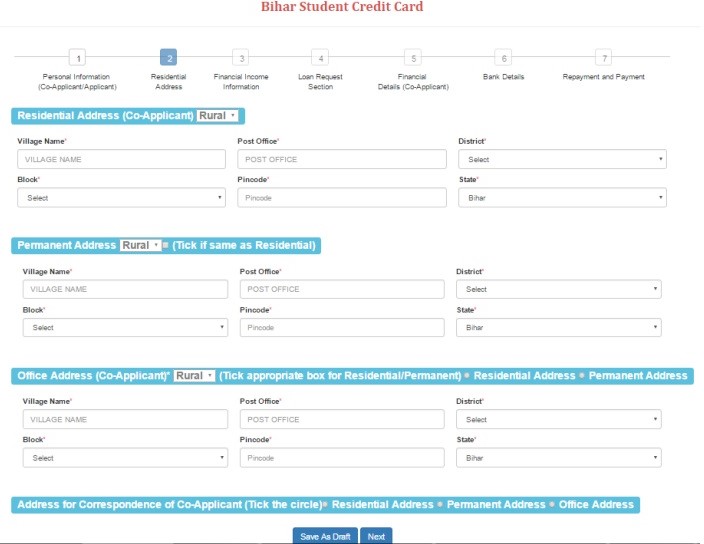

Step 13: In the second part of the form, fill in the residential addresses of the applicant and the co-applicant and the official address of the co-applicant. Click on Next.

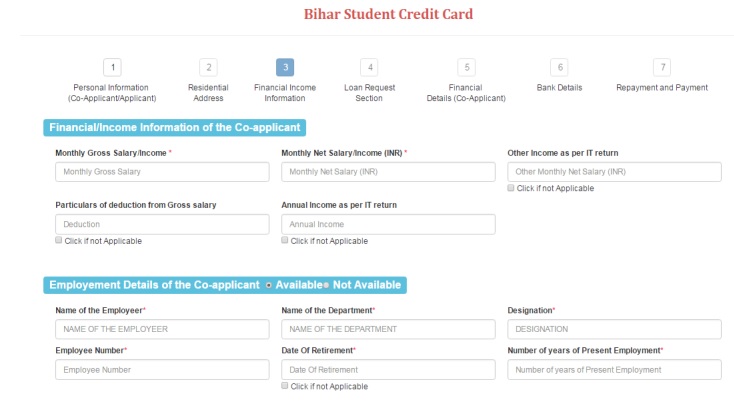

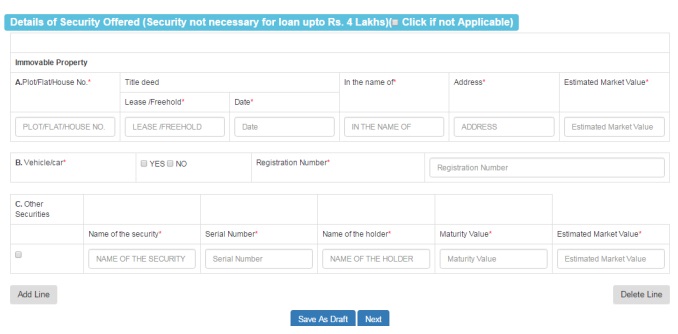

Step 14: In the third part of the form, furnish the financial/income information and employment details of your co-applicant. Also, provide details about the security offered.

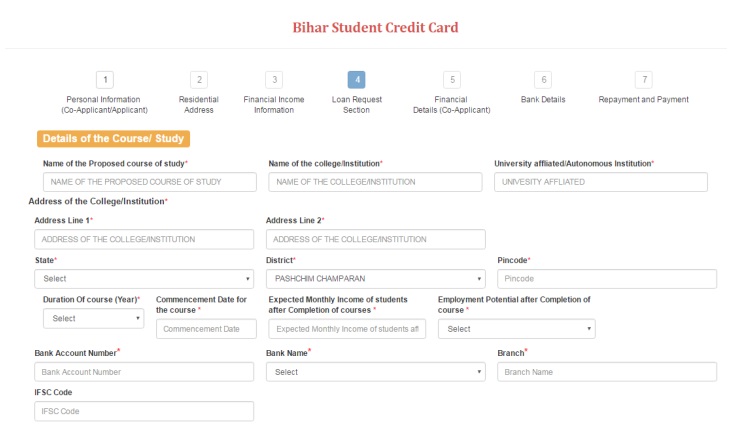

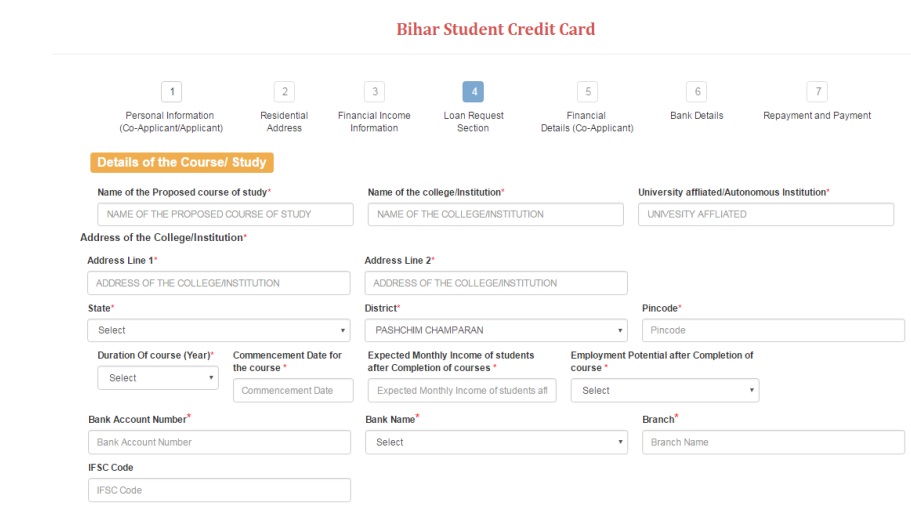

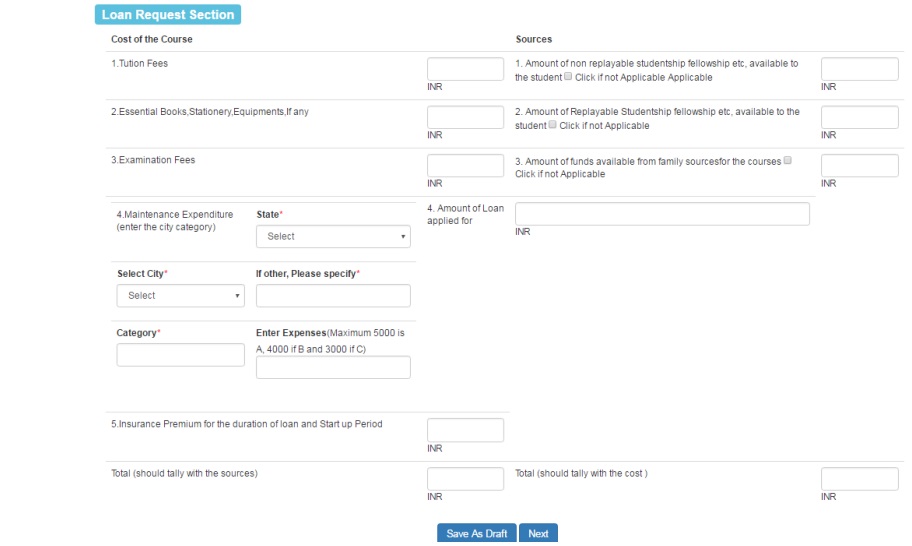

Step 15: In the fourth part of the form, enter the course details, such as the name of the proposed course, the name of the college/institution, the cost of the course, etc.

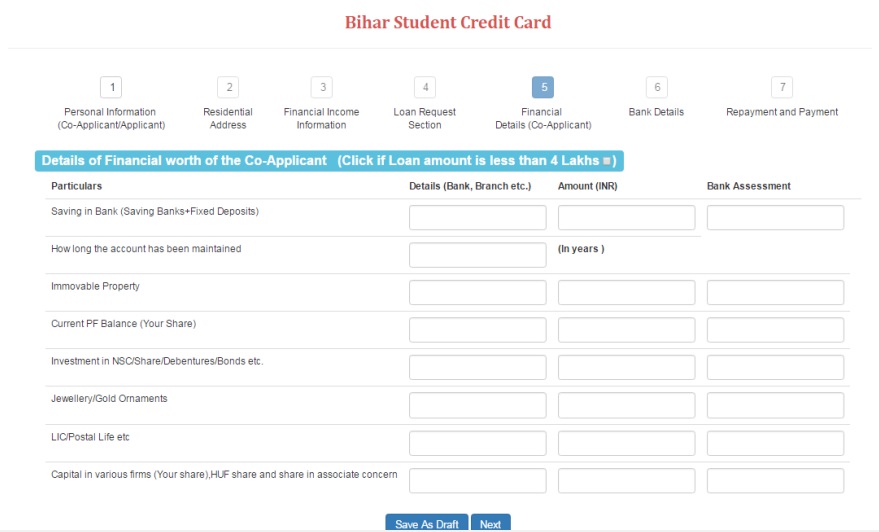

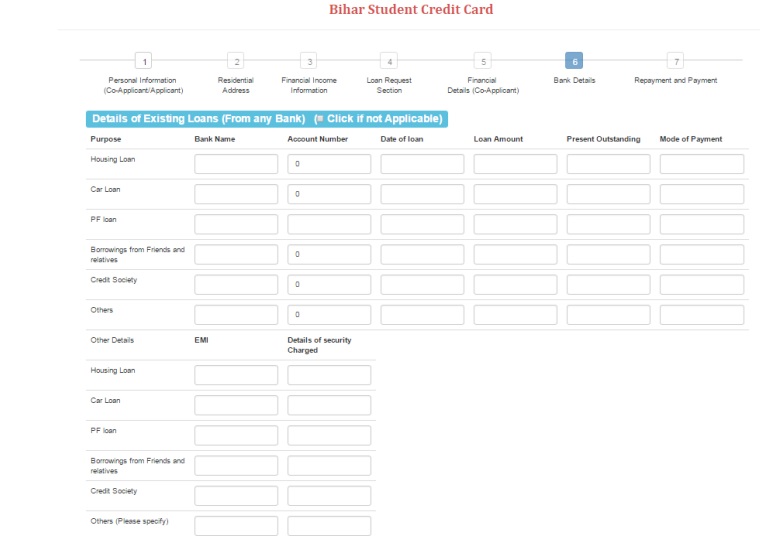

Step 16: In the fifth part, enter the details of the co-applicant (financial worth, details of existing loans, repayment and payment of interest details, etc.). Once done, check the boxes at the bottom of the form and click the Save as Draft button. Your information gets saved in the system, and you can access the details when you log in the next time.

Step 17: Lastly, click the Final Submit button. The system will check if you have filled all the mandatory fields. Upon successful confirmation, the system will save your information in the database and submit it for further action by the District Registration Counselling Centre (DRCC). You will receive an Acknowledgement on your registered email id. You can also print the slip right after the process completion.

Once the authorities have reviewed your application, you will get a mail and an SMS with the date to visit the DRCC. Go to the DRCC with your co-applicant and submit all required documents. Click here to learn the next steps of the process.

How to apply for Bihar Student Credit Card offline?

You can do a Bihar Student Credit Card apply offline by visiting the official website and downloading the form. Fill out the form and submit it along with all required documents at the nearest District Registration Counselling Centre (DRCC) for further action. You can also click on this link to download the form.

How to check the Bihar Student Credit Card status?

How do I check Bihar Student Credit Card status or Bihar Student Credit Card status kaise check kare is one of the common questions applicants ask. You can check your application status and loan status online using different methods.

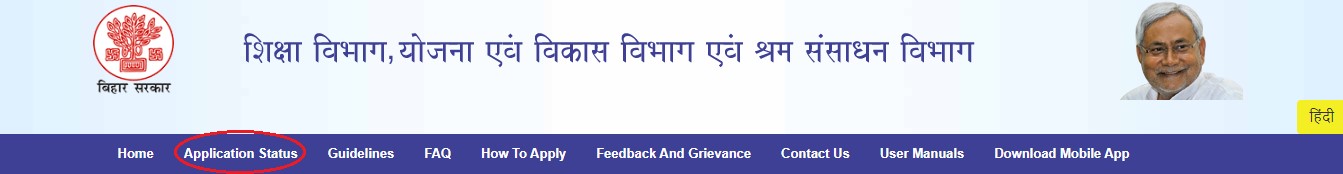

1. Bihar Student Credit Card Application Status Check (Without logging in)

Step 1: Visit the official MNSSBY website> Click on the Application Status tab on the main menu.

Step 2: Enter your registration number, Aadhar card number, and other details. Enter the CAPTCHA code.

Step 3: Click on the Submit button. You can now see your Bihar Student Credit Card application status.

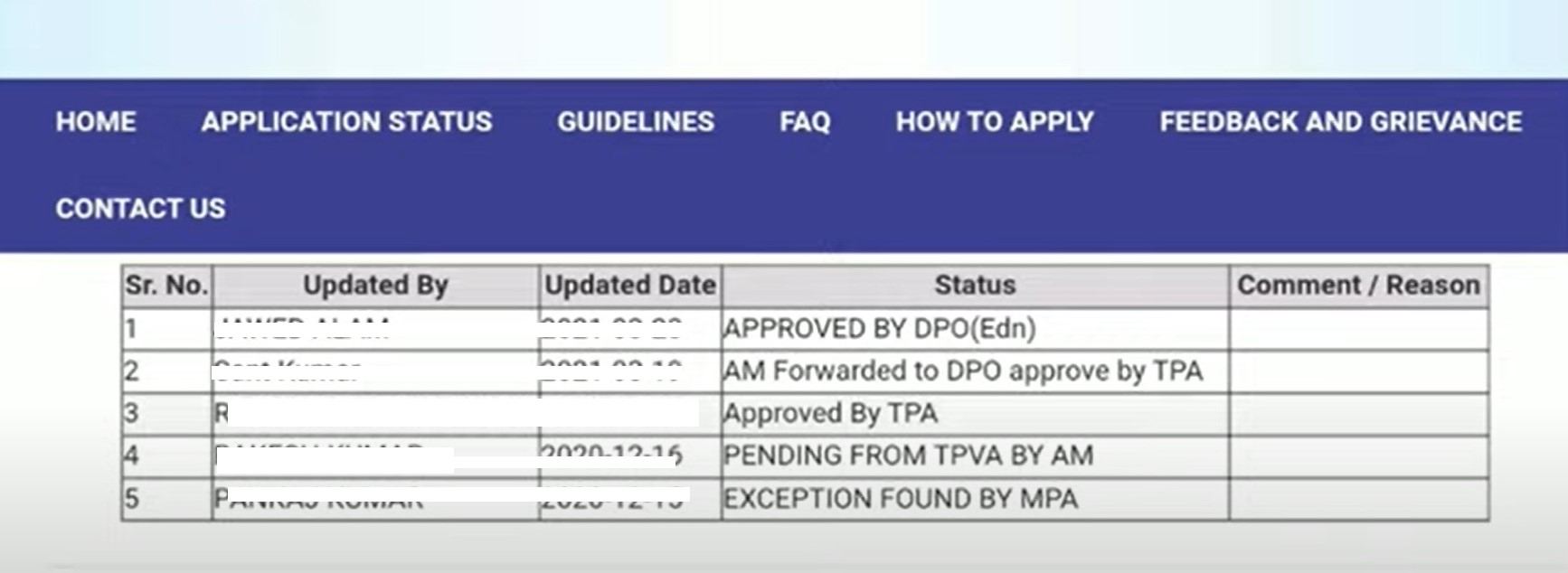

2. Bihar Student Credit Card Application Status Check (Logging in)

Those who have already created an account on the website can check their current status in the following way:

Step 1: Go to the MNSSBY website > Log in to your account using your user ID and password.

Step 2: Click on the Current Status tab on the menu > Click on the Get Information button.

Step 3: You can now see the current status of your Bihar Student Credit Card application.

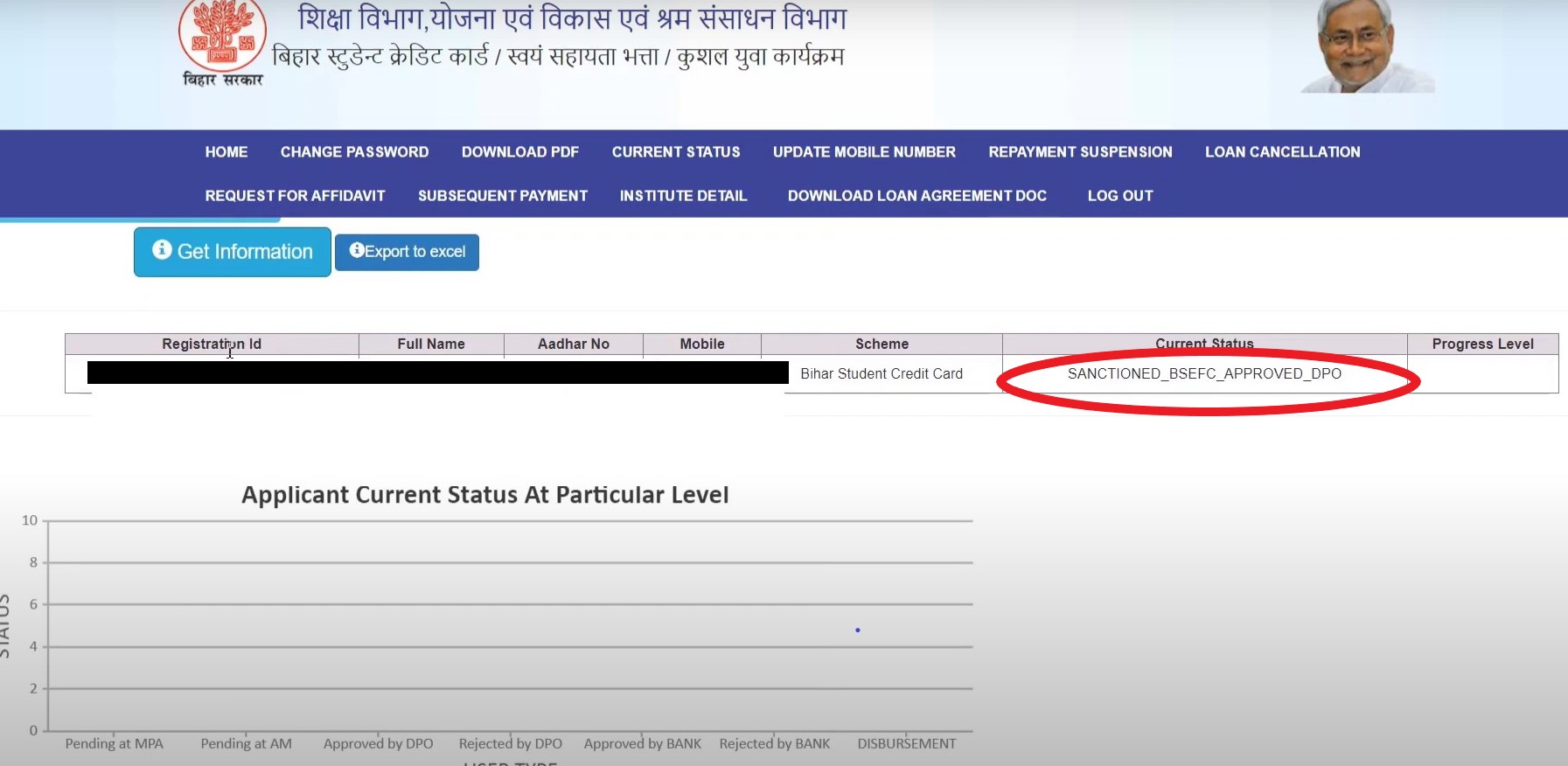

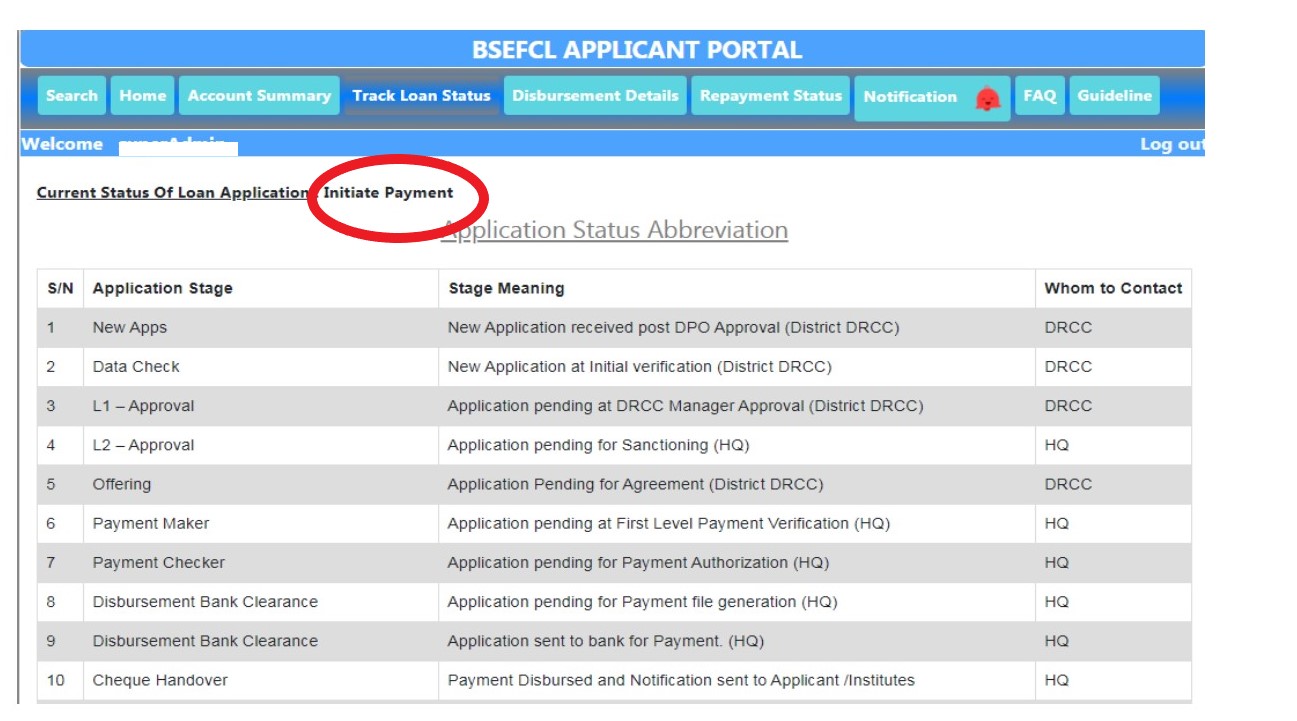

3. Bihar Student Credit Card Loan Status (Login required)

Once the loan is approved and you have signed the agreement, you can check your loan status online. Here, the method is different.

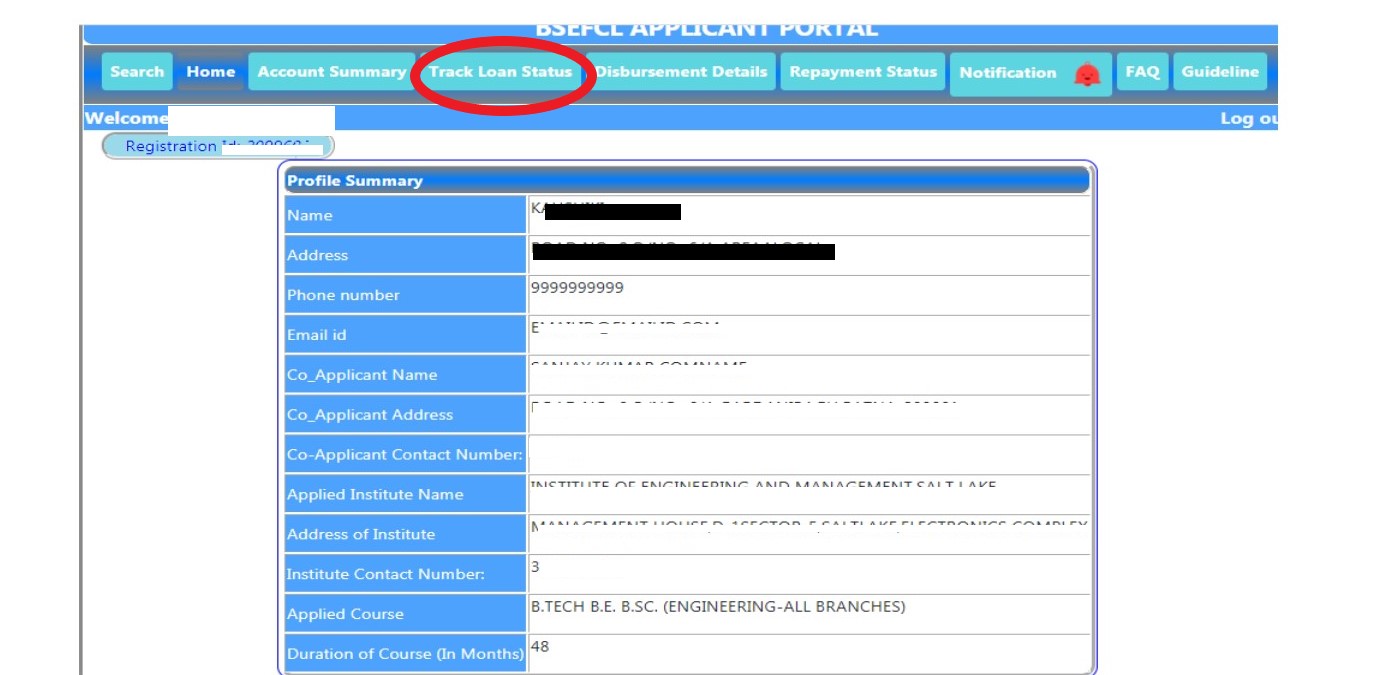

Step 1: Visit the BSCC student portal > Log in to your account. (You can use the same credentials used for the MNSSBY website)

Step 2: You can now see your home page. Click on the Track Loan Status tab on the main menu.

Step 3: You can now see the status of your loan.

Is there a Bihar Student Credit Card app?

Yes. It is called the Yuva Nischay app. To download the app, click here. The Bihar Student Credit Card app is currently available only for Android devices.

Can you download the Bihar Student Credit Card form?

Yes. You can download the Bihar Student Credit Card offline application from here. The PDF version of the form is available on this page.

What is the Bihar Student Credit Card loan interest rate?

The Bihar Student Credit Card interest rate is as follows:

· For male students – 4% simple interest per annum on the loan amount

· For female, transgender, and differently-abled students – 1% simple interest per

annum on the loan amount

If you repay the loan before the stipulated repayment period, you can avail of an additional 0.25% reduction on the interest.

Do I have to repay the Bihar student card loan?

Yes. BSCC is a loan, not a scholarship. You have to repay the loan with applicable interest after you have completed the course.

You can start repaying the loan 1 year after the course completion or 6 months after securing a job. Also, there will be no interest on the loan during this moratorium period.

After the moratorium period, you can repay the loan with interest in monthly instalments.

· For loans up to 2 lakh – repay in 60 monthly instalments

· For loans exceeding 2 lakh – repay in 84 monthly instalments

What is the moratorium period for the student credit card in Bihar?

The moratorium period for the student credit card loan in Bihar is 1 year after course completion or 6 months after getting a job, whichever is earlier. It is the time period you get to look for and secure a job and start earning income.

You should start repaying the loan after the moratorium period. You don’t have to pay interest on the loan amount during this period. After the moratorium period, interest rates (4% for male students and 1% for female, transgender, and differently-abled students) are applicable.

Is there a Bihar Student Credit Card loan maaf or waiver?

There have been reports regarding Bihar Student Credit Card loan maaf or waiver. Such reports say that the government will waive the loan for students who don’t get jobs or fail to earn income after completing the course. But there is no official confirmation regarding such a waiver or Bihar Student Credit Card loan maaf. It means you must repay the loan according to the repayment rules mentioned in your loan agreement.

As per the Bihar Student Credit Card guidelines, all students get a moratorium period of 1 year after course completion or 6 months after employment to start repaying the loan. If you don’t get a job even after this period, you can apply for a moratorium extension and keep the recovery process on hold for another 6 months.

How to apply for the Bihar Student Credit Card moratorium extension?

Students who don’t get a job or earn an income even after the moratorium period can apply for a moratorium extension of 6 months. For this, you must be a BSCC applicant whose loan is sanctioned and fully disbursed.

To apply for a moratorium extension, you must visit the nearest DRCC office in the last fortnight of June or December and submit an affidavit stating that you are still unemployed and not earning any income. You can also upload the affidavit online.

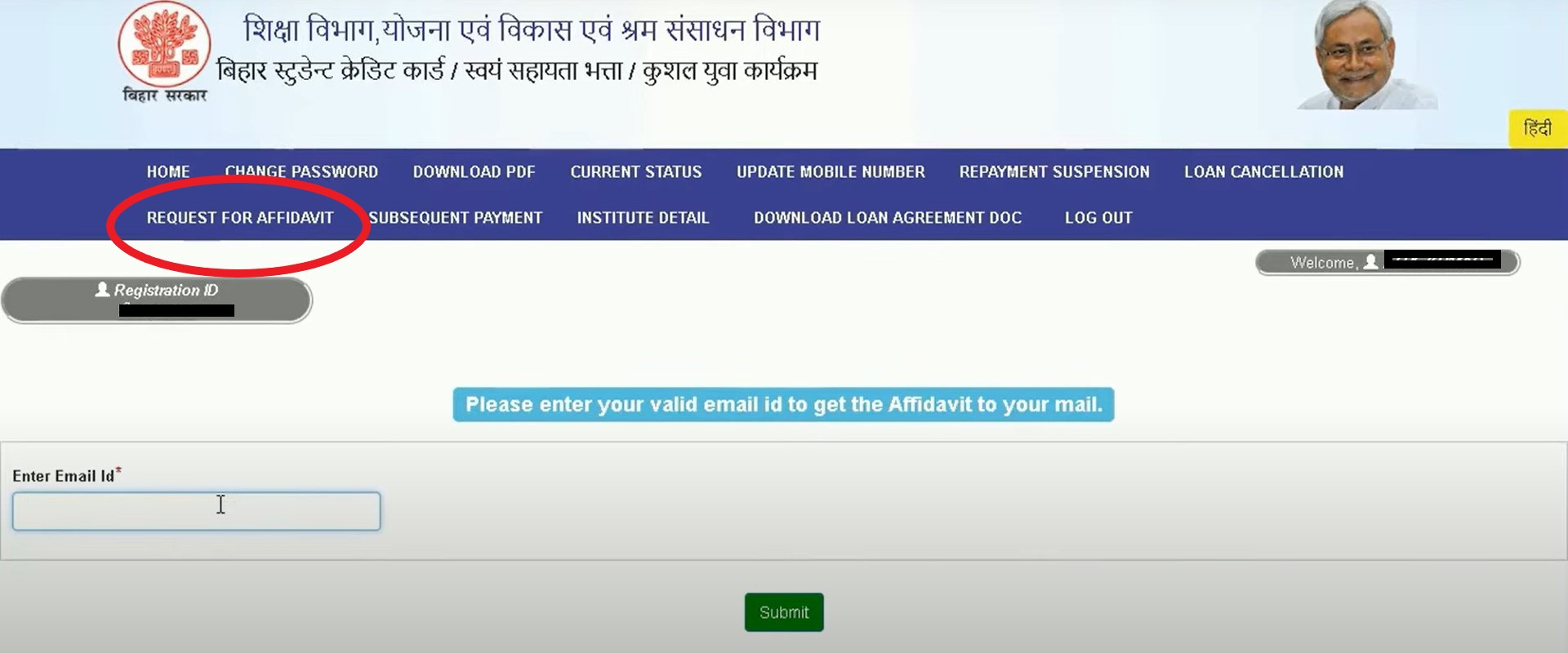

Here is how to apply for Bihar Student Credit Card loan moratorium extension and upload the affidavit online:

Step 1: Visit the official website. > Log into your account using your credentials.

Step 2: Click on the Request for Affidavit button.

Step 3: Enter your email address.

Step 4: You will receive a mail with the affidavit format.

Step 5: Fill in the required details > Notarize the affidavit on stamp paper (INR 100).

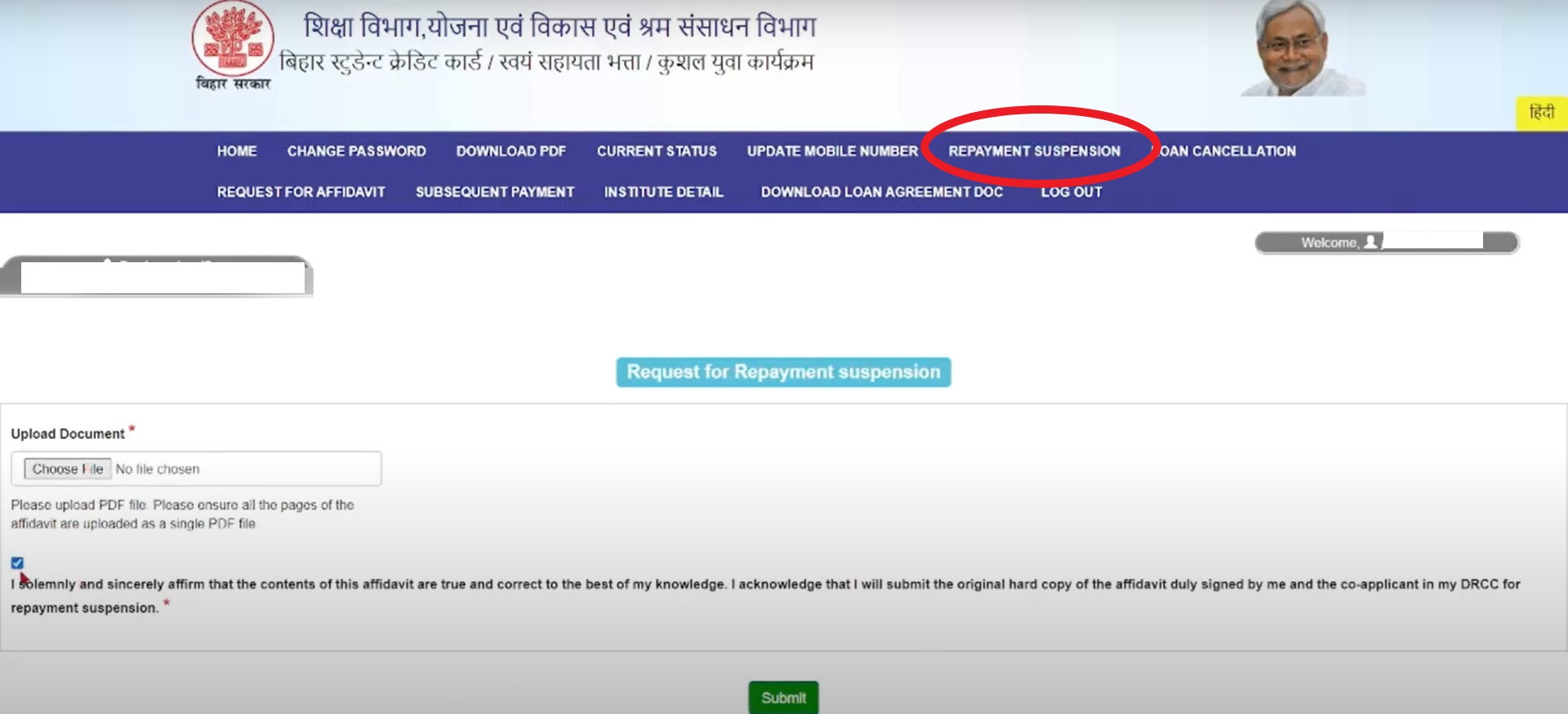

Step 6: Upload the scanned and signed copy of the affidavit to the website. For this, visit the website> Log in to your account > Click on Repayment Suspension > Upload the scanned affidavit > Click Submit.

Step 7: Submit the original affidavit at the nearest DRCC office.

Which is the Bihar Student Credit Card complaint email id?

The official website does not display a Bihar Student Credit Card complaint email id. However, you can always express your feedback and grievances. For that:

Step 1: Visit the Feedback & Grievances page on the website.

Step 2: Fill in the required information> Describe your grievance > Click on the submit button.

What is the Bihar Student Credit Card college list?

The Bihar Student Credit Card college list includes details of colleges to which students can apply for their choice of course. Click here to check the complete list of colleges under the BSCC scheme.

How long does it take to get the Bihar Student Credit Card loan?

Typically, it takes around 1 to 2 months for loan approval. Depending on any delays in the review or verification process, it could take longer.